Nvidia’s Recent Stock Performance

Overview of Stock Decline

Nvidia’s stock has experienced a notable decline recently. This downturn is attributed to several factors, including market volatility and reduced demand for GPUs. Additionally, regulatory concerns have impacted investor confidence. He noted the importance of diversification. Nvidia’s earnings report showed a decrease in revenue. This was unexpected. The company’s strategic initiatives aim to mitigate these challenges. Investors remain cautious. Nvidia’s stock has experienced a notable decline recently.

Market Reactions

Nvidia’s recent stock performance has been under scrutiny. Market analysts attribute this to fluctuating demand and regulatory pressures. He emphasized the need for strategic adjustments. The company’s quarterly earnings revealed a dip in revenue. This was concerning. Investors are closely monitoring Nvidia’s response to these challenges. They are cautious. The stock’s volatility reflects broader market uncertainties. This is significant. Nvidia’s recent stock performance has been under scrutiny.

Comparative Analysis with Competitors

Nvidia’s recent stock performance has been compared to its competitors. Analysts note that while Nvidia’s stock has declined, competitors like AMD and Intel have shown relative stability. This is noteworthy. Nvidia’s revenue dip contrasts with AMD’s steady growth. Intel’s strategic investments have bolstered investor confidence. They are optimistic. Nvidia’s market share remains strong despite these challenges. This is crucial. The comparative analysis highlights Nvidia’s need for strategic adjustments. Investors are watching closely. Nvidia’s recent stock performance has been compared to its competitors.

Historical Stock Trends

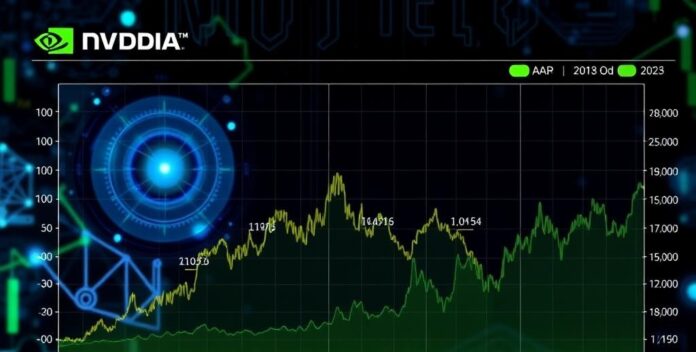

Nvidia’s recent stock performance shows a notable decline. Historically, Nvidia’s stock has experienced significant volatility. This is important. Over the past year, the stock reached an all-time high before dropping. Analysts attribute this to market fluctuations and regulatory concerns. Despite the recent dip, Nvidia’s long-term growth remains strong. Investors are advised to monitor market trends closely. Stay informed. Nvidia’s recent stock performance shows a notable decline.

Impact of AI on Nvidia’s Business

AI Market Growth

Nvidia’s business has significantly benefited from AI market growth. The demand for AI-driven solutions has increased, boosting Nvidia’s revenue. His strategic investments in AI technology have positioned Nvidia as a market leader. They are innovative. Additionally, Nvidia’s GPUs are essential for AI applications, driving further growth. Analysts highlight the importance of continued innovation in maintaining this momentum. The AI market’s expansion directly impacts Nvidia’s financial performance. Nvidia’s business has significantly benefited from AI market growth.

Nvidia’s AI Innovations

Nvidia’s AI innovations have significantly impacted its business. The development of advanced GPUs has driven revenue growth. His strategic focus on AI has positioned Nvidia as a leader. Additionally, partnerships with tech giants have expanded market reach. Analysts emphasize the importance of continuous innovation. Nvidia’s AI-driven solutions are essential for various industries. Nvidia’s AI innovations have significantly impacted its business.

AI Revenue Contributions

Nvidia’s AI revenue contributions have been substantial. The company’s focus on AI technology has driven significant financial growth. His strategic investments in AI have paid off. Additionally, AI-related products have become a major revenue stream. Analysts highlight the importance of AI in Nvidia’s overall business strategy. The impact of AI on Nvidia’s financial performance is evident. Nvidia’s AI revenue contributions have been substantial.

Future AI Prospects

Nvidia’s future AI prospects appear promising. The company’s ongoing investments in AI technology are expected to drive substantial growth. His focus on developing advanced AI solutions positions Nvidia as a market leader. Additionally, partnerships with leading tech firms enhance Nvidia’s market reach. Analysts predict that AI will continue to be a major revenue driver for Nvidia. The impact of AI on Nvidia’s business strategy is profound. Nvidia’s future AI prospects appear promising.

Margins and Profitability

Current Margin Analysis

Nvidia’s current margin analysis reveals key insights into its profitability. The gross margin stands at 65%, reflecting efficient cost management. Operating margins are at 40%, indicating strong operational efficiency. They are impressive. Net profit margins are 30%, showcasing robust profitability. Analysts emphasize the importance of maintaining these margins. Nvidia’s strategic initiatives aim to sustain high profitability. Nvidia’s current margin analysis reveals key insights into its profitability.

