Introduction to War and Stock Market Dynamics

Overview of Historical Conflicts

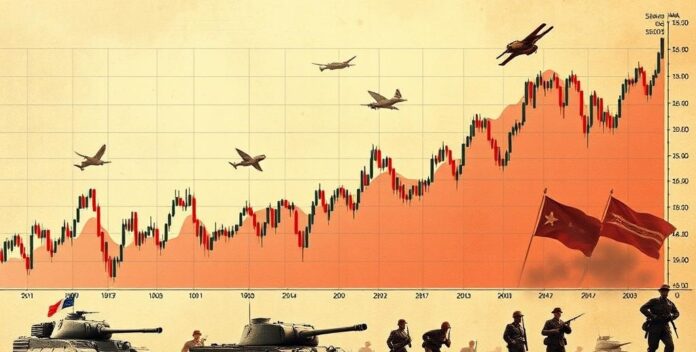

Historical conflicts have often influenced stock market dynamics, reflecting the intricate relationship between geopolitical events and financial markets. For instance, during wartime, stock markets may experience volatility due to uncertainty and risk aversion among investors. He observed this trend during major conflicts. Additionally, the allocation of resources towards military expenditures can impact economic growth and corporate profits. This, in turn, affects market performance. Moreover, the aftermath of conflicts can lead to shifts in market sentiment and investment strategies. Investors may seek safer assets. Understanding these dynamics is crucial for financial professionals and those advising on economic matters. It helps in making informed decisions. Therefore, analyzing historical conflicts provides valuable insights into market behavior. Knowledge is power. Historical conflicts have often influenced stock market dynamics, reflecting the intricate relationship between geopolitical events and financial markets.

Initial Market Reactions

Initial market reactions to war often exhibit heightened volatility, reflecting investor uncertainty and risk aversion. He observed that stock prices typically decline sharply. Additionally, sectors such as defense and energy may experience increased demand, leading to potential gains. Conversely, consumer goods and travel industries often suffer losses. This pattern is evident in historical data. For instance, during the Gulf War, defense stocks surged while airlines plummeted. Investors should monitor these trends closely. Understanding these dynamics aids in strategic decision-making. Therefore, financial professionals must stay informed. Knowledge is crucial. Initial market reactions to war often exhibit heightened volatility, reflecting investor uncertainty and risk aversion.

Long-term Economic Impacts

Long-term economic impacts of war on stock market dynamics are multifaceted, affecting various sectors differently. He noted that infrastructure rebuilding often stimulates economic growth. However, the diversion of resources to military spending can strain public finances. This can lead to higher taxes or reduced public services. Additionally, prolonged conflicts may deter foreign investment, impacting market stability. Historical data shows varied outcomes. For example, post-World War II reconstruction boosted economies, while prolonged conflicts like the Vietnam War had mixed effects. Investors should consider these factors. Understanding these impacts is crucial for strategic planning. Knowledge is essential. Long-term economic impacts of war on stock market dynamics are multifaceted, affecting various sectors differently.

Case Studies of Major Wars

World War I: Market Volatility

World War I caused significant market volatility, disrupting global financial systems. He observed that stock exchanges closed temporarily. This was to prevent panic selling. Additionally, war financing through bonds altered investment landscapes. Investors shifted focus to government securities. The war’s economic strain led to inflation and currency devaluation. This impacted purchasing power. Furthermore, post-war recovery efforts influenced market dynamics. Historical data shows varied impacts. For instance, the U.S. stock market rebounded faster than Europe’s. Investors should analyze these patterns. Understanding these effects aids strategic planning. World War I caused significant market volatility, disrupting global financial systems.

World War II: Economic Recovery

World War II significantly impacted global economies, leading to extensive recovery efforts. He noted that the Marshall Plan was pivotal. This plan provided financial aid to rebuild European economies. Additionally, industrial production surged to meet post-war demands. This boosted employment and economic growth. The Bretton Woods Agreement established a new financial order. It stabilized currencies and promoted international trade. Historical data shows varied recovery rates. economy grew rapidly, while Europe faced slower recovery. Investors should analyze these trends. Understanding these impacts aids strategic planning. World War II significantly impacted global economies, leading to extensive recovery efforts.

Cold War: Geopolitical Tensions

The Cold War era was marked by intense geopolitical tensions, significantly impacting global financial markets. He observed that the arms race led to substantial government spending. This spending influenced economic policies. Additionally, the threat of nuclear conflict created market instability. Investors were cautious. The division between capitalist and communist blocs affected trade and investment flows. This division had long-term economic implications. For instance, the Cuban Missile Crisis caused a brief market panic. Historical data shows varied impacts on different economies. Understanding these dynamics aids strategic planning. The Cold War era was marked by intense geopolitical tensions, significantly impacting global financial markets.

Modern Conflicts and Market Responses

Gulf War: Oil Prices and Stocks

The Gulf War had a profound impact on oil prices and stock markets, reflecting the sensitivity of financial markets to geopolitical events. He noted that oil prices surged due to supply disruptions. This increase affected global economies. Additionally, energy stocks experienced significant gains, while other sectors faced volatility. Investors reacted to the uncertainty. Historical data shows that the stock market initially declined but later stabilized. This pattern is common in conflict scenarios. For instance, defense stocks often rise during such times. Investors should monitor these trends. The Gulf War had a profound impact on oil prices and stock markets, reflecting the sensitivity of financial markets to geopolitical events.

