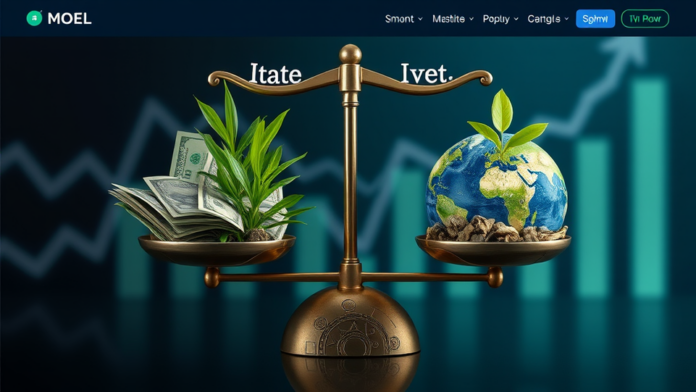

Sustainable Investing: Balancing Profits and Environmental Impact

Definition and Importance

Sustainable investing refers to the integration of environmental, social, and governance (ESG) factors into investment decisions. This approach aims to generate long-full term financial returns while promoting positive societal impact. Investors are increasingly recognizing that sustainability can drive profitability. This is a significant shift in the investment landscape.

The importance of sustainable investing lies in its potential to address pressing global challenges. Climate change, resource depletion, and social inequality are critical issues that require urgent attention. By directing capital towards sustainable enterprises, investors can contribute to solutions. This is not just a trend; it’s a necessity.

Key benefits of sustainable investing include risk mitigation and enhanced portfolio performance. Companies with strong ESG practices often exhibit lower volatility and better resilience during economic downturns. This is backed by research showing that sustainable firms outperform their peers. It’s a compelling argument for investors.

Moreover, sustainable investing aligns with the values of a growing demographic of conscious consumers. Millennials and Gen Z prioritize sustainability in their purchasing decisions. This shift influences corporate strategies and investment flows. It’s a powerful movement.

Historical Context and Evolution

The concept of sustainable investing has evolved significantly over the past few decades. Initially, it emerged from socially responsible investing (SRI) in the 1960s and 1970s, which focused on excluding certain industries, such as tobacco and arms. This early approach was primarily driven by ethical considerations. Many investors sought to align their portfolios with their personal values.

As awareness of environmental issues grew, the focus shifted towards integrating ESG factors into investment analysis. By the 1990s, institutional investors began to recognize the financial materiality of sustainability. Research indicated that companies with robust ESG practices often outperformed their peers. This was a pivotal moment in the evolution of sustainable investing.

In the 2000s, the establishment of frameworks like the United Nations Principlws for Responsible Investment (UN PRI) further legitimized the practice . He noted that these principles encouraged investors to incorporate ESG factors into their decision-making processes. This marked a transition from exclusionary practices to a more inclusive investment strategy.

Today, sustainable investing encompasses a wide range of strategies, including impact investing and green bonds. Investors are increasingly seeking opportunities that not only yield financial returns but also contribute positively to society. This reflects a broader recognition of the interconnectedness of financial performance and sustainable development. It’s a transformative shift in the investment paradigm.

Key Principles of Sustainable Investing

Environmental, Social, and Governance (ESG) Criteria

Environmental, Social, and Governance (ESG) criteria serve as a framework for evaluating the sustainability and ethical impact of investments. These criteria help investors assess how companies deal risks and opportunities related to environmental and social factors. For instance, environmental criteria examine a company’s energy use, waste management, and carbon footprint. This is crucial for understanding long-term viability.

Social criteria focus on a company’s relationships with employees, suppliers, customers, and communities. This includes labor practices, diversity, and commumity engagement. Companies that prioritize social responsibility often enjoy enhanced reputations. This can lead to increased customer loyalty and employee satisfaction.

Governance criteria evaluate a company’s leadership, executive pay, audits, and shareholder rights. Strong governance practices are essential for maintaining investor trust. Research shows that companies with robust governance structures tend to perform better financially. This is a key consideration for many investors.

Incorporating ESG criteria into investment decisions allows investors to align their portfolios with their values. It also helps mitigate risks associated with unsustainable practices. This approach is gaining traction among institutional and retail investors alike. It reflects a growing recognition of the importance of sustainability in the financial landscape.

