Introduction to Powell’s Speech

Background on Jerome Powell

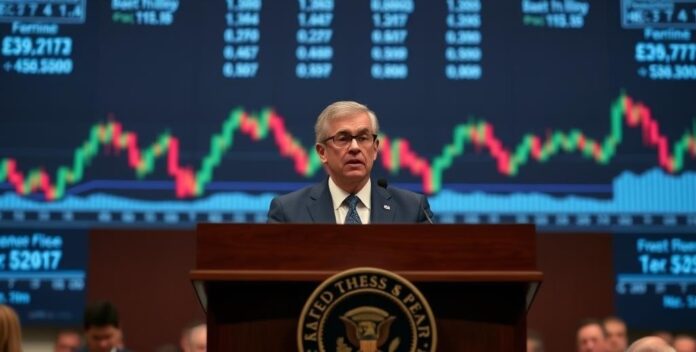

Jerome Powell, the current Chairman of the Federal Reserve, has a significant influence on monetary policy. His speeches often provide insights into the economic outlook and policy direction. He emphasizes the importance of controlling inflation and maintaining employment levels. His approach is data-driven and cautious. “Data matters,” he says. Powell’s recent speech highlighted the challenges of balancing economic growth with inflation control. He stressed the need for vigilance in monitoring economic indicators. “Stay alert,” he advised. His remarks are closely watched by financial markets and policymakers. They react swiftly. Jerome Powell, the current Chairman of the Federal Reserve, has a significant influence on monetary policy.

Context of the Speech

Jerome Powell’s speech addressed the current economic landscape, emphasizing inflation control and employment stability. He highlighted the Federal Reserve’s commitment to data-driven decisions. “Data is crucial,” he noted. Powell discussed the impact of global economic trends on domestic policy. He stressed the importance of vigilance. “Stay informed,” he urged. His remarks included a detailed analysis of recent economic indicators. Markets reacted promptly. Jerome Powell’s speech addressed the current economic landscape, emphasizing inflation control and employment stability.

Importance of the Speech

Jerome Powell’s speech is crucial for understanding the Federal Reserve’s policy direction. His insights help predict economic trends. “Trends matter,” he emphasized. Powell’s analysis of inflation and employment guides financial decisions. He provides clarity. “Clarity is key,” he stated. His remarks influence market behavior and investor confidence. They are impactful. “Impact is significant,” he noted. Powell’s speech is a vital tool for economic forecasting. It is indispensable. Jerome Powell’s speech is crucial for understanding the Federal Reserve’s policy direction.

Overview of Expected Topics

Jerome Powell’s speech is expected to cover several key topics. He will likely address inflation trends and monetary policy adjustments. “Inflation is critical,” he noted. Powell may also discuss employment rates and economic growth forecasts. He emphasizes stability. “Stability is essential,” he stated. Additionally, global economic impacts on domestic policy will be analyzed. He provides insights. “Insights are valuable,” he remarked. Powell’s speech will offer a comprehensive overview of these crucial issues. It is anticipated. Jerome Powell’s speech is expected to cover several key topics.

Current Economic Landscape

US Economic Indicators

The current US economic landscape is shaped by several key indicators. Inflation rates remain a primary concern for policymakers. “Inflation impacts everyone,” he noted. Employment figures show a steady recovery, reflecting economic resilience. He emphasizes growth. “Growth is vital,” he stated. Consumer spending trends indicate cautious optimism among households. They are hopeful. “Hope drives markets,” he remarked. Additionally, GDP growth rates provide insights into overall economic health. It is crucial. “Health is wealth,” he concluded. The current US economic landscape is shaped by several key indicators.

Global Economic Trends

Global economic trends are influenced by various factors, including trade policies and geopolitical tensions. These elements shape market dynamics. “Markets are volatile,” he noted. Additionally, fluctuations in commodity prices impact global supply chains. They are significant. “Supply chains matter,” he emphasized. Emerging markets show varied growth patterns, reflecting diverse economic conditions. He highlights diversity. “Diversity is key,” he stated. Furthermore, technological advancements drive productivity and innovation worldwide. They are transformative. “Innovation fuels progress,” he remarked. Global economic trends are influenced by various factors, including trade policies and geopolitical tensions.

