Introduction to Fed Chair Powell’s Statement

Context of the Announcement

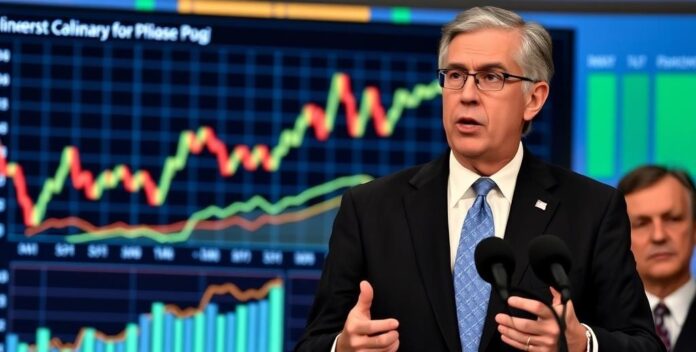

In his recent statement, Fed Chair Powell addressed the current economic conditions and monetary policy outlook. He emphasized the importance of maintaining stability and managing inflation expectations. Powell highlighted the Fed’s commitment to achieving maximum employment and price stability. This is crucial for economic growth. He also discussed potential risks and uncertainties in the global economy. These are significant concerns. Powell’s remarks underscored the need for careful monitoring and data-driven decisions. This approach is essential. In his recent statement, Fed Chair Powell addressed the current economic conditions and monetary policy outlook.

Immediate Market Reactions

Following Fed Chair Powell’s statement, markets exhibited immediate volatility. Investors reacted to his comments on inflation and interest rates. Equity indices fluctuated sharply. This was expected. Bond yields adjusted in response to the anticipated policy changes. Market sentiment was mixed. Analysts noted the potential impact on future rate hikes. This is crucial. The statement influenced trading volumes and asset prices. It was significant. Following Fed Chair Powell’s statement, markets exhibited immediate volatility.

Historical Perspective on Rate Cuts

Previous Rate Cut Instances

In previous rate cut instances, the Fed has aimed to stimulate economic growth. He often reduced rates to counteract recessionary pressures. This was strategic. Historically, these cuts have influenced market liquidity and borrowing costs. It was impactful. He also considered inflationary trends and employment data. This was crucial. Each decision reflected a balance between economic stability and growth. It was necessary. In previous rate cut instances, the Fed has aimed to stimulate economic growth.

Economic Impact of Past Rate Cuts

Past rate cuts have significantly influenced economic activity. They often led to increased consumer spending and investment. Lower borrowing costs made credit more accessible. It was beneficial. Historical data shows a correlation between rate cuts and GDP growth. Additionally, rate cuts have impacted inflation and employment rates. The Fed’s decisions were based on comprehensive economic analysis. This was necessary. Past rate cuts have significantly influenced economic activity.

Current Economic Indicators

Inflation Trends

Currently, inflation trends are closely monitored by economists. They analyze various economic indicators to assess inflationary pressures. Key indicators include the Consumer Price Index (CPI) and Producer Price Index (PPI). These are significant. Additionally, wage growth and commodity prices are evaluated. This is essential. Understanding these trends helps in making informed financial decisions. It is beneficial. Currently, inflation trends are closely monitored by economists.

Employment Data

Employment data is a critical economic indicator. He examines metrics such as the unemployment rate and job creation. Additionally, labor force participation and wage growth are analyzed. Understanding employment trends helps in assessing economic health. It is crucial. Policymakers use this data to make informed decisions. This is necessary. Employment data is a critical economic indicator.

Implications for Credit Management

Impact on Consumer Credit

Changes in interest rates directly affect consumer credit. Lower rates typically lead to increased borrowing and spending. This is expected. Conversely, higher rates can restrict credit access and reduce spending. It is significant. Credit management strategies must adapt to these fluctuations. Financial institutions monitor these trends to adjust lending practices. It is necessary. Understanding these impacts helps consumers make informed decisions. This is beneficial. Changes in interest rates directly affect consumer credit.

