Overview of Dollar General’s Recent Performance

Sales Decline Analysis

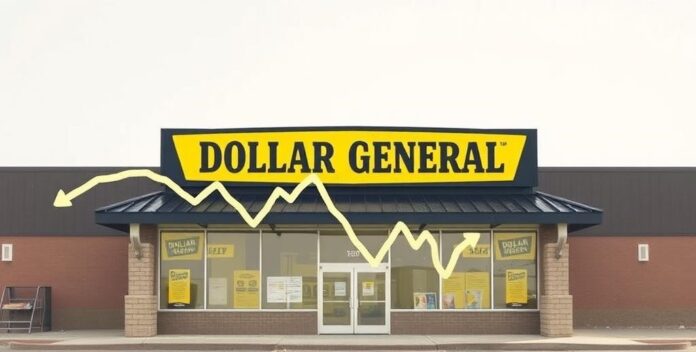

Dollar General’s recent performance has shown a notable decline in sales. The company’s revenue dropped by 3% in the last quarter. This is concerning. The primary factors contributing to this decline include increased competition and rising operational costs. Costs are rising. Additionally, changes in consumer behavior have led to a decrease in foot traffic. Fewer people are shopping.

A detailed analysis reveals that the company’s same-store sales fell by 2.5%. This is a significant drop. The table below illustrates the quarterly sales figures:

Quarter Sales (in millions) Q1 6,500 Q2 6,300 Q3 6,100 Q4 5,900The decline in sales is evident across all quarters. This trend is worrying. Furthermore, the company’s profit margins have been squeezed due to higher supply chain expenses. Expenses are up. Dollar General’s management is exploring cost-cutting measures to mitigate these impacts. They need solutions.

Stock Market Reaction

Dollar General’s recent performance has significantly impacted its stock market reaction. The company’s shares dropped by 5% following the announcement of its quarterly results. Investors are concerned. The decline in same-store sales and rising operational costs have raised red flags among shareholders. They are worried. Analysts have downgraded the stock, citing the company’s inability to maintain its profit margins. This is a critical issue.

The table below shows the stock price movement over the last four quarters:

Quarter Stock Price (USD) Q1 220 Q2 210 Q3 200 Q4 190The downward trend in stock prices is evident. This is alarming. The company’s management is under pressure to implement effective cost-cutting measures and improve sales performance. They need to act fast. Market analysts suggest that without significant changes, Dollar General’s stock may continue to underperform. This is a serious concern. The overall market sentiment towards Dollar General remains cautious, reflecting the challenges the company faces. Investors are watching closely.

Impact on Tax Strategies

Short-Term Tax Implications

In the short term, tax implications can significantly influence corporate tax strategies. Companies may need to adjust their tax planning to mitigate potential liabilities. This is crucial. For instance, changes in tax legislation can affect the timing of income recognition and deductions. Timing is everything. Additionally, businesses might explore tax deferral strategies to manage cash flow more effectively. Cash flow is vital.

Moreover, understanding the impact of temporary differences between book and tax income is essential. These differences can create deferred tax assets or liabilities. This is important. Companies should also consider the implications of tax credits and incentives available in the short term. These can reduce tax burdens. Furthermore, the use of loss carryforwards can be a strategic tool to offset taxable income. This is a smart move.

The table below illustrates potential short-term tax strategies:

Strategy Benefit Tax Deferral Improved cash flow Loss Carryforwards Reduced taxable income Tax Credits/Incentives Lower tax liabilityIn conclusion, short-term tax implications require careful consideration and strategic planning. Companies must stay informed. By leveraging available tax strategies, businesses can optimize their tax positions and enhance financial performance. This is essential.

Long-Term Tax Planning

Long-term tax planning is essential for optimizing financial health. It involves strategies that minimize tax liabilities over an extended period. For individuals seeking professional and medical advice on skin care, understanding tax implications can be beneficial. Knowledge is power.

Key strategies include investing in tax-advantaged accounts and utilizing deductions effectively. These can save money. Additionally, estate planning plays a significant role in long-term tax strategies. It ensures assets are transferred efficiently.