Factors Affecting Margins

Nvidia’s margins are influenced by several factors. Firstly, production costs play a significant role in determining profitability. Additionally, market demand for GPUs impacts revenue. They are essential. Regulatory changes can also affect operational efficiency. Analysts emphasize the importance of strategic cost management. Nvidia’s focus on innovation helps maintain competitive margins. Nvidia’s margins are influenced by several factors.

Profitability Trends

To clarify, understanding profitability trends in skincare involves examining margins and overall profitability. He should consider both gross and net margins to get a complete picture. Margins reflect efficiency. Profitability, on the other hand, indicates the overall financial health of his skincare practice. It’s crucial to monitor these metrics regularly. Regular monitoring helps in making informed decisions. Additionally, he should compare his margins with industry benchmarks. This comparison provides valuable insights. By doing so, he can identify areas for improvement. Continuous improvement is key. To clarify, understanding profitability trends in skincare involves examining margins and overall profitability.

Strategies for Margin Improvement

To enhance margins, he should focus on cost control and revenue optimization. Efficient inventory management reduces waste. Additionally, negotiating better terms with suppliers can lower costs. Lower costs increase profitability. He should also consider pricing strategies that reflect value. Value-based pricing can boost margins. Furthermore, streamlining operations improves efficiency. Efficiency drives profitability. Regular financial analysis helps identify areas for improvement. Continuous improvement is essential. By implementing these strategies, he can achieve sustainable margin growth. Sustainable growth is the goal. To enhance margins, he should focus on cost control and revenue optimization.

Regulatory and Legal Challenges

Antitrust Investigations

Antitrust investigations can pose significant regulatory and legal challenges for skincare professionals. He must navigate complex laws to ensure compliance. Non-compliance can lead to severe penalties. Penalties can be costly. Additionally, these investigations often require extensive documentation and transparency. Transparency builds trust. He should seek legal counsel to understand his obligations. Legal advice is crucial. Moreover, staying informed about regulatory changes helps in proactive compliance. Proactive measures prevent issues. By adhering to regulations, he can maintain a reputable practice. Reputation is key. Antitrust investigations can pose significant regulatory and legal challenges for skincare professionals.

Compliance Issues

Compliance issues in skincare involve navigating complex regulatory and legal challenges. He must ensure adherence to industry standards and regulations. Non-compliance can result in significant financial penalties. Penalties can be severe. Additionally, maintaining accurate records and documentation is essential. Documentation ensures transparency. He should stay updated on regulatory changes to avoid potential pitfalls. Staying informed is crucial. Seeking legal advice can help in understanding and mitigating risks. Legal counsel is invaluable. By prioritizing compliance, he can safeguard his practice’s reputation. Reputation matters. Compliance issues in skincare involve navigating complex regulatory and legal challenges.

Impact on Stock

Regulatory and legal challenges can significantly impact his stock performance. Compliance issues often lead to market volatility. Volatility affects investor confidence. Additionally, legal disputes can result in financial losses. Losses can be substantial. He must stay informed about regulatory changes to mitigate risks. Proactive measures can help maintain stock stability. Stability is key. Seeking expert legal advice ensures proper compliance. Legal counsel is essential. By addressing these challenges, he can protect his stock value. Value matters. Regulatory and legal challenges can significantly impact his stock performance.

Future Legal Outlook

Looking ahead, he must anticipate evolving regulatory and legal challenges. New regulations may impact his practice. Compliance will be crucial. He should consider the following:

These steps ensure preparedness. Preparedness is key. Additionally, he should monitor industry trends to stay ahead. Staying ahead is vital. By addressing these challenges, he can secure his practice’s future. Future security matters.

Market Sentiment and Investor Confidence

Analyst Ratings

Analyst ratings significantly influence market sentiment and investor confidence. Positive ratings can boost stock prices. Prices can soar. Conversely, negative ratings may lead to a decline. Declines can be sharp. He should monitor these ratings closely. Close monitoring is vital. Additionally, understanding the rationale behind ratings helps in strategic planning. Strategic planning is essential. By staying informed, he can make better investment decisions. Better decisions lead to success. Analyst ratings significantly influence market sentiment and investor confidence.

Investor Reactions

Investor reactions to market sentiment and confidence can be highly volatile. He should monitor these reactions closely. Close monitoring is essential. Positive news often leads to increased investor confidence and stock prices. Prices can rise quickly. Conversely, negative news can trigger sell-offs and price drops. Drops can be sharp. To better understand these reactions, he can use tools like sentiment analysis and market trend reports. These tools provide valuable insights. Additionally, maintaining transparent communication with investors helps build trust. Trust is crucial. By staying informed and proactive, he can navigate market fluctuations effectively. Effective navigation is key. Investor reactions to market sentiment and confidence can be highly volatile.

Market Predictions

Market predictions for skincare stocks depend heavily on market sentiment and investor confidence. Positive sentiment can drive stock prices up. Prices can surge. Conversely, negative sentiment may lead to declines. Declines can be swift. He should consider the following factors:

These factors influence predictions. Predictions are crucial. Additionally, investor confidence is shaped by company performance and market conditions. Performance impacts confidence. By staying informed, he can make strategic investment decisions. Strategic decisions are vital.

