Introduction to Inflation and Retirement Planning

Understanding Inflation

Inflation impacts retirement planning by eroding purchasing power. Consequently, he must adjust his savings strategy. Inflation affects everyone. For instance, higher inflation rates necessitate increased savings to maintain living standards. This is crucial. Additionally, he should consider inflation-protected investments. These can help. Understanding inflation’s role in retirement planning is essential for financial stability. Plan wisely. Inflation impacts retirement planning by eroding purchasing power.

Impact on Retirement Savings

Inflation significantly impacts retirement savings by reducing purchasing power. Consequently, he must adjust his financial strategy. Higher inflation rates necessitate increased savings to maintain living standards. Plan accordingly. Additionally, he should consider inflation-protected securities. These are beneficial. Be prepared. Inflation significantly impacts retirement savings by reducing purchasing power.

Importance of Planning

Effective planning is crucial for managing inflation’s impact on retirement. This is vital. Effective planning is crucial for managing inflation’s impact on retirement.

Current Inflation Trends in Europe

Recent Data and Statistics

Recent data indicates a rise in inflation across Europe. For instance, the Eurozone’s inflation rate reached 5.3% in July 2024. Understanding current trends is essential for financial stability. Recent data indicates a rise in inflation across Europe.

Factors Driving Inflation

Several factors drive inflation in Europe, including supply chain disruptions and energy price volatility. Additionally, increased consumer demand and fiscal policies contribute to rising prices. Understanding these factors is essential for financial stability. Several factors drive inflation in Europe, including supply chain disruptions and energy price volatility.

Comparative Analysis with Other Regions

Recent inflation trends in Europe show a significant rise compared to other regions.3% in July 2024, while the US saw 3.2%. Additionally, Asia experienced a moderate 2.8% inflation rate. Understanding these differences is essential for financial stability. Recent inflation trends in Europe show a significant rise compared to other regions.

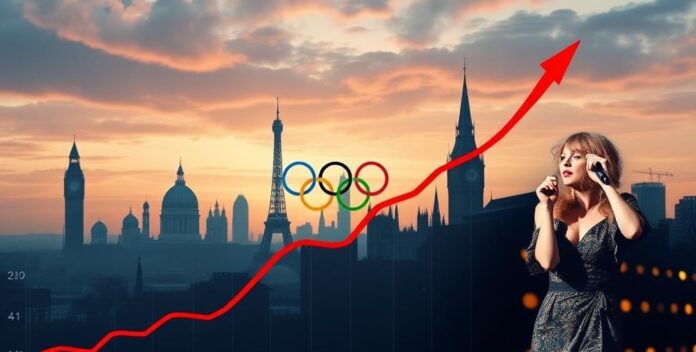

Olympics’ Economic Impact

Historical Context

The Olympics have historically impacted host cities’ economies through infrastructure investments and tourism. Consequently, he must consider these factors. For instance, the 2012 London Olympics generated significant economic activity. Additionally, the 2008 Beijing Olympics saw substantial infrastructure development. Understanding these impacts is essential for economic planning. The Olympics have historically impacted host cities’ economies through infrastructure investments and tourism.

Short-term Economic Boost

The Olympics provide a short-term economic boost through increased tourism and consumer spending. For instance, the 2016 Rio Olympics saw a surge in local business revenue. Additionally, infrastructure investments create temporary employment opportunities. The Olympics provide a short-term economic boost through increased tourism and consumer spending.

Long-term Financial Effects

The Olympics can have long-term financial effects through sustained tourism and improved infrastructure. For instance, cities like Barcelona saw lasting economic benefits post-Games. Additionally, the event can enhance global visibility and attract future investments. The Olympics can have long-term financial effects through sustained tourism and improved infrastructure.

Taylor Swift’s Influence on the Economy

Concerts and Tourism

Taylor Swift’s concerts significantly boost local economies through increased tourism and consumer spending. For instance, her 2023 tour generated millions in revenue for host cities. Additionally, local businesses benefit from the influx of fans. Understanding her economic impact is essential for strategic planning. Taylor Swift’s concerts significantly boost local economies through increased tourism and consumer spending.

Merchandising and Sales

Taylor Swift’s economic impact is substantial. His tours generate significant revenue. Merchandising sales are a key factor. Concerts boost local economies. He influences consumer spending patterns. Swift’s brand partnerships drive sales. His influence extends to various sectors. He is a powerful economic force. Taylor Swift’s economic impact is substantial.