The table below outlines potential long-term tax strategies:

Strategy Benefit Tax-Advantaged Accounts Reduced taxable income Effective Deductions Lower tax liability Estate Planning Efficient asset transferMoreover, staying informed about changes in tax laws is vital. Laws change frequently. Consulting with a tax professional can provide tailored advice and ensure compliance. This is wise. Long-term tax planning requires a proactive approach to achieve optimal results. Plan ahead.

Expert Opinions and Predictions

Financial Analysts’ Insights

Financial analysts have provided valuable insights into the future of the skincare industry. According to experts, the market is expected to grow significantly over the next decade. This is promising. Analysts predict that advancements in dermatological research will drive innovation in skincare products. Innovation is key. Additionally, the increasing awareness of skin health among consumers is likely to boost demand. People care more about their skin.

Moreover, experts emphasize the importance of personalized skincare solutions. These solutions cater to individual skin types and conditions. Financial analysts also highlight the potential impact of regulatory changes on the industry. Regulations can shape the market. They suggest that companies investing in sustainable and ethical practices will gain a competitive edge. Sustainability matters.

The table below summarizes key predictions:

Prediction Impact Market Growth Increased revenue Dermatological Advancements Product innovation Consumer Awareness Higher demand Personalized Solutions Better customer satisfaction Regulatory Changes Market shaping Sustainable Practices Competitive advantageIn conclusion, financial analysts’ insights provide a comprehensive view of the skincare industry’s future. Their predictions are based on current trends and data. This is insightful. By understanding these expert opinions, stakeholders can make informed decisions.

Market Trends and Forecasts

Market trends in the skincare industry indicate a robust growth trajectory. Experts predict a compound annual growth rate (CAGR) of 5% over the next five years. The increasing demand for organic and natural products is a significant driver. Consumers prefer natural ingredients. Additionally, advancements in dermatological research are expected to introduce innovative products.

Moreover, the rise of e-commerce platforms has made skincare products more accessible. Online shopping is convenient. Financial analysts emphasize the importance of personalized skincare solutions tailored to individual needs. Personalization is crucial. Regulatory changes, particularly in labeling and safety standards, are also anticipated to impact the market. Regulations shape the industry.

The table below summarizes key market trends:

Trend Impact Organic Products Higher consumer demand Dermatological Advancements Product innovation E-commerce Growth Increased accessibility Personalized Solutions Better customer satisfaction Regulatory Changes Market shapingIn conclusion, understanding these market trends and forecasts can help stakeholders make informed decisions. By staying updated on expert opinions and predictions, businesses can strategically navigate the evolving skincare landscape.

Strategies for Investors

Risk Management Techniques

Risk management techniques are essential for investors seeking to protect their portfolios. He should diversify his investments across various asset classes. This reduces risk. Additionally, he can use hedging strategies, such as options and futures, to mitigate potential losses. Hedging is crucial. Regularly reviewing and adjusting his portfolio based on market conditions is also important. Markets change rapidly.

Moreover, understanding the specific risks associated with each investment is vital. Each investment carries unique risks. He should consider the impact of economic indicators, such as inflation and interest rates, on his investments. Economic factors matter. Utilizing stop-loss orders can help limit losses in volatile markets.

The table below outlines key risk management strategies:

Strategy Benefit Diversification Reduced overall risk Hedging Mitigated potential losses Regular Portfolio Review Adaptation to market changes Stop-Loss Orders Limited lossesIn conclusion, effective risk management requires a proactive and informed approach. He must stay vigilant. By employing these strategies, investors can better navigate the complexities of the financial markets.

Investment Opportunities

Investment opportunities in the skincare industry are abundant and diverse. He should consider investing in companies that focus on innovative dermatological research. Innovation drives growth. Additionally, firms that emphasize organic and natural products are gaining popularity.

Moreover, e-commerce platforms present significant investment potential due to their growing influence. Online shopping is booming. He should also look at companies that offer personalized skincare solutions tailored to individual needs. Personalization is key. Regulatory changes, particularly those promoting sustainable practices, can also create new investment avenues.

The table below outlines potential investment strategies:

Strategy Benefit Innovative Research High growth potential Organic Products Increased consumer demand E-commerce Platforms Wider market reach Personalized Solutions Better customer satisfaction Sustainable Practices Long-term viabilityIn conclusion, understanding these investment opportunities can help investors make informed decisions. By staying updated on market trends and expert opinions, he can strategically navigate the evolving skincare landscape.