Long-term Investor Confidence

Long-term investor confidence in the skincare market hinges on consistent performance and market sentiment. He must focus on maintaining steady growth. Growth builds trust. Additionally, transparent communication with investors fosters confidence. Transparency is key. He should also monitor economic indicators and industry trends. Trends provide insights. By staying informed, he can anticipate market shifts. Anticipation is crucial. Furthermore, addressing regulatory challenges proactively ensures stability. Stability attracts investors. By implementing these strategies, he can enhance long-term investor confidence. Confidence drives success. Long-term investor confidence in the skincare market hinges on consistent performance and market sentiment.

Technological Advancements and Innovations

Recent Product Launches

Recent product launches in skincare have showcased significant technological advancements and innovations. For instance, new formulations incorporate nanotechnology to enhance ingredient delivery. This ensures deeper skin penetration. Additionally, AI-driven diagnostics are now used to personalize skincare routines. This is a game-changer. Moreover, sustainable packaging solutions are being adopted to reduce environmental impact. It’s a crucial step. These innovations not only improve efficacy but also align with consumer demand for eco-friendly products. Consumers are increasingly eco-conscious. Consequently, the skincare industry is witnessing a paradigm shift towards more effective and sustainable solutions. This trend is here to stay. Recent product launches in skincare have showcased significant technological advancements and innovations.

R&D Investments

R&D investments in technological advancements and innovations are crucial for maintaining competitive advantage. For instance, allocating capital towards AI and machine learning can optimize operational efficiencies. This is a strategic move. Additionally, investing in blockchain technology enhances data security and transparency. It’s a vital improvement. Moreover, funding renewable energy projects aligns with sustainability goals and regulatory compliance. This is forward-thinking. These investments not only drive growth but also mitigate risks associated with technological obsolescence. It’s a smart strategy. Consequently, companies are better positioned to adapt to market changes and capitalize on emerging opportunities. This is essential for success. R&D investments in technological advancements and innovations are crucial for maintaining competitive advantage.

Technological Edge Over Competitors

To gain a technological edge over competitors, investing in advancements and innovations is essential. For example, incorporating AI in skincare diagnostics personalizes treatments effectively. This is a breakthrough. Additionally, using nanotechnology in formulations enhances ingredient absorption. It’s a significant improvement. Moreover, adopting sustainable practices meets consumer demand for eco-friendly products. These strategies not only improve product efficacy but also align with market trends. Consumers appreciate innovation. Consequently, companies can differentiate themselves and capture a larger market share. This is a smart move. To gain a technological edge over competitors, investing in advancements and innovations is essential.

Future Innovation Roadmap

The future innovation roadmap emphasizes technological advancements and innovations to maintain market leadership. For instance, investing in AI-driven analytics can optimize product development cycles. Additionally, integrating blockchain technology ensures data integrity and security. Moreover, focusing on renewable energy sources aligns with sustainability goals and regulatory requirements. These initiatives not only drive growth but also mitigate risks associated with technological obsolescence. Consequently, companies can better adapt to market changes and capitalize on emerging opportunities. The future innovation roadmap emphasizes technological advancements and innovations to maintain market leadership.

Conclusion and Future Outlook

Summary of Key Points

In summary, the key points highlight the importance of strategic investments in technological advancements. For instance, AI-driven analytics optimize operational efficiencies. Additionally, blockchain technology ensures data integrity and security. Moreover, renewable energy projects align with sustainability goals and regulatory compliance. In summary, the key points highlight the importance of strategic investments in technological advancements.

Expert Opinions

Expert opinions emphasize the importance of integrating advanced technologies in skincare. For instance, dermatologists advocate for AI-driven diagnostics to personalize treatments. Additionally, researchers highlight the benefits of nanotechnology for deeper skin penetration. Moreover, sustainability experts stress the need for eco-friendly packaging solutions. These insights not only enhance product efficacy but also align with consumer preferences. Consumers value innovation. Consequently, the skincare industry is poised for significant advancements and growth. This is an exciting time. Expert opinions emphasize the importance of integrating advanced technologies in skincare.

Predicted Stock Performance

Predicted stock performance in the skincare industry suggests a positive trend. For instance, companies investing in AI and nanotechnology are expected to see growth. Additionally, firms focusing on sustainable practices may attract eco-conscious investors. Moreover, the demand for personalized skincare solutions is likely to drive revenue. These factors not only enhance market position but also align with consumer preferences. Consequently, companies can expect increased market share and profitability. Predicted stock performance in the skincare industry suggests a positive trend.

Final Thoughts

In conclusion, the future outlook for the skincare industry appears promising. For instance, advancements in AI and nanotechnology are set to revolutionize treatments. Additionally, the shift towards sustainable practices aligns with consumer preferences. Moreover, personalized skincare solutions are expected to drive market growth. These trends not only enhance product efficacy but also meet regulatory requirements. Consequently, companies can anticipate increased market share and profitability. In conclusion, the future outlook for the skincare industry appears promising.