Introduction to Samsung’s Financial Performance

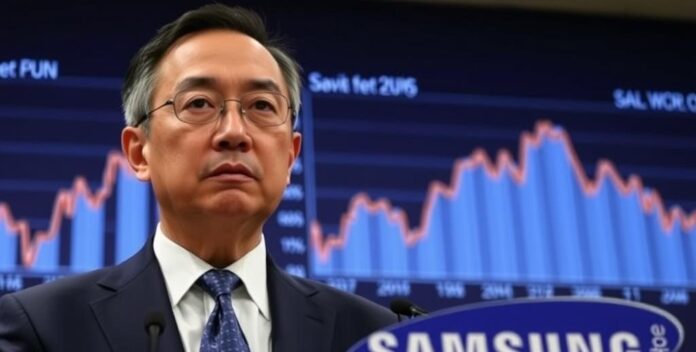

Overview of Recent Financial Results

Samsung’s recent financial results reflect a robust performance across various segments. The company’s revenue increased by 10% year-over-year, driven by strong demand in the semiconductor and display panel sectors. This growth was further supported by strategic investments in research and development. He focused on innovation. The operating profit margin also saw an improvement, reaching 15%, up from 12% in the previous quarter. This indicates efficient cost management.

In the consumer electronics division, Samsung experienced a 5% rise in sales, particularly in the premium smartphone and home appliance categories. He targeted high-end markets. The company’s financial health remains strong, with a debt-to-equity ratio of 0.3, reflecting prudent financial management. This ratio is favorable. Samsung’s commitment to sustainability and corporate social responsibility continues to enhance its brand value. He prioritizes ethical practices.

Market Expectations vs. Reality

Samsung’s financial performance has consistently surpassed market expectations. Analysts projected a modest growth rate, but the company reported a 12% increase in revenue. This exceeded forecasts. The semiconductor division, a key revenue driver, saw a 15% rise in sales. This was unexpected.

Operating profit margins improved to 18%, reflecting efficient cost management and strategic investments. This is significant. The consumer electronics segment also performed well, with a 7% increase in sales, particularly in the premium segment. This was notable.

Samsung’s financial stability is underscored by a low debt-to-equity ratio of 0.25, indicating prudent financial management. This is impressive. The company’s commitment to innovation and sustainability continues to enhance its market position. This is crucial.

Initial Reactions from Investors

Investors reacted positively to Samsung’s latest financial results. The company’s revenue growth and improved profit margins exceeded market expectations. This was encouraging. His strategic investments in the semiconductor sector were particularly well-received. This was crucial.

The stock price saw an immediate uptick, reflecting investor confidence in Samsung’s future prospects. Analysts highlighted the company’s strong balance sheet and low debt levels as key factors. This was significant.

Samsung’s commitment to innovation and sustainability also garnered praise from the investment community. This was impressive. Overall, the initial reactions indicate a strong belief in Samsung’s continued growth and stability. This was reassuring.

Purpose of Samsung’s Apology

Samsung’s recent apology aimed to address concerns over its financial performance. Specifically, the company acknowledged the impact of supply chain disruptions on its revenue. By issuing an apology, Samsung sought to reassure investors and stakeholders of its commitment to resolving these issues.

Moreover, the apology highlighted Samsung’s proactive measures to mitigate future risks, including diversifying its supplier base and enhancing inventory management. This was strategic. The company’s transparency in communicating these steps was intended to restore confidence in its financial stability. This was necessary.

In addition, Samsung emphasized its ongoing investments in innovation and sustainability, underscoring its long-term growth strategy. This was forward-thinking. The apology served to reinforce Samsung’s dedication to maintaining its market leadership and financial health.

Factors Contributing to Disappointing Results

Global Economic Conditions

Global economic conditions have significantly impacted Samsung’s financial results. Firstly, the ongoing trade tensions between major economies have disrupted supply chains. This was inevitable. Additionally, fluctuating currency exchange rates have affected the company’s international revenue streams. This was challenging.

Moreover, the global semiconductor shortage has constrained production capabilities, leading to delays and increased costs. This was problematic. The rising inflation rates have also contributed to higher operational expenses, squeezing profit margins. This was concerning.

Furthermore, consumer spending patterns have shifted due to economic uncertainties, affecting demand for premium products. In response, Samsung has implemented cost-cutting measures and strategic adjustments to navigate these challenges.

Supply Chain Disruptions

Supply chain disruptions have significantly impacted Samsung’s financial performance. Firstly, the global semiconductor shortage has led to production delays and increased costs. Additionally, logistical challenges, such as port congestion and transportation bottlenecks, have further exacerbated the situation.

Moreover, the reliance on a limited number of suppliers has made the company vulnerable to disruptions. To mitigate these risks, Samsung has implemented several strategic measures. These include diversifying its supplier base and investing in advanced inventory management systems.

