Overview of the Acquisition

Background of Saudi Arabia’s PIF

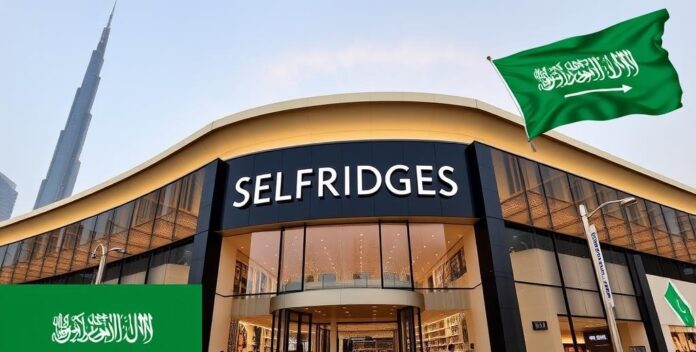

Saudi Arabia’s Public Investment Fund (PIF) is a sovereign wealth fund established in 1971. It aims to diversify the kingdom’s economy and reduce its dependence on oil revenues. The fund has grown significantly, managing assets worth hundreds of billions of dollars. It invests in various sectors, including technology, real estate, and infrastructure. PIF’s strategy focuses on long-term investments that align with Saudi Arabia’s Vision 2030. This vision seeks to transform the country’s economic landscape.

The acquisition process involves meticulous due diligence and strategic planning. PIF evaluates potential investments based on their financial performance and growth prospects. It also considers the alignment with national economic goals. The fund employs a rigorous risk assessment framework to mitigate potential losses. This ensures sustainable returns. PIF’s acquisitions often include equity stakes in global companies. These investments enhance its portfolio diversification. The fund’s approach is both proactive and adaptive. It responds to market dynamics and emerging opportunities. This strategy has positioned PIF as a key player in global finance. It continues to expand its influence.

Introduction to Selfridges

Selfridges, a renowned luxury department store, has a rich history dating back to its founding in 1908. It has become an iconic destination for high-end fashion, beauty, and lifestyle products. The store is known for its innovative retail experiences and exceptional customer service. Over the years, Selfridges has expanded its presence, with flagship stores in major cities. This growth reflects its commitment to providing a unique shopping experience.

The acquisition of Selfridges involved a detailed evaluation of its market position and financial health. The acquiring entity assessed the store’s revenue streams and profitability. They also considered the brand’s potential for future growth. This process included a thorough analysis of Selfridges’ competitive advantages. The goal was to ensure a strategic fit with the acquirer’s portfolio. The acquisition aimed to leverage Selfridges’ strong brand equity. This would enhance the overall value proposition. The transaction was structured to optimize financial returns. It also aimed to maintain the store’s premium positioning. This strategic move underscores the importance of aligning business objectives with market opportunities. It highlights the need for careful planning and execution.

Details of the Acquisition Deal

The acquisition deal was meticulously structured to ensure alignment with strategic goals. The acquiring entity conducted a comprehensive due diligence process. This included financial audits and market analysis. They assessed the target company’s revenue streams and profitability. The goal was to identify potential synergies. This process also involved evaluating the competitive landscape. They aimed to understand the target’s market position. The deal structure included various financial instruments. These ranged from equity stakes to debt financing. The terms were negotiated to optimize returns. The acquiring entity sought to minimize risks. They employed hedging strategies and other risk management tools. This approach ensured financial stability. The acquisition was designed to enhance the acquirer’s portfolio. It aimed to provide long-term value. The deal also included performance-based incentives. These were tied to specific financial metrics. The goal was to align interests. The acquisition was a strategic move. It aimed to capitalize on market opportunities. The acquiring entity demonstrated a proactive approach. They responded to market dynamics. This strategy underscores the importance of careful planning. It highlights the need for strategic alignment. The acquisition was a significant milestone. It marked a new chapter in the company’s growth. The acquisition deal was meticulously structured to ensure alignment with strategic goals.

Strategic Implications

Impact on Selfridges’ Operations

The acquisition of Selfridges is expected to significantly impact its operations. The new ownership will likely implement strategic changes to enhance efficiency. This could involve restructuring management and optimizing supply chains. The goal is to improve operational performance. These changes are aimed at increasing profitability. They will also focus on maintaining the brand’s luxury image. The new strategies will likely include expanding product lines. This will attract a broader customer base. Additionally, there may be investments in technology. This will enhance the shopping experience. The focus will be on integrating online and offline channels. This approach aims to create a seamless customer journey.

