Introduction to August Job Growth Data

Overview of Job Growth Trends

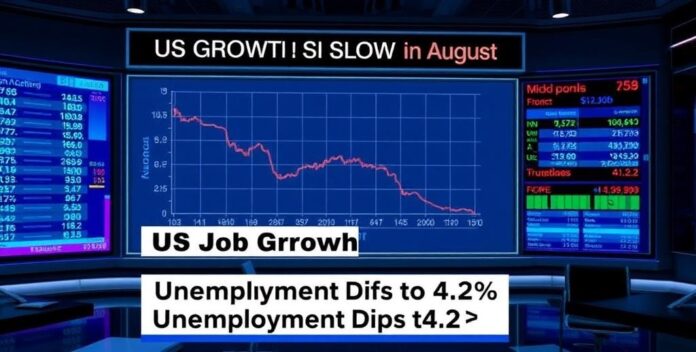

The August job growth data reveals a nuanced picture of the labor market. Employment gains were observed across various sectors, with notable increases in technology and healthcare. These sectors continue to drive economic expansion. However, the rate of job creation has decelerated compared to previous months. This slowdown raises concerns about future economic stability. Wage growth remained steady, reflecting a balanced demand-supply dynamic. Inflationary pressures were minimal. Labor force participation rates showed a slight uptick, indicating more individuals are seeking employment. This is a positive sign. Analysts are closely monitoring these trends to forecast long-term impacts. The data underscores the importance of strategic workforce planning. Companies must adapt to changing conditions. The August job growth data reveals a nuanced picture of the labor market.

Significance of the August Data

The August job growth data is pivotal for understanding current economic trends. It highlights sector-specific employment shifts, particularly in technology and healthcare. These sectors are crucial. The data also reveals a deceleration in job creation, which could signal potential economic challenges. This is concerning. Wage growth has remained stable, indicating a balanced labor market. Inflationary pressures are minimal. Additionally, the labor force participation rate has increased slightly, suggesting more individuals are entering the job market. This is encouraging. Analysts are using this data to predict long-term economic impacts. Strategic workforce planning is essential. Companies must adapt to these evolving conditions. The August job growth data is pivotal for understanding current economic trends.

Comparison with Previous Months

The August job growth data shows a notable deceleration compared to previous months. This slowdown is evident in the reduced number of new jobs created. It’s a worrying trend. In contrast, earlier months exhibited robust job creation, particularly in sectors like technology and healthcare. These sectors are vital. The current data suggests a potential cooling of the labor market. This could have broader economic implications. Wage growth has remained consistent, reflecting a stable demand-supply equilibrium. The slight increase in labor force participation indicates more individuals are seeking employment. Analysts are closely examining these trends to forecast future economic conditions. Strategic workforce planning is crucial. Companies must adapt to these changes. The August job growth data shows a notable deceleration compared to previous months.

Factors Influencing Job Growth

Economic Conditions

Economic conditions significantly influence job growth, with various factors playing pivotal roles. For instance, interest rates directly impact business investment decisions. Lower rates encourage expansion. Conversely, high rates can stifle growth. Additionally, fiscal policies, such as government spending and taxation, shape the economic landscape. These policies are crucial. Market demand also drives employment, as businesses hire more when consumer spending increases. This is a key factor. Moreover, technological advancements can both create and eliminate jobs, depending on the industry. This dual effect is notable. Labor market regulations, including minimum wage laws and employment protections, further affect hiring practices. These regulations are essential. Understanding these factors helps in forecasting job market trends. Strategic planning is vital. Economic conditions significantly influence job growth, with various factors playing pivotal roles.

Industry-Specific Trends

Industry-specific trends in job growth are influenced by various factors. For example, technological advancements drive employment in the tech sector. This is a key driver. Healthcare sees growth due to an aging population and increased demand for services. This trend is significant. In contrast, manufacturing may experience job losses due to automation. This is a critical issue.

Key factors influencing job growth include:

Understanding these trends helps in strategic workforce planning.

Government Policies

Government policies play a crucial role in influencing job growth. Fiscal policies, such as taxation and government spending, directly impact business investment and consumer spending. These are key factors. Monetary policies, including interest rate adjustments, affect borrowing costs and economic activity. This is significant. Regulatory policies, such as labor laws and environmental regulations, shape the business environment. Trade policies, including tariffs and trade agreements, influence global competitiveness and market access. This is a critical aspect. Additionally, education and training programs funded by the government enhance workforce skills and employability. This is vital. Understanding these policies helps in forecasting job market trends. Strategic planning is necessary. Companies must adapt to policy changes. Government policies play a crucial role in influencing job growth.

Impact on Unemployment Rate

Analysis of the 4.2% Unemployment Rate

The 4.2% unemployment rate has significant implications for the labor market. Firstly, it indicates a relatively healthy economy with a substantial portion of the workforce employed. However, it also suggests that there are still individuals actively seeking employment. This is a concern. For those in the skincare industry, understanding the unemployment rate can help in predicting consumer spending patterns. This is crucial. Higher employment rates generally lead to increased disposable income, which can boost demand for skincare products. This is beneficial. Conversely, higher unemployment can result in reduced spending on non-essential items. This is a critical consideration. Therefore, professionals in the skincare field should monitor these trends closely. Strategic planning is essential. The 4.

