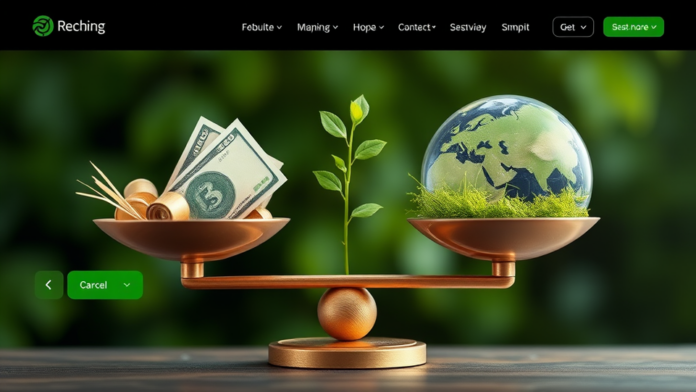

Sustainable Investing: Balancing Profits and Environmental Impact

Definition and Importance

Sustainable investing integrates financial returns with environmental stewardship. This approach addresses climate change and social issues. It’s a necessary shift in investment strategy. Many investors seek to align their portfolios with their values. This is a growing trend in finance. It reflects a deeper awareness of global challenges.

Historical Context

Sustainable investing emerged in the 1960s, driven by social movements. Investors began to consider ethical implications. This shift marked a significant change in finance. Key milestones include the establishment of socially responsible funds. These funds focused on avoiding harmful industries. Awareness grew over the decades. It reflects changing societal values.

Current Trends in Sustainable Investing

Current trends in sustainable investing emphasize ESG integration. Investors increasingly demand transparency and accountability. This shift influences capital allocation decisions. Many funds now prioritize sustainability metrics. Performance is often linked to responsible practices. It’s a critical factor for long-term success. Investors are becoming more discerning.

The Financial Case for Sustainable Investing

Performance Metrics

Performance metrics for sustainable investing include risk-adjusted returns. These metrics assess both financial and social impacts. Additionally, they help evaluate long-term viability. Investors often seek data-driven insights. This approach enhances decision-making processes. It’s essential for informed investment strategies. Metrics can reveal hidden opportunities.

Risk Management

Risk management in sustainable investing involves identifying potential threats. This includes environmental, social, and governance risks. Investors must assess how these factors impact returns. Effective strategies can mitigate adverse effects. It’s crucial for maintaining portfolio stability. Understanding risks leads to better decisions. Knowledge is power in investing.

Long-term Value Creation

Long-term value creation in sustainable investing focuses on enduring benefits. This approach emphasizes sustainable practices that enhance profitability. Investors often prioritize companies with strong ESG performance. Such companies tend to exhibit resilience. They are better positioned for future challenges. This strategy fosters trust and loyalty. It’s a win-win tor stakeholders.

Environmental, Social, and Governance (ESG) Criteria

Understanding ESG Factors

Understanding ESG factors involves evaluating environmental, social, and governance criteria. These elements assess a company’s sustainability and ethical impact. Investors increasingly consider these factors in decision-making. Strong ESG performance often correlates with lower risks. This can lead to enhanced financial returns. Companies with robust ESG practices attract more investment. It’s a strategic advantage in today’s market.

How ESG Influences Investment Decisions

ESG factors significantly influence investment decisions by highlighting risks and opportunities. Investors assess how companies manage environmental and social issues. This evaluation can impact long-term profitability. Strong ESG performance often leads to better market positioning. Investors prefer companies with sustainable practices. It reflects a commitment to responsible growth.

Challenges in ESG Measurement

Challenges in ESG measurement arise from inconsistent data sources. This inconsistency complicates accurate assessments. Additionally, varying methodologies can lead to confusion. Investors may struggle to compare companies effectively. Transparency is often lacking in reporting practices. This creates uncertainty in decision-making. Reliable metrics are essential for informed choices.

Investment Strategies for Sustainable Investing

Negative Screening

Negative screening involves excluding specific sectors or companies from investment portfolios. This strategy targets industries deemed unethical or harmful. For instance, tobacco and fossil fuels are common exclusions. Investors aim to align their portfolios with personal values. This approach can enhance overall portfolio integrity. It reflects a commitment to responsible investing. Many investors find this method effective.

Positive Screening

Positive screening focuses on selecting companies with strong sustainability practices. This strategy emphasizes investments in firms that excel in environmental and social governance. Investors seek out leaders in renewable energy or ethical labor practices. Such companies often demonstrate resilience and growth potential. This approach aligns financial goals with ethical values. It fosters a positive impact on society. Investors can drive change through their choices.

