Introduction to Dollar General’s Sales Forecast Cut

Overview of Dollar General’s Recent Performance

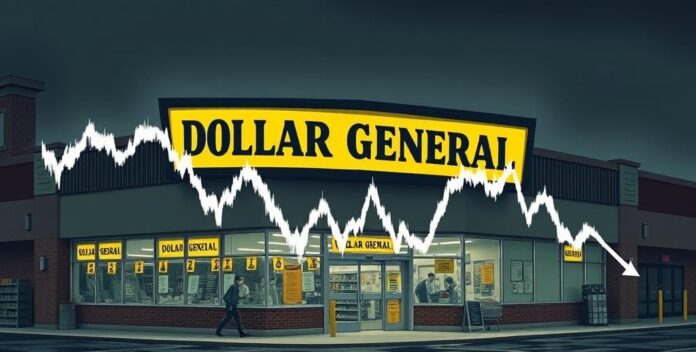

Dollar General recently revised its sales forecast downward, citing weaker consumer spending. This adjustment reflects broader economic challenges impacting retail. Consequently, the company anticipates slower growth. This is a significant shift. Analysts note that inflation and rising costs have pressured margins. Dollar General’s strategic response includes cost-cutting measures. These efforts aim to stabilize profitability. However, the outlook remains cautious. Investors should monitor these developments closely. Dollar General recently revised its sales forecast downward, citing weaker consumer spending.

Reasons Behind the Sales Forecast Cut

Dollar General’s sales forecast cut stems from multiple factors, including inflationary pressures and reduced consumer spending. These economic conditions have led to a decline in discretionary purchases. This is a critical issue. Additionally, supply chain disruptions have exacerbated inventory challenges. This impacts availability. The company has also faced increased operational costs. This affects profitability. Analysts suggest that these combined factors necessitated the forecast adjustment. It’s a complex situation. Investors should consider these dynamics when evaluating Dollar General’s performance. This is essential advice. Dollar General’s sales forecast cut stems from multiple factors, including inflationary pressures and reduced consumer spending.

Immediate Market Reaction

Following Dollar General’s sales forecast cut, the market reacted swiftly, with shares dropping significantly. This decline reflects investor concerns over future profitability. It’s a notable drop. Analysts highlighted the impact of inflation and supply chain issues. These factors are critical. The company’s stock volatility underscores market sensitivity to economic indicators. This is a key point. Investors are advised to monitor these developments closely. It’s essential advice. Following Dollar General’s sales forecast cut, the market reacted swiftly, with shares dropping significantly.

Impact on Retirement Portfolios

Short-term Effects on Stock Prices

The short-term effects on stock prices can significantly impact retirement portfolios. When stock prices drop, the value of his investments may decrease. This is a concern. For retirees, this volatility can affect their income streams. It’s a critical issue. Additionally, market fluctuations can lead to changes in asset allocation. This requires careful management. Financial advisors often recommend diversifying investments to mitigate risks. It’s sound advice. Monitoring market trends is essential for maintaining portfolio stability. This is crucial advice. The short-term effects on stock prices can significantly impact retirement portfolios.

Long-term Implications for Investors

Long-term implications for investors can be profound, especially regarding retirement portfolios. Market volatility can erode the value of investments over time. Diversification is crucial to mitigate risks and ensure stability. Investors should regularly review and adjust their portfolios. This helps maintain balance. Additionally, understanding market trends and economic indicators is vital. This knowledge aids decision-making. Financial advisors often recommend a mix of stocks, bonds, and other assets. Monitoring these factors can help secure a stable retirement. Long-term implications for investors can be profound, especially regarding retirement portfolios.

Adjusting Retirement Strategies

Adjusting retirement strategies is crucial in response to market fluctuations. Investors should consider reallocating assets to balance risk and return. Diversification across various asset classes can help mitigate potential losses. It’s a sound strategy. Additionally, regularly reviewing and updating the portfolio ensures alignment with financial goals. This is important. Consulting with a financial advisor can provide personalized insights. It’s a wise move. Monitoring economic indicators and market trends aids in making informed decisions. Adjusting retirement strategies is crucial in response to market fluctuations.

