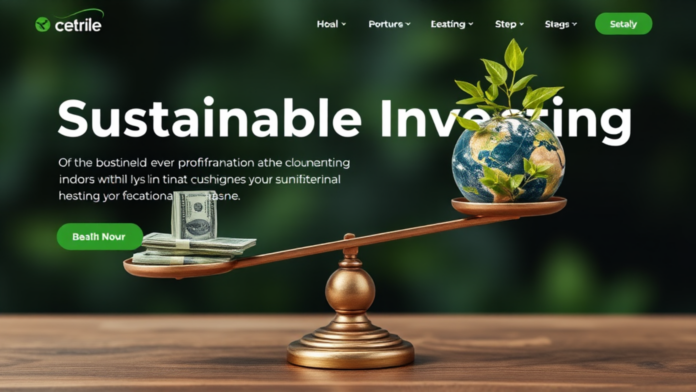

Sustainable Investing: Balancing Profits and Environmental Impact

Definition and Importance

Sustainable investing refers to the integration of environmental, social, and governance (ESG) factors into investment decisions. This approach aims to generate financial returns while promoting positive societal impact. Investors increasingly recognize that sustainability can influence long-term performance. It is essential to understand these dynamics.

The importance of sustainable investing lies in its potential to address pressing global challenges. Climate change, resource depletion, and social inequality are substantial issues that require urgent attention. By directing capital towards sustainable enterprises, investors can contribute to solutions. This is a powerful opportunity.

Moreover, sustainable investing can mitigate risks associated with traditional investments. Companies that neglect ESG factors may face regulatory penalties or reputational damage. Investors should consider these risks carefully. It is wise to be proactive.

In addition, sustainable investing aligns with the values of a growing segment of the population. Many individuals prefer to invest in ways that reflect their ethical beliefs. This trend is reshaping the investment landscape. It is a notable shift.

Historical Context and Evolution

Sustainable investing has evolved significantly over the past few decades. Initially, it emerged from socially responsible investing (SRI) in the 1960s and 1970s. Investors began to exclude companies involved in activities like tobacco and weapons. This was a moral stance. Over time, the focus shifted from exclusion to inclusion of positive ESG factors.

In the 1980s and 1990s, the concept of corporate social responsibility (CSR) gained traction. Companies started to recognize the importance of their social and environmental impact. This led to the development of various ESG metrics. Investors began to demand transparency. It was a necessary change.

The 21st century marked a turning point with the rise of impact investing. This approach seeks to generate measurable social and environmental benefits alongside financial returns. A notable example is the Global Impact Investing Network (GIIN), established in 2010. It has fostered a community of investors committed to this dual objective. This is a significant movement.

Today, sustainable investing encompasses a wide range of strategies, including green bonds and ESG-focused funds. The market for sustainable investments has grown exponentially. It reflects a broader recognition of the interconnectedness of financial performance and sustainability. This is a critical insight.

Financial Performance of Sustainable Investments

Comparative Analysis with Traditional Investments

Sustainable investments have increasingly demonstrated competitive financial performance compared to traditional investments. Numerous studies indicate that portfolios incorporating ESG criteria often yield comparable or superior returns. This is a noteworthy finding. For instance, a meta-analysis of over 2,000 studies revealed that sustainable investments frequently outperform their conventional counterparts. This trend is gaining attention.

Moreover, sustainable investments tend to exhibit lower volatility. Companies with strong ESG practices often manage risks more effectively. This can lead to greater resilience during market downturns. Investors should consider this aspect seriously. It is a critical factor.

Additionally, the growing demand for sustainable products and services can drive revenue growth for these companies. As consumer preferences shift towards sustainability, businesses that adapt are likely to thrive. This is a significant opportunity. The financial implications are profound.

Furthermore, regulatory frameworks are increasingly favoring sustainable practices. Governments worldwide are implementing policies that incentivize green investments. This creates a favorable environment for sustainable portfolios. It is an important consideration for investors. The landscape is changing rapidly.

Case Studies of Successful Sustainable Funds

Several case studies illustrate the financial success of sustainable funds. One prominent example is the iShares Global Clean Energy ETF. This fund has consistently outperformed traditional energy sector funds over the past decade. Its focus on renewable energy companies has yielded impressive returns. This is a remarkable achievement.