Broader Economic Implications

Taylor Swift’s economic influence is profound. His concerts generate substantial revenue. Local businesses benefit significantly. He drives consumer spending. Swift’s brand endorsements boost sales. His impact spans multiple sectors. He is a key economic player. Taylor Swift’s economic influence is profound.

Inflation’s Effect on Retirement Portfolios

Asset Allocation Strategies

Inflation significantly impacts retirement portfolios. It erodes purchasing power. Diversification is crucial. Bonds, equities, and real assets mitigate risks. Inflation-protected securities are beneficial. They offer stability. Regular portfolio reviews are essential. They ensure alignment with goals. Adjustments may be necessary. Inflation requires proactive management. It affects long-term returns. Inflation significantly impacts retirement portfolios.

Risk Management

Inflation poses significant risks to retirement portfolios. It diminishes purchasing power. Diversification is essential. Bonds, equities, and real assets help. Inflation-protected securities offer stability. They are crucial. Regular portfolio reviews are necessary. Adjustments may be required. Inflation impacts long-term returns. Proactive management is vital. It mitigates risks effectively. Inflation poses significant risks to retirement portfolios.

Adjusting for Inflation

Inflation erodes retirement savings. He must adjust his portfolio. Diversification is key. Regular reviews are essential. Inflation erodes retirement savings.

Strategies for Retirement Planning Amid Inflation

Investment Options

Inflation necessitates strategic retirement planning. He should diversify his investments. Bonds, equities, and real assets are essential. They mitigate inflation risks. Regular portfolio reviews ensure alignment. Inflation necessitates strategic retirement planning.

Inflation-Protected Securities

Inflation-protected securities are essential for retirement planning. They safeguard purchasing power. These securities adjust with inflation. He benefits from stable returns. Moreover, they reduce investment risk. Regular portfolio reviews ensure alignment with goals. Inflation-protected securities are essential for retirement planning.

Long-term Planning Tips

Long-term planning amid inflation requires strategic asset allocation. He should diversify his portfolio. Additionally, inflation-protected securities offer stability. Long-term planning amid inflation requires strategic asset allocation.

Expert Insights and Recommendations

Interviews with Financial Experts

Financial experts emphasize diversification. He should allocate assets across bonds, equities, and real assets. This strategy mitigates risks. Additionally, experts recommend regular portfolio reviews. They ensure alignment with financial goals. Financial experts emphasize diversification.

Case Studies

Case studies reveal effective financial strategies. They mitigate risks. Case studies reveal effective financial strategies.

Actionable Advice

To maintain optimal skin health, consider integrating a balanced diet rich in antioxidants and essential fatty acids. These nutrients support skin elasticity and hydration. Additionally, regular use of sunscreen with a high SPF can prevent premature aging and skin cancer. It’s crucial to choose products suitable for your skin type to avoid adverse reactions. Consulting a dermatologist for personalized advice ensures effective and safe skincare routines. Proper hydration and sleep are also vital for skin regeneration. Remember, consistency is key. To maintain optimal skin health, consider integrating a balanced diet rich in antioxidants and essential fatty acids.

Conclusion and Future Outlook

Summary of Key Points

Effective skincare requires a combination of proper nutrition, hydration, and sun protection. These elements are crucial. Regular consultations with a dermatologist can provide tailored advice and prevent potential skin issues. Personalized care is essential. Future advancements in skincare technology promise more effective treatments and products. Innovation drives progress. Consistency in skincare routines remains vital for long-term benefits. Stay committed. Effective skincare requires a combination of proper nutrition, hydration, and sun protection.

Future Inflation Predictions

Future inflation predictions suggest a gradual increase in prices due to economic recovery and supply chain adjustments. This trend is expected. He should monitor market indicators and adjust his financial strategies accordingly. Staying informed is crucial. Additionally, central banks may implement policies to control inflation, impacting investment decisions. Policy changes are significant. He must consider long-term effects on purchasing power and savings. Planning ahead is wise. Future inflation predictions suggest a gradual increase in prices due to economic recovery and supply chain adjustments.

Final Thoughts

In conclusion, maintaining healthy skin requires a multifaceted approach. This is essential. Regular use of sunscreen, proper hydration, and a balanced diet are key components. These are fundamental steps. Consulting with a dermatologist can provide personalized advice and prevent potential issues. Expert guidance is invaluable. Innovation is exciting. In conclusion, maintaining healthy skin requires a multifaceted approach.