Analyzing Dollar General’s Financial Health

Current Financial Statements

Dollar General’s current financial statements reveal key insights into its financial health. The company’s revenue growth has slowed, reflecting broader economic challenges. Additionally, operating expenses have increased, impacting net income. The balance sheet shows a rise in liabilities, which may affect long-term stability. Analysts recommend closely monitoring cash flow and debt levels. Investors should consider these factors when evaluating Dollar General’s financial health. Dollar General’s current financial statements reveal key insights into its financial health.

Comparison with Competitors

Dollar General’s financial health can be assessed by comparing it with competitors like Walmart and Target. While Dollar General has maintained steady revenue growth, its profit margins are narrower. Walmart’s extensive supply chain gives it a competitive edge. It’s a key advantage. Target’s focus on higher-margin products boosts its profitability. This is notable. Dollar General’s strategy of low-cost offerings appeals to budget-conscious consumers. It’s a strong point. However, rising operational costs and inflation pose challenges. Investors should consider these factors when evaluating Dollar General’s position. Dollar General’s financial health can be assessed by comparing it with competitors like Walmart and Target.

Future Projections

Future projections for Dollar General indicate potential challenges and opportunities. Analysts predict moderate revenue growth, driven by cost-cutting measures. However, inflation and rising operational costs may impact profitability. It’s a concern. The company plans to expand its product range to attract more customers. This is a strategic move. Additionally, improving supply chain efficiency is crucial for maintaining margins. Investors should monitor these factors closely to assess long-term viability. Future projections for Dollar General indicate potential challenges and opportunities.

Market Trends and Economic Factors

Influence of Economic Conditions

Economic conditions significantly influence market trends and financial performance. Inflationary pressures can erode purchasing power, affecting consumer spending. Additionally, interest rate fluctuations impact borrowing costs for businesses. It’s a critical factor. Supply chain disruptions can lead to increased operational expenses. Analysts emphasize the importance of monitoring these economic indicators. Investors should consider these factors when making financial decisions. Understanding market trends helps in strategic planning. Economic conditions significantly influence market trends and financial performance.

Retail Sector Trends

Retail sector trends are influenced by various market trends and economic factors. Consumer spending patterns, driven by disposable income levels, significantly impact retail sales. He observes this closely. Additionally, technological advancements, such as e-commerce platforms, have reshaped the retail landscape. This is crucial. Economic indicators like inflation rates and employment levels also play a pivotal role in determining retail performance. He notes these changes. Furthermore, supply chain disruptions can affect inventory levels and pricing strategies. Understanding these factors helps in making informed decisions in the retail sector. He emphasizes this point. Retail sector trends are influenced by various market trends and economic factors.

Consumer Spending Patterns

Consumer spending patterns are shaped by various market trends and economic factors. Disposable income levels directly influence purchasing power. Inflation rates can erode consumer confidence, impacting spending habits. He notes this. Employment levels also play a significant role in determining spending capacity. Additionally, technological advancements, such as digital payment systems, have streamlined purchasing processes. Understanding these factors is essential for financial planning. Consumer spending patterns are shaped by various market trends and economic factors.

Expert Opinions and Analysis

Insights from Financial Analysts

Insights from financial analysts often highlight the importance of market volatility and risk management. Analysts emphasize the need for diversification to mitigate potential losses. They also discuss the impact of macroeconomic indicators on investment strategies. Additionally, expert opinions often focus on the significance of regulatory changes in financial markets. Understanding these insights can aid in making informed investment decisions. Insights from financial analysts often highlight the importance of market volatility and risk management.