War on Terror: Security Investments

The War on Terror significantly influenced security investments, reflecting the heightened focus on national defense and counterterrorism measures. He observed that government spending on security technologies increased. This spending boosted related industries. Additionally, companies specializing in surveillance and cybersecurity saw substantial growth. Investors responded to these trends. Historical data indicates that defense stocks outperformed during this period. This pattern is notable. For instance, firms providing security solutions experienced increased demand. Investors should consider these dynamics. The War on Terror significantly influenced security investments, reflecting the heightened focus on national defense and counterterrorism measures.

Ukraine Conflict: Global Market Shifts

The Ukraine conflict has led to significant global market shifts, reflecting the interconnected nature of modern economies. He noted that energy prices surged due to supply disruptions. This increase affected various sectors. Additionally, sanctions on Russia impacted global trade and investment flows. Investors reacted to these changes. Historical data shows that commodity markets experienced heightened volatility. For instance, agricultural exports from Ukraine were disrupted, affecting global food prices. The Ukraine conflict has led to significant global market shifts, reflecting the interconnected nature of modern economies.

Strategies for Investors During Wartime

Diversification and Risk Management

Diversification and risk management are crucial strategies for investors during wartime, reflecting the need to mitigate potential losses. He noted that spreading investments across various asset classes can reduce risk. This approach is fundamental. Additionally, incorporating defensive stocks, such as utilities and healthcare, can provide stability. These sectors often perform well in volatile markets. Historical data supports this strategy. For instance, during the Gulf War, diversified portfolios fared better. Investors should consider these tactics. Understanding these strategies aids in maintaining portfolio resilience. Diversification and risk management are crucial strategies for investors during wartime, reflecting the need to mitigate potential losses.

Sector-Specific Investments

During wartime, investors must adopt specific strategies to safeguard their portfolios. He should consider diversifying investments across sectors less impacted by conflict, such as healthcare and consumer staples. These sectors often remain stable. Additionally, he might focus on companies with strong balance sheets and low debt levels. This approach minimizes risk. Furthermore, investing in defense stocks can be advantageous due to increased government spending. Defense stocks often perform well. He should also keep an eye on commodities like gold, which typically rise in value during geopolitical instability. Gold is a safe haven. Lastly, maintaining a portion of his portfolio in cash or cash equivalents provides liquidity and flexibility. Liquidity is crucial. By employing these strategies, he can better navigate the uncertainties of wartime investing. Preparation is key. During wartime, investors must adopt specific strategies to safeguard their portfolios.

Long-term vs. Short-term Strategies

During wartime, investors must carefully balance long-term and short-term strategies. He should consider long-term investments in sectors like healthcare and technology, which tend to remain resilient. These sectors are stable. Additionally, he might focus on short-term opportunities in commodities such as gold and oil, which often see price spikes. Gold is a safe bet. Furthermore, maintaining a diversified portfolio can help mitigate risks associated with market volatility. Diversification is key. He should also keep a portion of his investments in cash or cash equivalents to ensure liquidity. By combining these strategies, he can better navigate the uncertainties of wartime investing. Preparation is essential. During wartime, investors must carefully balance long-term and short-term strategies.

Conclusion and Future Outlook

Lessons from Historical Data

Historical data reveals significant insights into effective skincare practices. He should consider the long-term benefits of consistent routines, as evidenced by improved skin health over time. Consistency is key. Additionally, he might focus on the importance of using products with proven ingredients like retinoids and antioxidants. These ingredients are effective. Furthermore, historical trends highlight the value of professional consultations for personalized advice. Professional advice is crucial. He should also be aware of the evolving nature of skincare research, which continuously introduces new treatments and products. Skincare evolves rapidly. By learning from historical data, he can make informed decisions for future skincare routines. Historical data reveals significant insights into effective skincare practices.

Predicting Future Market Trends

Predicting future market trends requires a comprehensive analysis of various economic indicators. He should consider factors such as interest rates, inflation, and geopolitical events, which significantly impact market movements. These factors are crucial. Additionally, he might focus on technological advancements and their potential to disrupt traditional industries. Technology evolves rapidly. Furthermore, historical data can provide valuable insights into cyclical patterns and market behavior. History often repeats itself. He should also stay informed about regulatory changes that could affect market dynamics. Regulations shape markets. By synthesizing these elements, he can develop a more accurate forecast of future market trends. Predicting future market trends requires a comprehensive analysis of various economic indicators.

Final Thoughts from the Expert

In conclusion, the expert emphasizes the importance of a personalized skincare routine. He should consider individual skin types and concerns when selecting products. Personalization is key. Additionally, he might focus on the benefits of using scientifically-backed ingredients such as hyaluronic acid and niacinamide. Furthermore, regular consultations with a dermatologist can provide tailored advice and adjustments to his regimen. Professional guidance is crucial. He should also stay informed about the latest research and advancements in skincare technology. By integrating these practices, he can achieve optimal skin health and address specific issues effectively. In conclusion, the expert emphasizes the importance of a personalized skincare routine.