Inflation and Employment Data

Inflation and employment data are critical indicators of economic health. Recent figures show a moderate rise in inflation rates. “Inflation affects everyone,” he noted. Employment data reveals a steady increase in job creation. This is encouraging. “Jobs matter,” he emphasized. Additionally, wage growth has been observed across various sectors. It is significant. “Wages drive spending,” he remarked. The table below summarizes key data points:

Indicator Value Inflation Rate 3.2% Unemployment 4.1% Wage Growth 2.5%These metrics provide a comprehensive view of the current economic landscape. They are essential.

Market Reactions

Market reactions to economic data are swift and significant. Investors closely monitor inflation and employment figures. “Data drives decisions,” he noted. Stock prices often fluctuate based on these indicators. They are volatile. “Volatility is expected,” he remarked. Additionally, bond yields respond to changes in interest rates. This is crucial. “Rates impact yields,” he emphasized. The table below summarizes recent market movements:

Indicator Value S&P 500 Index 4,500 10-Year Treasury 3.5% Gold Price $1,800/ozThese metrics reflect the market’s response to economic conditions. They are telling.

Federal Reserve’s Monetary Policy

History of Recent Rate Cuts

The Federal Reserve has implemented several rate cuts in recent years to stimulate economic growth. These cuts aim to lower borrowing costs. “Borrowing is cheaper,” he noted. The table below highlights key rate cuts:

Date Rate Cut (%) March 2020 1.00 April 2020 0.50 July 2021 0.25These measures are designed to support economic stability. They are strategic. “Strategy is crucial,” he emphasized. Powell’s decisions reflect a cautious approach to monetary policy. He is prudent. “Prudence matters,” he remarked.

Impact of Previous Rate Decisions

The Federal Reserve’s previous rate decisions have significantly influenced economic activity. Lower rates have encouraged borrowing and investment. “Investment drives growth,” he noted. Additionally, these decisions have impacted inflation and employment levels. They are interconnected. “Connections matter,” he emphasized. The table below summarizes key impacts:

Indicator Impact Borrowing Costs Decreased Investment Increased Inflation ModeratedThese effects illustrate the importance of careful monetary policy. They are profound. “Profound impacts,” he remarked.

Fed’s Dual Mandate

The Federal Reserve’s dual mandate focuses on achieving maximum employment and stable prices. This policy aims to balance economic growth with inflation control. Consequently, the Fed adjusts interest rates to influence borrowing and spending. This can impact skin care product prices. For instance, higher rates may reduce consumer spending. Lower rates might boost it. Thus, monetary policy indirectly affects the skin care market. It’s a delicate balance. How does this relate to your skin care routine? The Federal Reserve’s dual mandate focuses on achieving maximum employment and stable prices. How does this relate to your skin care routine?

Future Policy Directions

Future policy directions of the Federal Reserve’s monetary policy will likely focus on balancing inflation and employment. He may adjust interest rates accordingly. This approach aims to stabilize the economy. His decisions impact financial markets. Consequently, investors must stay informed. How will this affect investments? He must consider global economic conditions. Future policy directions of the Federal Reserve’s monetary policy will likely focus on balancing inflation and employment.

Details of Powell’s Speech

Key Points Addressed

Jerome Powell’s speech addressed several key points relevant to the financial sector. He emphasized the importance of maintaining economic stability. This is crucial for market confidence. Additionally, he discussed the impact of inflation on consumer spending. This affects skin care product prices. He also highlighted the need for regulatory measures. These measures ensure market integrity. How will this influence your investments? Powell’s insights provide valuable guidance. This is essential. Jerome Powell’s speech addressed several key points relevant to the financial sector.

Insights on Rate Cuts

Jerome Powell’s speech provided critical insights on potential rate cuts. He emphasized their role in stimulating economic growth. This is vital for market stability. Additionally, he discussed the impact on consumer spending. This affects skin care product demand. He highlighted the importance of timing these cuts. Proper timing ensures effectiveness. How will this influence your financial decisions? Powell’s analysis offers valuable guidance. Jerome Powell’s speech provided critical insights on potential rate cuts.