Predictions for Dollar General’s Recovery

Predictions for Dollar General’s recovery focus on strategic cost management and market expansion. Analysts highlight the importance of optimizing supply chain operations to enhance profitability. Additionally, they emphasize the need for targeted marketing efforts to attract a broader customer base. Furthermore, expert opinions suggest that adapting to changing consumer preferences will be key to sustained growth. Understanding these strategies can provide valuable insights for stakeholders. Predictions for Dollar General’s recovery focus on strategic cost management and market expansion.

Recommendations for Investors

Recommendations for investors often emphasize the importance of portfolio diversification and risk assessment. Analysts suggest allocating assets across various sectors to mitigate potential losses. Additionally, they highlight the significance of staying informed about market trends and economic indicators. Furthermore, expert opinions stress the need for regular portfolio reviews to ensure alignment with financial goals. Understanding these recommendations can aid in making strategic investment decisions. Recommendations for investors often emphasize the importance of portfolio diversification and risk assessment.

Case Studies and Historical Comparisons

Similar Incidents in Retail History

Similar incidents in retail history often provide valuable lessons through case studies and historical comparisons. For instance, the 2008 financial crisis significantly impacted retail sales, leading to widespread store closures. Additionally, the COVID-19 pandemic caused unprecedented disruptions in supply chains and consumer behavior. Furthermore, the rise of e-commerce has reshaped traditional retail models, forcing many brick-and-mortar stores to adapt or close. Understanding these incidents helps in developing resilient business strategies. Similar incidents in retail history often provide valuable lessons through case studies and historical comparisons.

Lessons Learned from Past Market Reactions

Lessons learned from past market reactions highlight the importance of adaptability and strategic planning. For instance, during the 2008 financial crisis, companies that diversified their portfolios managed risks better. Additionally, the dot-com bubble burst taught investors the dangers of speculative investments. Furthermore, the 2020 pandemic underscored the need for robust supply chains and digital transformation. Understanding these lessons helps in navigating future market uncertainties. Lessons learned from past market reactions highlight the importance of adaptability and strategic planning.

Comparative Analysis with Other Retailers

Comparative analysis with other retailers reveals key insights through case studies and historical comparisons. For instance, during economic downturns, companies like Walmart and Target leveraged cost leadership strategies to maintain market share. Additionally, Amazon’s focus on technological innovation has set a benchmark for e-commerce efficiency. Furthermore, traditional retailers like Sears struggled due to a lack of digital adaptation. Understanding these comparisons aids in strategic planning. Comparative analysis with other retailers reveals key insights through case studies and historical comparisons.

Conclusion and Future Outlook

Summary of Key Points

In summary, understanding key points in skincare involves recognizing the importance of consistent routines and quality products. For instance, using sunscreen daily can prevent premature aging and skin cancer. Additionally, incorporating antioxidants like vitamin C can enhance skin health by neutralizing free radicals. Furthermore, staying hydrated and maintaining a balanced diet contribute significantly to skin vitality. These practices, combined with professional advice, can lead to healthier skin. In summary, understanding key points in skincare involves recognizing the importance of consistent routines and quality products.

Potential Scenarios for Dollar General

Potential scenarios for Dollar General include strategic expansion and market adaptation. Analysts suggest focusing on underserved rural areas to drive growth. Additionally, optimizing supply chain efficiency can enhance profitability. Furthermore, adapting to e-commerce trends will be essential for future success. Understanding these scenarios helps in planning for sustainable growth. Potential scenarios for Dollar General include strategic expansion and market adaptation.

Final Advice for Retirement Planning

In conclusion, retirement planning requires a strategic approach, considering both current financial status and future needs. He should evaluate his investment portfolio regularly. This ensures alignment with long-term goals. Additionally, understanding tax implications can optimize retirement savings. Tax efficiency is crucial. Future outlooks suggest increasing reliance on diversified income sources. This mitigates risks. Therefore, staying informed about market trends and economic shifts is essential. Knowledge is power. Ultimately, a well-rounded plan provides financial security and peace of mind. Plan wisely. In conclusion, retirement planning requires a strategic approach, considering both current financial status and future needs.