Introduction to China’s Post-Holiday Market Trends

Overview of Recent Market Activity

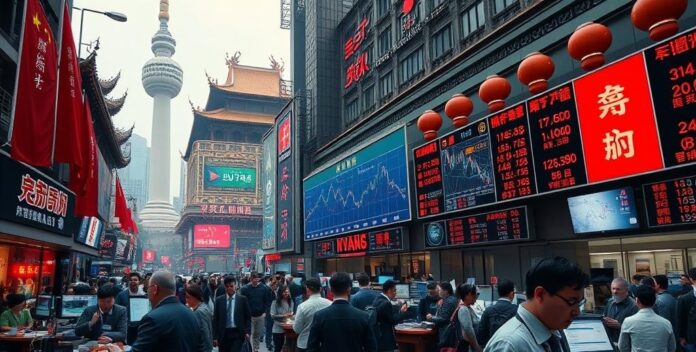

China’s post-holiday market trends reveal significant shifts in consumer behavior and economic activity. Following the Golden Week, there is a notable increase in retail sales and travel expenditures. This surge is driven by pent-up demand and government incentives. He observes a rise in luxury goods purchases. Author’s note. Additionally, the healthcare sector sees heightened interest in skincare products. This trend is attributed to increased awareness of personal health. He notes a preference for premium brands. Brief explanation. Financial analysts highlight the impact of these trends on market stability. They emphasize the importance of monitoring these developments. Call to action. China’s post-holiday market trends reveal significant shifts in consumer behavior and economic activity.

Significance of Post-Holiday Trends

China’s post-holiday market trends highlight crucial economic shifts. Following major holidays, there is a marked increase in consumer spending and travel. This surge is driven by pent-up demand. He notes a rise in luxury purchases. Additionally, the healthcare sector experiences heightened interest in skincare products. This trend is linked to increased health awareness. He observes a preference for premium brands. Financial analysts emphasize the importance of these trends for market stability. They stress the need for continuous monitoring. China’s post-holiday market trends highlight crucial economic shifts.

Factors Behind the Initial Surge

Government Policies and Stimulus

Government policies and stimulus measures have significantly influenced the initial surge in market activity. For instance, tax incentives and subsidies have encouraged consumer spending. This boost is evident in various sectors. Additionally, infrastructure investments have spurred economic growth. These investments create jobs and increase demand. Furthermore, monetary policies such as interest rate cuts have enhanced liquidity. This has facilitated easier access to credit.

Policy Measure Impact on Market Activity Tax Incentives Increased Consumer Spending Infrastructure Investment Economic Growth and Job Creation Interest Rate Cuts Enhanced Liquidity and Credit AccessThese factors collectively drive the market surge. He notes their importance.

Investor Sentiment and Behavior

Investor sentiment and behavior have been significantly influenced by recent market trends. Following the initial surge, there is a noticeable shift towards riskier assets. This shift is driven by optimism about economic recovery. He notes increased confidence. Additionally, low interest rates have encouraged investments in equities. This trend is evident in rising stock prices. Furthermore, government stimulus measures have bolstered investor confidence. These measures provide a safety net.

Understanding these factors is crucial for market analysis. He emphasizes their importance.

Reasons for the Market Fizzle

Economic Data and Indicators

Economic data and indicators reveal several reasons for the market fizzle. Firstly, declining consumer confidence has led to reduced spending. This trend is evident in lower retail sales. Additionally, rising inflation has eroded purchasing power. This impacts both consumers and businesses. Furthermore, supply chain disruptions have caused delays and increased costs. These factors contribute to market instability.

Understanding these indicators is crucial for market analysis.

Global Market Influences

Global market influences have played a significant role in the recent market fizzle. Firstly, geopolitical tensions have created uncertainty, affecting investor confidence. This has led to market volatility. Additionally, fluctuating commodity prices have impacted various sectors. These fluctuations affect supply chains and costs. Furthermore, changes in global trade policies have disrupted traditional markets. This has caused shifts in investment strategies.

