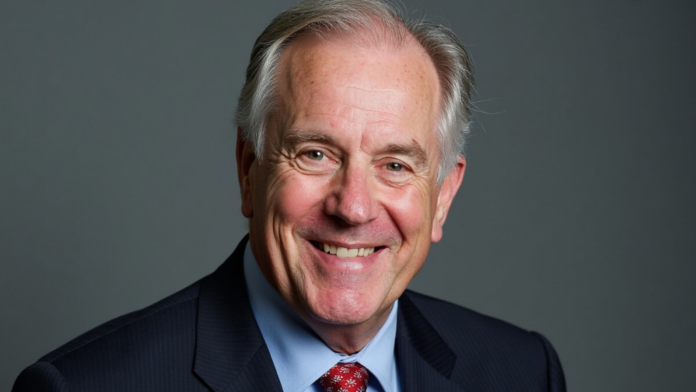

Introduction to Stanley Druckenmiller’s Investment Strategy

Background and Achievements

Stanley Druckenmiller’s investment strategy is renowned for its adaptability and precision. He emphasizes macroeconomic trends and uses a top-down approach. This means he looks at the big picture first. He then narrows down to specific investments. His strategy involves a mix of long and short positions. He is known for his ability to predict market movements. This skill has earned him significant returns. He also focuses on risk management. He believes in cutting losses quickly. This minimizes potential damage. His approach is both strategic and flexible. He adapts to changing market conditions. This adaptability is key to his success. He often uses leverage to amplify returns. This can increase both gains and risks. His track record speaks for itself. He has consistently outperformed the market. His achievements are a testament to his skill. He is a master of his craft. His insights are highly valued. Many investors look up to him. His strategies are studied worldwide. He is a legend in the investment community. His methods are both art and science. He combines intuition with analysis. This makes his approach unique. His success is not by chance. It is the result of years of experience. He is a true investment genius. Stanley Druckenmiller’s investment strategy is renowned for its adaptability and precision.

Investment Philosophy

Stanley Druckenmiller’s investment strategy is characterized by a keen focus on macroeconomic trends and a top-down approach. He begins by analyzing global economic indicators. This helps him identify potential investment opportunities. Subsequently, he narrows down to specific sectors and companies. This skill is crucial. His strategy involves a mix of long and short positions, allowing him to capitalize on both rising and falling markets. He is adept at managing risk. He cuts losses quickly. Additionally, he often uses leverage to amplify returns. Stanley Druckenmiller’s investment strategy is characterized by a keen focus on macroeconomic trends and a top-down approach.

Recent Market Moves

Stanley Druckenmiller’s recent market moves reflect his strategic acumen and adaptability. He has been focusing on sectors poised for growth. This includes technology and healthcare. His investments are driven by macroeconomic trends. He analyzes global economic indicators. This helps him identify potential opportunities. He has also been cautious about geopolitical risks. These can impact market stability. This allows him to capitalize on market fluctuations. Stanley Druckenmiller’s recent market moves reflect his strategic acumen and adaptability.

Impact on Retirement Planning

Stanley Druckenmiller’s investment strategy significantly influences retirement planning. His focus on macroeconomic trends helps in identifying long-term opportunities. This is crucial for retirement portfolios. He emphasizes risk management, which is vital for preserving capital. His use of leverage can amplify returns, benefiting retirement savings. Additionally, his ability to predict market movements aids in strategic asset allocation. This ensures a balanced portfolio. His approach combines long and short positions, providing flexibility. This allows for adaptation to market changes. His track record of consistent outperformance is noteworthy. It inspires confidence. His insights are highly valued by financial advisors. They guide retirement planning strategies. His methods are both analytical and intuitive. His success is a result of years of experience. His impact on retirement planning is profound. Stanley Druckenmiller’s investment strategy significantly influences retirement planning.

New Investment Targets for 2024

Emerging Markets

Stanley Druckenmiller’s focus on emerging markets for 2024 highlights his strategic foresight and adaptability. He identifies regions with high growth potential. This includes Southeast Asia and Latin America. These markets offer significant opportunities. They are driven by favorable demographics and economic reforms. He emphasizes the importance of understanding local market dynamics. This is crucial for success. His strategy involves a mix of equities and fixed income. This provides a balanced approach. He also considers geopolitical risks. His ability to predict market movements is invaluable. This skill sets him apart. He often uses leverage to enhance returns. They guide investment strategies. His impact on emerging markets is profound. Stanley Druckenmiller’s focus on emerging markets for 2024 highlights his strategic foresight and adaptability.

Technology Sector

Stanley Druckenmiller’s focus on the technology sector for 2024 underscores his strategic foresight and adaptability. He identifies companies with strong growth potential. This includes firms in artificial intelligence and cybersecurity. These areas are poised for significant advancements. They offer substantial investment opportunities. His strategy involves a mix of equities and derivatives. He also considers regulatory risks. His impact on the technology sector is profound. Stanley Druckenmiller’s focus on the technology sector for 2024 underscores his strategic foresight and adaptability.

Healthcare Innovations

Stanley Druckenmiller’s focus on healthcare innovations for 2024 highlights his strategic foresight and adaptability. He identifies companies with strong growth potential in biotechnology and telemedicine. His impact on healthcare innovations is profound. Stanley Druckenmiller’s focus on healthcare innovations for 2024 highlights his strategic foresight and adaptability.

Sustainable Investments

Stanley Druckenmiller’s focus on sustainable investments for 2024 highlights his strategic foresight and adaptability. He identifies companies with strong environmental, social, and governance (ESG) practices. These firms are poised for long-term growth. His strategy involves a mix of equities and green bonds. His impact on sustainable investments is profound. Stanley Druckenmiller’s focus on sustainable investments for 2024 highlights his strategic foresight and adaptability.