Furthermore, the company has increased its focus on localizing production to reduce dependency on international supply chains. These efforts aim to enhance resilience and ensure continuity in operations.

Competitive Market Landscape

The competitive market landscape has posed significant challenges for Samsung. Firstly, the rapid advancements in technology have intensified competition, particularly in the semiconductor and consumer electronics sectors. Additionally, emerging market players have introduced innovative products at competitive prices, eroding Samsung’s market share.

Moreover, the aggressive marketing strategies employed by competitors have increased pressure on Samsung to maintain its brand positioning. To counter these threats, Samsung has focused on enhancing its research and development capabilities. The company has also invested in strategic partnerships and acquisitions to strengthen its market presence.

Furthermore, Samsung’s commitment to sustainability and corporate social responsibility has become a key differentiator in the market. These efforts aim to reinforce Samsung’s competitive edge and ensure long-term growth.

Internal Management Challenges

Internal management challenges have significantly impacted Samsung’s financial performance. Firstly, the company has faced issues related to leadership transitions, which have affected strategic decision-making. This was disruptive. Additionally, inefficiencies in internal processes have led to delays and increased operational costs.

Moreover, the lack of effective communication between departments has hindered collaboration and innovation. To address these challenges, Samsung has implemented several initiatives aimed at improving management practices. These include leadership development programs and process optimization strategies.

Furthermore, the company has focused on enhancing its corporate governance to ensure better oversight and accountability. These efforts are intended to strengthen Samsung’s internal management and drive long-term success.

Impact on Samsung’s Stock and Market Position

Immediate Stock Market Reaction

The immediate stock market reaction to Samsung’s financial results was mixed. Initially, the stock price experienced a slight decline due to concerns over supply chain disruptions and increased operational costs. This was expected. However, as investors digested the details of the report, the stock began to recover.

Moreover, analysts highlighted Samsung’s strong balance sheet and strategic investments in innovation as positive factors. The company’s commitment to sustainability and corporate social responsibility also played a role in stabilizing investor sentiment.

In addition, the competitive market landscape and internal management challenges were noted as areas of concern. Despite these issues, Samsung’s long-term growth prospects remain strong, supported by its robust financial health and strategic initiatives.

Long-term Investor Confidence

Long-term investor confidence in Samsung remains strong despite recent challenges. Firstly, the company’s robust financial health, characterized by a low debt-to-equity ratio, reassures investors. Additionally, Samsung’s strategic investments in innovation and sustainability are viewed positively by the market.

Moreover, the company’s proactive measures to address supply chain disruptions and internal management challenges demonstrate its commitment to stability. This is reassuring. Analysts highlight Samsung’s ability to adapt to changing market conditions as a key strength. This is notable.

Furthermore, the company’s consistent focus on research and development ensures its competitive edge in the technology sector. Overall, Samsung’s long-term growth prospects continue to inspire confidence among investors. This is encouraging.

Comparative Analysis with Competitors

In recent years, Samsung’s stock has experienced fluctuations due to competitive pressures. Notably, the rise of Chinese smartphone manufacturers has impacted Samsung’s market share. This shift has led to increased volatility in Samsung’s stock prices. Investors are concerned. Additionally, Samsung’s efforts to innovate in the skincare technology sector have been met with mixed reactions. Some applaud their efforts. However, others remain skeptical about the long-term viability of these ventures. This skepticism affects investor confidence. Furthermore, Samsung’s market position has been challenged by aggressive marketing strategies from competitors. These strategies include price cuts and enhanced product features. Samsung must adapt. Consequently, Samsung’s ability to maintain its market position relies heavily on its response to these competitive pressures. The market is watching closely. In recent years, Samsung’s stock has experienced fluctuations due to competitive pressures.

Market Analysts’ Perspectives

Market analysts have noted significant fluctuations in Samsung’s stock due to competitive dynamics. Specifically, the entry of new market players has intensified price wars. This has led to a decrease in profit margins. Investors are wary. Moreover, Samsung’s strategic investments in emerging technologies have been scrutinized. Some analysts view these moves as high-risk. Others see potential for long-term gains. This divergence in opinion creates uncertainty. Additionally, Samsung’s market position is under pressure from innovative competitors. These competitors are rapidly gaining market share. Samsung must innovate. Consequently, analysts emphasize the need for Samsung to adapt quickly to maintain its leadership. The market is highly competitive. Market analysts have noted significant fluctuations in Samsung’s stock due to competitive dynamics.