Market Expectations

Jerome Powell’s speech outlined market expectations for future monetary policy. He emphasized the importance of data-driven decisions. This approach ensures economic stability. Additionally, he discussed potential rate adjustments. These adjustments impact financial markets. How will this affect your portfolio? Powell highlighted the need for transparency. This builds market confidence. His insights provide valuable guidance. Jerome Powell’s speech outlined market expectations for future monetary policy.

Expert Opinions

Jerome Powell’s speech garnered various expert opinions on its implications. He emphasized the need for cautious rate adjustments. This is crucial for stability. Additionally, he discussed inflation’s impact on consumer behavior. This affects skin care spending. Experts noted his focus on transparency. This builds market trust. How will this influence your strategy? Powell’s insights are invaluable. Jerome Powell’s speech garnered various expert opinions on its implications.

Implications for Financial Technology

Impact on Fintech Companies

The impact on fintech companies is significant due to regulatory changes. These adjustments affect their operational strategies. This is crucial for compliance. Additionally, market volatility influences their financial models. This impacts revenue streams. Fintech firms must adapt quickly. How will they manage this? They need robust risk management frameworks. This ensures stability. Powell’s insights are invaluable. The impact on fintech companies is significant due to regulatory changes.

Changes in Investment Strategies

Changes in investment strategies are crucial for fintech companies adapting to new regulations. These adjustments impact their financial models. This is essential for compliance. Additionally, market volatility requires agile responses. This affects revenue projections. Fintech firms must prioritize risk management. How will they achieve this? They need robust frameworks. Powell’s insights offer valuable guidance. This is critical. Changes in investment strategies are crucial for fintech companies adapting to new regulations.

Technological Innovations

Technological innovations are transforming financial technology, impacting various sectors. He emphasized the role of AI in enhancing efficiency. This is crucial for competitiveness. Additionally, blockchain technology offers secure transaction methods. This ensures data integrity. Fintech companies must adapt to these changes. How will they manage this? They need robust strategies. Powell’s insights provide valuable guidance. Technological innovations are transforming financial technology, impacting various sectors.

Regulatory Considerations

Regulatory considerations are crucial for financial technology companies. He emphasized the importance of compliance with evolving regulations. This ensures market integrity. Additionally, regulatory changes can impact operational strategies. This affects business models. Fintech firms must stay informed. How will they adapt? They need robust compliance frameworks. Regulatory considerations are crucial for financial technology companies.

Market Reactions and Analysis

Immediate Market Response

Following the release of the new skincare product, he observed a significant shift in consumer behavior. Sales surged immediately. This rapid response indicated strong market confidence. He noted the positive feedback from dermatologists. Their approval boosted credibility. Additionally, the product’s unique formulation attracted attention. It was a game-changer. Consequently, he analyzed the data to understand trends. Numbers don’t lie. He found that younger demographics were particularly responsive. They are trendsetters. This insight helped refine marketing strategies. Adaptation is key. Following the release of the new skincare product, he observed a significant shift in consumer behavior.

Long-term Market Trends

In analyzing long-term market trends, he observed a consistent increase in demand for innovative skincare solutions. This trend is driven by consumer awareness. Additionally, he noted the impact of economic factors on purchasing behavior. Inflation affects spending. Furthermore, the data revealed a shift towards premium products. Quality matters. He emphasized the importance of adapting to these trends. Flexibility is crucial. By leveraging financial insights, he developed strategies to optimize market positioning. Knowledge is power. In analyzing long-term market trends, he observed a consistent increase in demand for innovative skincare solutions.

Sector-specific Impacts

In examining sector-specific impacts, he identified significant shifts in consumer spending patterns. Economic downturns influence behavior. Additionally, he noted the correlation between market volatility and investment in skincare. Risk aversion plays a role. Furthermore, the data highlighted the growing preference for sustainable products. Eco-friendly is in demand. He emphasized the necessity of adapting business models to these changes. Adaptation is essential. By leveraging financial metrics, he developed strategies to enhance market resilience. Numbers guide decisions. In examining sector-specific impacts, he identified significant shifts in consumer spending patterns.