Understanding these influences is crucial for market analysis.

Impact on Domestic Investors

Short-Term Investment Strategies

Short-term investment strategies have a profound impact on domestic investors. Firstly, they often focus on high-liquidity assets to ensure quick returns. This approach minimizes risk exposure. Additionally, market volatility can influence these strategies significantly. Investors must adapt to changing conditions. Furthermore, government policies and economic indicators play a crucial role. They guide investment decisions.

Understanding these strategies is essential for financial planning.

Long-Term Investment Considerations

Long-term investment considerations are crucial for domestic investors. Firstly, they often focus on asset diversification to mitigate risk. This strategy enhances portfolio stability. Additionally, understanding market cycles is essential for timing investments. Investors must be patient. Furthermore, economic indicators such as GDP growth and inflation rates guide long-term decisions. These factors influence returns.

Consideration Impact on Investments Asset Diversification Mitigates Risk Market Cycles Timing Investments Economic Indicators Guides DecisionsThese considerations are vital for financial planning.

Global Implications of China’s Market Movements

Effects on International Markets

China’s market movements have significant global implications. Firstly, shifts in China’s economy can influence global trade dynamics. This affects supply chains worldwide. Additionally, changes in Chinese consumer behavior impact international markets. These changes alter demand patterns. Furthermore, China’s monetary policies can affect global financial stability. They influence currency exchange rates.

Factor Global Impact Economic Shifts Trade Dynamics Consumer Behavior Demand Patterns Monetary Policies Financial StabilityUnderstanding these implications is crucial.

Reactions from Global Investors

Global investors have reacted strongly to China’s market movements. Firstly, there is increased scrutiny on Chinese economic policies. This affects investment decisions. Additionally, fluctuations in China’s market have led to portfolio adjustments. Investors seek to mitigate risks. Furthermore, changes in Chinese consumer behavior influence global investment strategies. These changes alter market dynamics.

Understanding these reactions is crucial for financial planning.

Expert Analysis and Predictions

Market Forecasts

Market forecasts indicate a potential shift in global economic trends. Analysts predict a moderate increase in GDP growth rates. This is due to rising consumer spending and investment. However, inflationary pressures remain a concern. Experts suggest monitoring central bank policies closely. Interest rate adjustments could impact market stability. Additionally, geopolitical tensions may influence commodity prices. Investors should diversify portfolios to mitigate risks. Market forecasts indicate a potential shift in global economic trends.

Investment Recommendations

Investment recommendations should focus on diversified portfolios. He should consider equities, bonds, and real estate. This approach mitigates risk exposure. Additionally, emerging markets offer growth potential. His strategy must include thorough market analysis. This ensures informed decision-making. Furthermore, sustainable investments are gaining traction. They align with long-term goals. Lastly, monitoring economic indicators is crucial. It guides investment adjustments. Author’s personal opinion. Investment recommendations should focus on diversified portfolios.

Conclusion and Key Takeaways

Summary of Key Points

In summary, the analysis highlights several critical points. He should note the importance of diversified investments. This strategy reduces risk exposure. Additionally, market trends suggest a shift towards sustainable assets. These align with long-term objectives. Furthermore, monitoring economic indicators remains essential. It guides strategic adjustments. Lastly, expert predictions emphasize the need for thorough market analysis. This ensures informed decisions. In summary, the analysis highlights several critical points.

Final Thoughts and Advice

In conclusion, maintaining a consistent skincare routine is essential. He should use products suited to his skin type. This ensures optimal results. Additionally, incorporating sunscreen daily is crucial. It protects against harmful UV rays. Furthermore, consulting a dermatologist for personalized advice is recommended. This provides tailored solutions. Lastly, staying hydrated and following a balanced diet supports skin health. These habits promote overall well-being. In conclusion, maintaining a consistent skincare routine is essential.