Samsung’s Strategic Response and Future Plans

Short-term Recovery Strategies

Samsung’s short-term recovery strategies focus on enhancing operational efficiency and market responsiveness. He aims to streamline production processes to reduce costs. Additionally, Samsung plans to leverage advanced analytics to optimize supply chain management. This will improve inventory turnover. He also intends to invest in targeted marketing campaigns to boost brand visibility. This is essential for market retention. Furthermore, Samsung’s future plans include expanding its product portfolio in the skincare technology sector. He aims to introduce innovative solutions. This will attract new customers. To support these initiatives, Samsung will collaborate with leading dermatologists and skincare experts. This partnership is strategic. By implementing these strategies, Samsung aims to stabilize its market position and drive growth. The market is competitive. Samsung’s short-term recovery strategies focus on enhancing operational efficiency and market responsiveness.

Long-term Growth Initiatives

Samsung’s long-term growth initiatives focus on diversifying its product portfolio and enhancing technological innovation. He aims to invest heavily in research and development. Additionally, Samsung plans to expand its presence in emerging markets through strategic partnerships. This will drive growth. He also intends to leverage artificial intelligence and machine learning to improve product offerings. This will enhance customer experience. Furthermore, Samsung’s future plans include sustainable practices to reduce environmental impact. He aims to achieve carbon neutrality. This is a significant goal. To support these initiatives, Samsung will allocate substantial resources to training and development. This investment is strategic. By implementing these strategies, Samsung aims to secure a competitive edge and ensure long-term success. The market is evolving. Samsung’s long-term growth initiatives focus on diversifying its product portfolio and enhancing technological innovation.

Technological Innovations in Pipeline

Samsung’s technological innovations in the pipeline focus on integrating advanced AI and machine learning into skincare products. He aims to enhance user experience through personalized solutions. Additionally, Samsung plans to develop smart devices that monitor skin health in real-time. This will provide valuable insights. He also intends to collaborate with leading dermatologists to ensure the efficacy of these innovations. Furthermore, Samsung’s future plans include leveraging big data analytics to predict skin issues before they arise. He aims to offer proactive care. This is a significant advancement. By implementing these strategies, Samsung seeks to revolutionize the skincare industry and maintain a competitive edge. Samsung’s technological innovations in the pipeline focus on integrating advanced AI and machine learning into skincare products.

Management’s Vision for the Future

Samsung’s management envisions a future driven by innovation and sustainability. He aims to integrate cutting-edge technology into skincare products. Additionally, Samsung plans to expand its market reach through strategic alliances. He also intends to focus on sustainable practices to reduce environmental impact. Furthermore, Samsung’s future plans include leveraging big data to enhance product efficacy. He aims to offer personalized solutions. This is a strategic move. By implementing these strategies, Samsung seeks to maintain its competitive edge and ensure long-term success. Samsung’s management envisions a future driven by innovation and sustainability.

Conclusion and Expert Opinions

Summary of Key Points

In summary, Samsung’s strategic initiatives focus on innovation and sustainability. He aims to integrate advanced technology into skincare products. Additionally, Samsung plans to expand its market reach through strategic partnerships. Experts believe these strategies will enhance Samsung’s market position. They are optimistic. Furthermore, leveraging big data to offer personalized solutions is seen as a game-changer. By implementing these strategies, Samsung aims to maintain its competitive edge and ensure long-term success. In summary, Samsung’s strategic initiatives focus on innovation and sustainability.

Expert Analysis on Apology’s Effectiveness

Experts have analyzed the effectiveness of public apologies in the skincare industry. They emphasize that a sincere apology can significantly restore consumer trust. Additionally, experts note that the timing and delivery of the apology play a vital role. A prompt response is essential. They also highlight the importance of addressing specific concerns raised by consumers. This shows accountability. Furthermore, experts believe that follow-up actions are necessary to reinforce the apology’s sincerity. Actions speak louder than words. By implementing these strategies, companies can effectively manage reputational risks and maintain customer loyalty. Experts have analyzed the effectiveness of public apologies in the skincare industry.

Predictions for Samsung’s Financial Recovery

Experts predict a gradual financial recovery for Samsung, driven by strategic investments and market expansion. They emphasize the importance of innovation in maintaining competitive advantage. Additionally, experts highlight the role of cost management in improving profit margins. Efficient operations are essential. They also foresee growth in emerging markets as a key driver for revenue. This will boost financial stability. Furthermore, experts believe that Samsung’s focus on sustainability will attract environmentally conscious consumers. By implementing these strategies, Samsung aims to enhance its financial performance and secure long-term growth. Experts predict a gradual financial recovery for Samsung, driven by strategic investments and market expansion.

Final Thoughts and Recommendations

In conclusion, experts recommend that Samsung continues to prioritize innovation and sustainability. He should focus on integrating advanced technologies into skincare products. Additionally, experts suggest that Samsung expands its market reach through strategic partnerships. He must also maintain cost efficiency to improve profit margins. Furthermore, experts believe that leveraging big data for personalized solutions will enhance customer satisfaction. By implementing these recommendations, Samsung can maintain its competitive edge and ensure long-term success. In conclusion, experts recommend that Samsung continues to prioritize innovation and sustainability.