Impact Investing

Impact investing aims to generate measurable social and environmental benefits alongside financial returns. This strategy targets sectors like renewable energy and affordable housing. Investors actively seek opportunities that align with their values. Such investments can drive significant change in communities. They often yield competitive financial performance. It’s a powerful way to influence positive outcomes. Investors can make a difference.

Regulatory Landscape and Policy Implications

Global Regulations on Sustainable Investing

Global regulations on sustainable investing are evolving rapidly. Governments are implementing frameworks to enhance transparency. These regulations often require disclosure of ESG practices. Investors must adapt to comply with new standards. This can influence investment strategies significantly. Understanding these regulations is crucial for success. Compliance fosters trust and credibility in the market.

Impact of Government Policies

Government policies significantly shape sustainable investing practices. These policies can incentivize or restrict certain investments. For instance, subsidies for renewable energy encourage capital flow. Regulations often mandate ESG disclosures, enhancing transparency. Investors must navigate these evolving landscapes. This requires strategic adjustments in their portfolios. Awareness is key for informed decisions.

Future Regulatory Trends

Future regulatory trends will likely emphasize stricter ESG standards. Policymakers are increasingly focused on sustainability metrics. This shift aims to enhance accountability in investments. Investors should prepare for more comprehensive disclosures. Compliance will become essential for market participation. Awareness of these changes is crucial. Adaptation will drive competitive advantage.

Case Studies of Successful Sustainable Investments

Corporate Examples

Several corporations exemplify successful sustainable investments. For instance, Unilever has integrated sustainability into its core strategy. This approach has enhanced brand loyalty and market share. Similarly, Tesla focuses on renewable energy solutions. Their innovations drive both growth and environmental benefits. These companies demonstrate the financial viability of sustainable practices. It’s a compelling model for others.

Fund Performance Analysis

Fund performance analysis reveals the effectiveness of sustainable investments. Many funds focusing on ESG criteria have outperformed traditional benchmarks. This trend indicates a growing investor confidence in sustainability. For example, the Calvert Equity Fund consistently shows strong returns. Such performance underscores the financial benefits of responsible investing. Investors are increasingly recognizing this potency. It’s a significant shift in the market.

Lessons Learned

Lessons learned from successful sustainable investments highlight key strategies . Companies that prioritize ESG factors often achieve better resilience. This approach can lead to enhanced brand reputation. Additionally, stakeholder enfagement proves crucial for long-term success. Investors should focus on transparency and accountability. These elements foster trust and loyalty. It’s essential to adapt to changing market dynamics.

Challenges and Criticisms of Sustainable Investing

Greenwashing Concerns

Greenwashing concerns arise when companies misrepresent their sustainability efforts. This practice can mislead investors and consumers alike. It undermines genuine sustainable initiatives in the market. Investors must critically assess ESG claims. Transparency is essential to combat greenwashing. Companies should provide verifiable data on their practices. Awareness of this issue is crucial for informed decisions.

Market Limitations

Market limitations in sustainable investing include a lack of standardized metrics. This inconsistency complicates performance comparisons across funds. Additionally, limited data availability can hinder informed decision-making. Investors may struggle to identify truly sustainable options. Furthermore, market volatility can disproportionately affect green investments. This creates uncertainty for risk-averse investors. Awareness of these limitations is essential for strategy development.

Balancing Profit and Purpose

Balancing profit and purpose presents significant challenges for investors. Many struggle to align financial returns with ethical considerations. This tension can lead to difficult decision-making processes. Investors often question the trade-offs involved. Sustainable investments may require patience for long-term gains. It’s essential to evaluate both financial and social impacts. Awareness of this balance is crucial for success.

The Future of Sustainable Investing

Emerging Trends and Innovations

Emerging trends in sustainable investing include increased use of technology. Innovations such as AI and big data enhance ESG analysis. These tools improve decision-making and transparency. Additionally, impact measurement frameworks are evolving. Investors seek more robust metrics for social outcomes. This shift reflects a growing demand for accountability. Awareness of these trends is essential for investors.

Role of Technology in Sustainable Investing

Technology plays a crucial role in sustainable investing. Advanced analytics enable better ESG data assessment. This enhances the accuracy of investment decisions. Furthermore, blockchain technology improves transparency in transactions. Investors can track the impact of their investments more effectively. These innovations foster greater accountability in the market. Awareness of technological advancements is essential for success.

Predictions for the Next Decade

Predictions for the next decade indicate significant growth in sustainable investing. More investors will prioritize ESG factors in their portfolios. This shift will drive demand for transparent reporting. Additionally, regulatory frameworks will likely become stricter. Companies must adapt to these evolving standards. Awareness of sustainability will increase among consumers. It’s a critical time for investment strategies.