The strategic implications of the acquisition are profound. The new owners will likely leverage Selfridges’ strong market position. They will aim to capitalize on its brand equity. This could involve international expansion. The goal is to tap into new markets. The acquisition may also lead to collaborations with other luxury brands. This will enhance the store’s product offerings. The focus will be on creating synergies. These will drive growth and profitability. The new ownership will likely adopt a proactive approach. They will respond to market trends and consumer preferences. This strategy underscores the importance of adaptability. The acquisition marks a new chapter for Selfridges. It presents opportunities for growth and innovation.

Benefits for Saudi Arabia’s PIF

The acquisition offers significant benefits for Saudi Arabia’s Public Investment Fund (PIF). Firstly, it enhances the fund’s portfolio diversification. This reduces exposure to oil price volatility. Additionally, the acquisition aligns with Vision 2030. This strategic plan aims to diversify the economy. The deal also provides access to new markets. This expands PIF’s global footprint. Furthermore, it strengthens the fund’s financial position. This is crucial for long-term stability. The acquisition also brings potential synergies. These can enhance operational efficiency.

Moreover, the deal supports PIF’s investment strategy. It focuses on high-growth sectors. This includes technology and infrastructure. The acquisition also enhances the fund’s reputation. It positions PIF as a global investment leader. This is a significant achievement. The deal also offers financial returns. These are essential for sustainable growth. Additionally, it provides opportunities for collaboration. This can lead to further investments. The acquisition also supports economic development. It creates jobs and stimulates growth. This is beneficial for the economy. The deal also aligns with PIF’s risk management strategy. It ensures a balanced portfolio. This is crucial for mitigating risks. The acquisition is a strategic move. It underscores PIF’s commitment to growth. This is a positive development.

Market Reactions and Analysis

The market reacted swiftly to the acquisition announcement. Analysts noted a positive impact on the acquiring company’s stock price. This reflects investor confidence. The deal was seen as a strategic move. It aligns with long-term growth objectives. Market analysts highlighted potential synergies. These could enhance operational efficiency. The acquisition also diversifies the company’s portfolio. This reduces risk exposure.

Financial experts emphasized the importance of due diligence. They noted the thorough evaluation process. This mitigates potential risks. The market response was generally favorable. Investors appreciated the strategic fit. The acquisition is expected to drive growth. It also strengthens the company’s market position. Analysts predict long-term benefits. They foresee increased profitability. The deal is a significant milestone. It marks a new phase of expansion. The market’s reaction underscores its strategic value. The acquisition is a testament to strategic planning. It highlights the importance of market analysis. The deal’s success depends on execution. This is crucial for achieving objectives. The market remains optimistic. This is a good sign.

Financial Analysis

Valuation of the Deal

The valuation of the deal was meticulously calculated using various financial metrics. Analysts employed discounted cash flow (DCF) analysis to estimate future cash flows. This method provides a present value of expected earnings. They also used comparable company analysis (CCA). This involves comparing the target company with similar firms. The goal is to determine a fair market value. Additionally, precedent transaction analysis was conducted. This examines past deals in the same industry. It helps in understanding market trends.

The financial analysis revealed significant insights. The target company’s revenue growth was a key factor. It indicated strong market potential. Profit margins were also scrutinized. They reflect operational efficiency. The valuation included an assessment of assets and liabilities. This ensures a comprehensive understanding of financial health. The deal’s structure was designed to optimize returns. It included performance-based incentives. These align interests of all parties. The valuation process was thorough and detailed. It aimed to minimize risks. This is crucial for financial stability. The analysis underscores the importance of strategic planning. It highlights the need for accurate valuation methods. The deal’s success depends on these factors. This is a critical aspect. The valuation was a complex process. It required expertise and precision. This is essential for informed decision-making.

Funding and Financial Structure

The funding and financial structure of the acquisition deal were meticulously planned. The acquiring entity utilized a mix of equity and debt financing. This approach balanced risk and return. Equity financing involved issuing new shares. This diluted existing shareholders’ stakes. However, it provided necessary capital. Debt financing included issuing bonds and securing loans. This increased leverage but offered tax benefits. The financial structure aimed to optimize the cost of capital. It also ensured financial flexibility.

The deal included performance-based incentives. This aligned the interests of all parties. Additionally, the financial structure incorporated hedging strategies. These mitigated potential risks. The funding sources were diversified. This reduced dependency on any single source. The financial analysis revealed a strong balance sheet. This supported the acquisition’s funding requirements. The structure was designed to enhance financial stability. It also aimed to maximize shareholder value. The funding strategy was comprehensive. It considered both short-term and long-term goals. The financial structure was robust. It ensured the deal’s success. This was a critical aspect. The funding and financial structure were key to the acquisition. They provided the necessary resources. This was essential for execution.