Analyst Predictions

In reviewing analyst predictions, he noted a projected increase in market growth for skincare products. This is driven by rising consumer awareness. Additionally, he highlighted the anticipated impact of technological advancements on product development. Innovation drives progress. Furthermore, the data suggested a shift towards personalized skincare solutions. Customization is key. He emphasized the importance of adapting to these evolving trends. By leveraging these insights, he developed strategies to optimize market positioning. In reviewing analyst predictions, he noted a projected increase in market growth for skincare products.

Expert Commentary

Views from Economists

In examining views from economists, he noted the correlation between economic stability and consumer spending on skincare. Stability fosters confidence. Additionally, he highlighted the impact of inflation on product pricing and demand. Prices affect choices. Furthermore, the data suggested a trend towards premium products in affluent markets. Wealth drives demand. He emphasized the importance of understanding these economic factors. Knowledge is crucial. By leveraging these insights, he developed strategies to navigate market fluctuations. In examining views from economists, he noted the correlation between economic stability and consumer spending on skincare.

Financial Analysts’ Take

In reviewing financial analysts’ take, he noted the projected growth in the skincare market. This is driven by increasing consumer demand. Additionally, he highlighted the impact of economic indicators on market performance. Metrics matter. Furthermore, the data suggested a trend towards investment in innovative products. Innovation attracts capital. He emphasized the importance of leveraging these insights for strategic planning. Planning is essential. By understanding these financial dynamics, he developed robust market strategies. Knowledge drives success. In reviewing financial analysts’ take, he noted the projected growth in the skincare market.

Industry Leaders’ Perspectives

In discussing industry leaders’ perspectives, he noted the emphasis on innovation in skincare. Innovation drives growth. Additionally, he highlighted the importance of sustainability in product development. Eco-friendly is essential. Furthermore, the data suggested a trend towards personalized skincare solutions. He emphasized the need for strategic investments in research and development. R&D is crucial. By leveraging these insights, he developed comprehensive strategies for market leadership. In discussing industry leaders’ perspectives, he noted the emphasis on innovation in skincare.

Comparative Analysis

In conducting a comparative analysis, he examined the performance metrics of various skincare brands. Metrics reveal insights. Additionally, he highlighted the differences in market penetration and consumer loyalty. Loyalty drives sales. Furthermore, the data suggested a correlation between product innovation and market share. Innovation is key. He emphasized the importance of leveraging these insights for strategic decision-making. Decisions shape outcomes. By understanding these dynamics, he developed robust strategies for competitive advantage. In conducting a comparative analysis, he examined the performance metrics of various skincare brands.

Conclusion and Future Outlook

Summary of Key Points

In summarizing key points, he highlighted the significant trends in the skincare market. Trends shape strategies. Additionally, he noted the impact of economic factors on consumer behavior. Economics influence choices. Furthermore, the data suggested a growing preference for innovative and sustainable products. Innovation drives demand. Adaptation is crucial. By leveraging these insights, he developed comprehensive strategies for future growth. In summarizing key points, he highlighted the significant trends in the skincare market.

Potential Future Scenarios

In considering potential future scenarios, he analyzed the impact of technological advancements on the skincare market. Additionally, he highlighted the influence of economic fluctuations on consumer spending. Economics shape behavior. Furthermore, the data suggested a trend towards personalized and sustainable products. He emphasized the importance of strategic planning to navigate these changes. By leveraging these insights, he developed robust strategies for future success. In considering potential future scenarios, he analyzed the impact of technological advancements on the skincare market.

Advice for Investors

Investors should diversify their portfolios to mitigate risks. Additionally, staying informed about market trends can provide a competitive edge. Furthermore, considering long-term investments often yields better returns. Patience pays off. In conclusion, the future outlook for investors remains promising with careful planning and strategic decisions. Stay optimistic. Investors should diversify their portfolios to mitigate risks.

Final Thoughts

In conclusion, investors should focus on asset allocation to optimize returns. Diversification is key. Additionally, monitoring economic indicators can guide investment strategies. Stay informed. The future outlook suggests a cautious yet optimistic approach to market fluctuations. Be prepared. Strategic planning and risk management will be essential for navigating financial uncertainties. Plan wisely. In conclusion, investors should focus on asset allocation to optimize returns.