Impact Investing vs. Traditional Investing

Impact investing and traditional investing represent two distinct approaches to capital allocation. Traditional investing primarily focuses on maximizing financial returns without necessarily considering social or environmental outcomes. Investors typically evaluate performance based on financial metrics alone. This method has been the standard for decades.

In contrast, impact investing seeks to generate measurable social and environmental benefits alongside financial returns. Investors in this space actively choose projects that address societal challenges, such as poverty alleviation or climate change. This dual focus is increasingly appealing to a new generation of investors. It reflects a shift in priorities.

cay differences between the two approaches can be summarized as follows:

This evolving landscape highlights the growing importance of aligning investment strategies with personal values. Investors are increasingly aware of their influence on societal issues. This awareness drives the demand for impact-oriented investment opportunities. It’s a significant development in the financial sector.

Challenges in Sustainable Investing

Measuring Impact and Performance

Measuring impact and performance in sustainable investing presents several challenges. One significant issue is the lack of standardized metrics for evaluating social and environmental outcomes. Different investors may use varying criteria, leading to inconsistencies in reporting. This can create confusion and hinder comparability. Clear metrics are essential for informed decision-making.

Another challenge is the difficulty in quantifying long-term impacts. Many social and environmental benefits may take years to materialize. Investors often seek immediate results, which can lead to short-term thinking. This is a common pitfall in the industry. Additionally, the complexity of social issues makes it hard to isolate the effects of specific investments.

To address these challenges, investors can adopt a structured approach. They may consider the following strategies:

These strategies can help investors navigate the complexities of measuring impact. They also promote transparency and accountability in sustainable investing. This is crucial for building trust among stakeholders.

Greenwashing and Misleading Claims

Greenwashing and misleading claims pose significant challenges in sustainable investing. Companies may exaggerate their environmental efforts to attract investors. This practice undermines the credibility of genuinely sustainable businesses. It can lead to investor skepticism and confusion. Trust is essential in investing.

Investors often struggle to differentiate between authentic sustainability initiatives and superficial marketing tactics. Many companies use vague language, making it difficult to assess their true impact. This lack of clarity can mislead investors. He may find it challenging to make informed decisions.

To combat greenwashing, investors should adopt a critical approach. They can consider the following strategies:

These strategies can help investors navigate the complexities of greenwashing. They promote informed decision-making and enhance accountability. This is vital for fostering a sustainable investment landscape.

The Future of Sustainable Investing

Technological Innovations and Financial Technology

Technological innovations are reshaping the landscape of sustainable investing. Financial technology, or fintech, plays a crucial role in enhancing transparency and efficiency. Advanced data analytics allows investors to assess ESG metrics more accurately. This leads to better-informed investment decisions. Data is power.

Blockchain technology is another significant advancement. It provides a secure and transparent way to running investments and their impacts. This can help mitigate issues related to greenwashing. Investors can verify claims more easily. Trust is essential un finance.

Moreover, robo-advisors are emerging as valuable tools for sustainable investing. These platforms can offer personalized investment strategies based on individual values and goals. They democratize access to sustainable investment opportunities. This is a game changer.

Artificial intelligence (AI) is also making strides in this field. AI algorithms can analyze vast amounts of data to identify sustainable investment opportunities. This enhances decision-making processes. It’s an exciting development. As technology continues to evolve, it will likely drive further innovation in sustainable investing. This is a promising future.

Regulatory Trends and Market Demand

Regulatory trends are increasingly shaping the landscape of sustainable investing. Governments and regulatory bodies are implementing stricter guidelines for ESG disclosures. This aims to enhance transparency and accountability among companies. Investors are demanding more information about sustainability practices. Clear regulations are essential for informed decision-making.

In addition, market demand for sustainable investment products is rising. A growing number of investors, particularly millennials, prioritize sustainability in their portfolios. This shift is prompting financial institutions to develop innovative products that meet these preferences. It’s a significant change inward investor behavior.

Furthermore, initiatives such as the European Union’s Sustainable Finance Disclosure Regulation (SFDR) are setting new standards. These regulations require financial market participants to disclose how sustainability risks are integrated into their processes. This fosters a more sustainable financial system. It’s a necessary evolution.

As regulatory frameworks continue to evolve, they will likely influence market dynamics. Companies that fail to adapt may face feputational risks and financial penalties . This creates a compelling case for integrating sustainability into core business strategies. Investors are paying attention.