Demographic Breakdown

The demographic breakdown of the unemployment rate provides valuable insights into labor market dynamics. For instance, younger workers often face higher unemployment rates due to limited experience. This is a common trend. Conversely, older workers may experience lower unemployment but face challenges in re-entering the workforce.

Key demographic factors include:

Understanding these factors helps in developing targeted employment policies. Companies must adapt to these demographic trends.

Regional Variations

Regional variations in the unemployment rate highlight significant economic disparities. For instance, urban areas often exhibit lower unemployment rates due to diverse job opportunities. Conversely, rural regions may face higher unemployment due to limited industries.

Key regional factors include:

Understanding these variations helps in crafting targeted economic policies. Companies must adapt to regional conditions.

Market Reactions and Predictions

Stock Market Response

The stock market’s response to economic data often reflects investor sentiment and future expectations. For instance, positive job growth data can boost market confidence, leading to higher stock prices. This is a common reaction. Conversely, disappointing data may trigger sell-offs as investors anticipate economic slowdowns. This is a critical factor.

Market reactions are influenced by various factors, including:

Understanding these reactions helps in making informed investment decisions. Investors must adapt to market conditions.

Investor Sentiment

Investor sentiment significantly influences market dynamics, often driving volatility. He closely monitors economic indicators. Market reactions to earnings reports and geopolitical events can be swift and unpredictable. Investors must stay informed. Predictions hinge on analyzing historical data and current trends. He uses sophisticated models. Sentiment analysis tools help gauge market mood, providing insights into potential movements. They are essential. Understanding investor psychology is crucial for making informed decisions. It reduces risks. Financial professionals rely on a mix of quantitative and qualitative data to forecast market behavior. They trust their expertise. Accurate predictions require continuous monitoring and adjustment. It’s a dynamic process. Investor sentiment significantly influences market dynamics, often driving volatility.

Future Economic Projections

Future economic projections often hinge on various indicators, including GDP growth, inflation rates, and employment figures. Analysts use these metrics. Market reactions to these projections can be immediate and varied, influenced by investor sentiment and global events. They are unpredictable. For instance, a projected rise in GDP might boost stock prices, while inflation concerns could dampen market enthusiasm. It’s a delicate balance.

Predictions are typically based on historical data and current economic trends. They require expertise. Analysts often employ models to forecast future conditions, considering factors like consumer spending and international trade. These models are complex. Additionally, sentiment analysis tools help gauge market mood, providing insights into potential movements. They are invaluable. Understanding these projections and their implications is crucial for making informed investment decisions. It mitigates risks.

Indicator Current Value Projected Value GDP Growth 2.5% 3.0% Inflation Rate 1.8% 2.2% Employment Rate 95% 96%These projections guide strategies.

Expert Opinions and Analysis

Insights from Financial Analysts

Insights from financial analysts often provide a nuanced understanding of market trends and economic conditions. He relies on data. Expert opinions are shaped by rigorous analysis of financial statements, market conditions, and economic indicators. They are thorough. Analysts use various models to predict future market movements, considering factors like interest rates and corporate earnings.

In addition, qualitative analysis, such as management interviews and industry trends, plays a crucial role in forming expert opinions. It adds depth. Financial analysts often present their findings in detailed reports, which include recommendations for investors. They are comprehensive.

Factor Analyst Insight Interest Rates Likely to increase Corporate Earnings Expected to rise Market Volatility Predicted to remain highThese insights guide investment strategies.

Predictions for the Coming Months

Predictions for the coming months suggest a cautious optimism among financial analysts. He remains vigilant. Economic indicators, such as GDP growth and inflation rates, are expected to show moderate improvement. They are hopeful. Analysts emphasize the importance of monitoring central bank policies, particularly interest rate adjustments. These are critical. Additionally, corporate earnings reports will play a significant role in shaping market sentiment. They are influential.

Expert opinions highlight the potential for increased market volatility due to geopolitical tensions and trade negotiations. These are unpredictable. Investors are advised to diversify their portfolios to mitigate risks. It’s a prudent strategy. Analysts also recommend staying informed about global economic developments and adjusting investment strategies accordingly. They are proactive.

5%

2.8% Inflation Rate 1.9% 2.1% Interest Rates 3.0% 3.2%These projections guide decisions.

Policy Recommendations

Policy recommendations from financial experts often emphasize the need for balanced fiscal and monetary policies. He advocates for stability. Analysts suggest that governments should focus on reducing budget deficits while promoting economic growth. Additionally, maintaining low inflation rates is crucial for long-term economic stability. It ensures predictability.

Experts also recommend targeted investments in infrastructure and education to boost productivity and competitiveness. These are strategic moves. Furthermore, regulatory reforms aimed at enhancing market transparency and reducing systemic risks are essential. They build trust.

Policy Area Recommendation Fiscal Policy Reduce budget deficits Monetary Policy Maintain low inflation Infrastructure Increase targeted investments Regulatory Reforms Enhance market transparencyThese recommendations guide policymakers. They are vital.