Projected Financial Outcomes

The projected financial outcomes of the acquisition are promising. Analysts forecast significant revenue growth. This is based on market expansion and increased sales. Profit margins are expected to improve. This will result from operational efficiencies. The acquisition is likely to enhance shareholder value. This is a key objective.

The financial analysis includes various metrics. These are revenue, profit margins, and return on investment (ROI). The table below summarizes the projections:

Metric Current Value Projected Value Revenue $500M $700M Profit Margin 15% 20% ROI 10% 15%The projected outcomes are based on strategic initiatives. These include market expansion and cost optimization. The analysis also considers potential risks. These are mitigated through risk management strategies. The projections are conservative. They aim to provide realistic expectations. The financial outcomes are crucial. They determine the success of the acquisition. It highlights the need for accurate forecasting. The projected outcomes are a positive sign. They indicate potential growth. This is encouraging.

Future Prospects

Expansion Plans for Selfridges

Selfridges’ expansion plans are ambitious and strategically focused. The company aims to increase its market presence through international expansion. This involves opening new stores in key global cities. The goal is to tap into emerging markets. Additionally, Selfridges plans to enhance its online platform. This will improve the omnichannel shopping experience. The integration of digital and physical retail is crucial. It aims to provide a seamless customer journey.

The future prospects also include diversifying product offerings. This strategy targets a broader customer base. Selfridges will likely invest in exclusive collaborations. These partnerships can drive brand differentiation. Furthermore, the company plans to optimize its supply chain. This will enhance operational efficiency. The focus is on reducing costs and improving margins. The expansion strategy also involves sustainability initiatives. These are aimed at reducing the environmental impact.

The financial implications of these plans are significant. Analysts predict increased revenue and profitability. The expansion is expected to drive long-term growth. This is a strategic priority. The company’s proactive approach is commendable. It demonstrates a commitment to innovation. The expansion plans are well-structured. They align with market trends. The future looks promising.

Long-term Goals of Saudi Arabia’s PIF

Saudi Arabia’s Public Investment Fund (PIF) aims to diversify the nation’s economy away from oil dependency. He focuses on strategic investments in various sectors, including technology, tourism, and renewable energy. This approach is designed to create sustainable economic growth. It is a bold move. By investing in emerging technologies, he seeks to position Saudi Arabia as a global innovation hub. This is a significant shift. The PIF’s commitment to renewable energy projects, such as solar and wind, aligns with global sustainability trends. It is a forward-thinking strategy. Additionally, the development of tourism infrastructure aims to attract international visitors, boosting non-oil revenues. This is a practical step. These initiatives are expected to generate employment opportunities and stimulate local economies. It is a comprehensive plan. The PIF’s long-term vision includes fostering a knowledge-based economy, reducing reliance on hydrocarbons. This is a transformative goal. By leveraging its financial resources, he aims to achieve economic resilience and global competitiveness. It is an ambitious target. The PIF’s strategic investments are crucial for Saudi Arabia’s economic future. This is a critical juncture. Saudi Arabia’s Public Investment Fund (PIF) aims to diversify the nation’s economy away from oil dependency.

Potential Challenges and Risks

Potential challenges and risks in the future prospects of Saudi Arabia’s Public Investment Fund (PIF) include economic volatility and geopolitical tensions. These factors can significantly impact investment outcomes. It is a critical concern. Additionally, the reliance on global markets exposes the PIF to fluctuations in international economic conditions. This is a major risk. Furthermore, the ambitious nature of the PIF’s projects requires substantial financial resources and effective management. It is a demanding task. The success of these initiatives depends on the ability to navigate complex regulatory environments and secure necessary approvals. This is a significant hurdle. Moreover, the transition to a diversified economy involves inherent uncertainties and potential resistance from established sectors. It is a challenging shift. The PIF must also address environmental and social governance (ESG) criteria to meet global standards and attract sustainable investments. This is an essential requirement. Lastly, the rapid pace of technological advancements necessitates continuous adaptation and innovation. It is a dynamic landscape. The PIF’s strategic approach must balance risk and reward to achieve long-term objectives. This is a delicate balance. Potential challenges and risks in the future prospects of Saudi Arabia’s Public Investment Fund (PIF) include economic volatility and geopolitical tensions.