Analyzing the Potential Risks and Rewards

Market Volatility

Stanley Druckenmiller’s analysis of market volatility emphasizes the importance of understanding potential risks and rewards. He identifies key factors that contribute to market fluctuations. These include economic indicators, geopolitical events, and investor sentiment. His approach involves a thorough analysis of these elements. This helps in making informed decisions. He often uses derivatives to hedge against risks. This can protect investments. His strategy also includes diversification. This spreads risk across various assets. He is adept at predicting market movements. His ability to adapt to changing conditions sets him apart. His impact on market volatility analysis is profound. Stanley Druckenmiller’s analysis of market volatility emphasizes the importance of understanding potential risks and rewards.

Regulatory Challenges

Stanley Druckenmiller’s analysis of regulatory challenges emphasizes the importance of understanding potential risks and rewards. He identifies key factors that contribute to regulatory changes. These include government policies, international trade agreements, and industry-specific regulations. He often uses compliance strategies to mitigate risks. He is adept at predicting regulatory impacts. His ability to adapt to changing regulations sets him apart. His impact on regulatory analysis is profound. Stanley Druckenmiller’s analysis of regulatory challenges emphasizes the importance of understanding potential risks and rewards.

Economic Indicators

Economic indicators are essential tools for assessing the health of an economy. They provide insights into various aspects such as employment, inflation, and GDP growth. Understanding these indicators helps policymakers make informed decisions. It also aids investors in evaluating potential risks and rewards. For instance, high inflation can erode purchasing power. This is a concern. Conversely, strong GDP growth signals a robust economy. It’s a positive sign. However, relying solely on one indicator can be misleading. Multiple indicators should be considered. For example, low unemployment might mask underemployment issues. This is often overlooked. Therefore, a comprehensive analysis is crucial for accurate economic forecasting. It ensures balanced decision-making. Economic indicators are essential tools for assessing the health of an economy.

Long-Term Growth Prospects

Long-term growth prospects are influenced by various factors, including technological advancements, demographic shifts, and policy decisions. He must consider these elements carefully. Technological innovation can drive productivity and economic expansion. This is crucial. However, rapid technological changes may also lead to job displacement. This is a risk. Demographic trends, such as aging populations, can impact labor markets and economic growth. He should analyze these trends. Policy decisions, including fiscal and monetary policies, play a significant role in shaping long-term growth. They are vital. Poor policy choices can hinder economic progress. Conversely, sound policies can foster a stable and conducive environment for growth. This is beneficial. Therefore, a comprehensive analysis of these factors is essential for understanding the potential risks and rewards associated with long-term growth prospects. He must stay informed. Long-term growth prospects are influenced by various factors, including technological advancements, demographic shifts, and policy decisions.

Implications for Retirement Planning

Adjusting Investment Portfolios

Adjusting investment portfolios is crucial for effective retirement planning. He must consider asset allocation. Diversifying investments can mitigate risks and enhance returns. This is essential. However, market volatility can impact portfolio performance. He should regularly review and rebalance his portfolio to align with changing financial goals. This is prudent. Incorporating fixed-income securities can provide stability and income. Equities, though riskier, offer growth potential. This is attractive. He must also consider tax implications and withdrawal strategies. This is vital. Proper planning can ensure a sustainable income stream during retirement. He should seek professional advice. Adjusting investment portfolios is crucial for effective retirement planning.

Diversification Strategies

Diversification strategies are essential for effective retirement planning. He must consider various asset classes. By spreading investments across different sectors, he can mitigate risks and enhance returns. Equities, bonds, and real estate each offer unique benefits and risks. He should analyze these carefully. Equities provide growth potential but come with higher volatility. Bonds offer stability and regular income but may have lower returns. This is a trade-off. Real estate can provide both income and appreciation but requires significant capital. He must weigh these factors. Additionally, international diversification can further reduce risk by spreading investments across global markets. However, currency fluctuations and geopolitical risks must be considered. He should stay informed. Regularly reviewing and adjusting the portfolio ensures alignment with long-term financial goals. Seeking professional advice can help navigate complex investment decisions. He should consult an expert. Diversification strategies are essential for effective retirement planning.

Risk Management Techniques

Risk management techniques are vital for effective retirement planning. He must consider various strategies. Diversification is a key method to mitigate risk. By spreading investments across different asset classes, he can reduce exposure to any single market downturn. Another technique is asset allocation, which involves balancing risk and reward by adjusting the percentage of each asset in the portfolio. This is strategic. Regular portfolio rebalancing ensures alignment with long-term financial goals. This is necessary. Hedging, using instruments like options and futures, can protect against market volatility. Additionally, maintaining an emergency fund provides liquidity in unforeseen circumstances. This is wise. He should also consider insurance products to safeguard against significant losses. Proper risk management ensures a stable and secure retirement. Seeking professional advice can help navigate complex financial decisions. Risk management techniques are vital for effective retirement planning.

Expert Recommendations

Expert recommendations for retirement planning emphasize the importance of starting early and maintaining a diversified portfolio. He should consider this advice. By investing in a mix of equities, bonds, and real estate, he can balance risk and reward. Experts also suggest regularly reviewing and adjusting the portfolio to align with changing financial goals and market conditions. Additionally, incorporating tax-efficient investment strategies can enhance long-term returns. Utilizing retirement accounts like IRAs and 401(k)s offers tax advantages that can significantly impact savings growth. Experts recommend maintaining an emergency fund to cover unexpected expenses without disrupting investment strategies. Seeking professional financial advice can help navigate complex decisions and optimize retirement planning. Proper planning and informed decisions are key to a secure retirement. Expert recommendations for retirement planning emphasize the importance of starting early and maintaining a diversified portfolio.