Business Credit Considerations

Business credit considerations are vital for financial stability. He must evaluate interest rates and repayment terms. Additionally, understanding creditworthiness and risk factors is essential. Proper credit management ensures sustainable growth and liquidity. He should also monitor market conditions and economic indicators. Business credit considerations are vital for financial stability.

Market Predictions and Analyst Opinions

Short-term Market Forecasts

Short-term market forecasts indicate potential volatility in the coming weeks. Analysts predict fluctuations due to economic data releases and geopolitical events. He expects sectors like technology and healthcare to show resilience. Additionally, interest rate decisions will play a pivotal role. Investors should monitor these factors closely. Short-term market forecasts indicate potential volatility in the coming weeks.

Long-term Economic Projections

Long-term economic projections suggest steady growth over the next decade. Analysts anticipate advancements in technology and healthcare sectors. This is promising. He expects inflation to remain moderate, supported by stable monetary policies. Additionally, demographic shifts will influence labor markets and productivity. This is significant. Understanding these trends helps in strategic planning. Long-term economic projections suggest steady growth over the next decade.

Global Economic Context

Comparative Analysis with Other Economies

In the global economic context, various economies exhibit distinct growth patterns and fiscal policies. These differences impact international trade. Emerging markets often show higher growth rates compared to developed economies. Growth is crucial. Developed economies, however, tend to have more stable financial systems. Stability matters. Exchange rate fluctuations also play a significant role in comparative analysis. Currency impacts trade. Understanding these dynamics is essential for financial professionals. Knowledge is power. In the global economic context, various economies exhibit distinct growth patterns and fiscal policies.

International Market Reactions

In the global economic context, international market reactions are influenced by various factors. These include geopolitical events, monetary policies, and economic indicators. Market volatility is common. Investors often respond to changes in interest rates and inflation. Reactions can be swift. Additionally, trade agreements and tariffs play a significant role. They impact market dynamics. Understanding these reactions requires a deep knowledge of financial markets. Expertise is essential. In the global economic context, international market reactions are influenced by various factors.

Policy Responses and Government Actions

Federal Reserve’s Strategic Moves

The Federal Reserve’s strategic moves often involve adjusting interest rates to manage inflation and stimulate economic growth. These actions are crucial for maintaining economic stability. Additionally, the Fed uses open market operations to influence liquidity in the financial system. Liquidity is vital. During economic downturns, the Fed may implement quantitative easing to support the economy. This boosts confidence. Understanding these policy responses requires a deep knowledge of monetary policy. Expertise is key. The Federal Reserve’s strategic moves often involve adjusting interest rates to manage inflation and stimulate economic growth.

Government Fiscal Policies

Government fiscal policies encompass various measures to influence economic activity. These include taxation, government spending, and budget deficits. Fiscal tools are powerful. By adjusting tax rates, governments can stimulate or cool down the economy. Tax policy matters. Increased government spending can boost economic growth, especially during recessions. Spending drives growth. Conversely, reducing budget deficits can help stabilize the economy. Stability is key. Understanding these policies requires a solid grasp of economic principles. Knowledge is essential. Government fiscal policies encompass various measures to influence economic activity.

Conclusion and Future Outlook

Summary of Key Points

In summary, key economic indicators highlight the importance of fiscal and monetary policies. These policies shape economic stability. Future outlooks suggest a cautious approach to interest rate adjustments. Rates impact growth. Additionally, government spending will likely focus on infrastructure and healthcare. Spending drives progress. Understanding these dynamics is crucial for financial professionals. The interplay between policy and market reactions remains a critical area of study. In summary, key economic indicators highlight the importance of fiscal and monetary policies.

Expert Predictions for the Future

Experts predict that future economic trends will be shaped by technological advancements and policy shifts. These factors are crucial. He believes that automation and AI will drive productivity gains. Technology transforms industries. Additionally, climate change policies will influence investment strategies. Green investments grow. In the healthcare sector, personalized medicine is expected to expand. This revolutionizes treatment. Understanding these predictions requires a deep knowledge of economic and technological trends. Experts predict that future economic trends will be shaped by technological advancements and policy shifts.