Another notable case is the Parnassus Core Equity Fund. This fund integrates ESG criteria into its investment strategy and has delivered strong performance relative to its benchmark. Over a five-year period, it outperformed the S&P 500 index. This demonstrates the potential of sustainable investing.

Additionally, the TIAA-CREF Social Choice Equity Fund has shown resilience during market fluctuations. By investing in companies with robust sustainability practices, it has maintained lower volatility. This is an important advantage for risk-averse investors.

Moreover, the performance of these funds is supported by growing consumer demand for sustainable products. As more investors prioritize ESG factors, the market for sustainable funds continues to expand. This trend is likely to persist. The implications for financial performance are significant.

Tax Implications of Sustainable Investing

Tax Benefits and Incentives

Sustainable investing offers various tax benefits and incentives that can enhance overall returns. For instance, many governments provide tax credits for investments in renewable energy projects. These credits can significantly reduce an investor’s tax liability. This is a valuable opportunity.

Additionally, certain sustainable investments qualify for favorable capital gains treatment. Long-term investments in green technologies may be taxed at lower rates. This can lead to increased after-tax returns. Investors should be aware of these advantages.

Moreover, some jurisdictions offer deductions for contributions to environmentally focused funds. These deductions can further incentivize investments in sustainable initiatives. It is essential to understand local tax regulations. This knowledge can maximize benefits.

Furthermore, impact investing may also provide access to specialized tax-advantaged accounts. For example, some retirement accounts allow for investments in ESG-focused funds without immediate tax consequences. This can be a strategic approach. Investors should consider these options carefully. The potential savings are significant.

Reporting Requirements and Compliance

Sustainable investing involves specific reporting requirements and compliance measures that investors must adhere to. Regulatory bodies often mandate disclosures related to ESG factors. These disclosures ensure transparency and accountability. This is crucial for informed decision-making.

Investors are typically required to report on the sustainability metrics of their portfolios. This includes information on carbon emissions, resource usage, and social impact. Accurate reporting can enhance credibility. It is essential for trust.

Moreover, compliance with international standards, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB), is increasingly important. These frameworks provide guidelines for consistent reporting. Adhering to these standards can improve investment attractiveness. This is a strategic advantage.

Additionally, failure to comply with reporting requirements can result in penalties or reputational damage. Investors should be proactive in understanding their obligations. This awareness can mitigate risks.

Strategies for Implementing Sustainable Investments

Building a Sustainable Investment Portfolio

Building a sustainable investment portfolio requires a strategic approach that aligns financial goals with environmental and social values. Investors should begin by defining their sustainability criteria. This clarity helps in selecting appropriate assets. It is a crucial first step.

Next, diversification is essential in managing risk while pursuing sustainable investments. A well-rounded portfolio may include equities, bonds, and alternative investments focused on sustainability. This variety can enhance stability. It is a smart strategy.

Additionally, investors should consider integrating ESG ratings into their selection process. These ratings provide insights into a company’s sustainability practices. Higher-rated companies often exhibit better long-term performance. This is an important consideration.

Moreover, engaging with companies on their sustainability practices can influence positive change. Shareholder advocacy can drive improvements in corporate behavior. This approach can yield significant benefits. It is a proactive measure.

Finally, regular monitoring and rebalancing of the portfolio are necessary to ensure alignment with sustainability goals. This ongoing assessment helps in adapting to market changes. Staying informed is vital. It can lead to better outcomes.

Engaging with Companies on Sustainability Practices

Engaging with companies on sustainability practices is a vital strategy for investors committed to responsible investing. By actively participating in shareholder meetings, investors can voice their concerns and expectations regarding ESG issues. This engagement fosters accountability. It is an essential practice.

Additionally, investors can collaborate with other stakeholders to amplify their influence. Forming coalitions with like-minded investors can lead to more significant pressure on companies to adopt sustainable practices. Collective action can drive change. This approach is often more effective.

Moreover, investors should utilize proxy voting as a tool to support sustainability initiatives. Voting on shareholder resolutions related to environmental and social governance can shape corporate policies. This is a powerful mechanism. It allows investors to express their values.

Furthermore, maintaining open lines of communication with company management is crucial. Regular dialogue can provide insights into a company’s sustainability strategies and challenges. This understanding can inform investment decisions. It is a valuable exchabge.

Finally, tracking the progress of companies on their sustainability commitments is essential. Investors should monitor key performance indicators and report outcomes. This accountability ensures that companies remain focused on their goals. It is a necessary follow-up.