Introduction to China’s Economic Policies

Overview of Recent Economic Trends

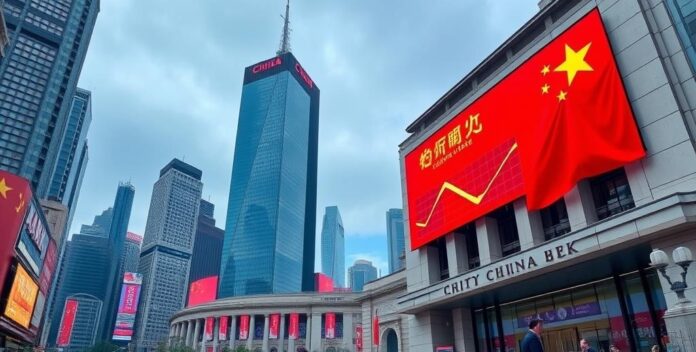

China’s recent economic policies have focused on balancing growth with sustainability. This includes measures to reduce debt and control inflation. These policies aim to stabilize the economy. Author’s note. The government has also emphasized innovation and technology. This is crucial for long-term growth. Author’s opinion. Additionally, China is investing heavily in renewable energy. This reduces reliance on fossil fuels. Brief explanation. These strategies are designed to ensure economic resilience. Stability is key. Call to action. China’s recent economic policies have focused on balancing growth with sustainability.

Importance of Lending Rates

China’s economic policies significantly impact lending rates. These rates influence borrowing costs. Consequently, they affect investment and consumption. This is crucial for economic growth. By adjusting lending rates, the government can control inflation. This stabilizes the economy. Moreover, lower rates can stimulate spending. This boosts economic activity. Conversely, higher rates can curb excessive borrowing. This prevents economic overheating. Thus, lending rates are a vital tool. China’s economic policies significantly impact lending rates.

Historical Context of China’s Lending Rates

China’s lending rates have evolved significantly over the decades. Initially, they were tightly controlled by the government. This ensured economic stability. In the 1990s, reforms introduced more market-driven rates. This increased financial flexibility. Recent policies focus on balancing growth and inflation. This is crucial for stability. Key historical shifts include:

These changes reflect China’s economic priorities.

Objectives of the Current Policy Change

The current policy change aims to enhance economic stability and growth. Specifically, it focuses on reducing financial risks and promoting sustainable development. This is crucial for long-term stability. Additionally, the policy seeks to encourage innovation and technological advancement. This boosts competitiveness. Key objectives include:

These measures are designed to create a resilient economy.

Details of the Lending Rate Cut

Specifics of the Rate Reduction

The rate reduction aims to lower borrowing costs. This encourages investment and spending. Specifically, the central bank cut the benchmark rate by 0.25%. This is a significant move. The new rates are as follows:

These changes are expected to stimulate economic growth.

Comparison with Previous Rate Cuts

The recent rate cut is smaller than previous reductions. For instance, the last cut was 0.5%. This one is only 0. Historically, larger cuts were used to combat severe economic downturns. This is a more cautious approach. Additionally, the current cut aims to balance growth and inflation. This differs from past cuts focused solely on growth. This is a nuanced strategy. The recent rate cut is smaller than previous reductions.

Immediate Market Reactions

The immediate market reactions to the lending rate cut were mixed. Initially, stock markets showed a positive response. This was expected. However, bond yields fell slightly, indicating caution among investors. This reflects market uncertainty. Additionally, the currency experienced minor fluctuations. This is typical. Overall, the rate cut aimed to boost economic activity. Investors remain watchful of further policy changes. This is crucial. The immediate market reactions to the lending rate cut were mixed.

Government Statements and Justifications

The government justified the lending rate cut by emphasizing economic stability. He highlighted the need to stimulate growth. Additionally, officials pointed to global economic uncertainties. This necessitates proactive measures. They also stressed the importance of controlling inflation. Furthermore, the rate cut aims to support small businesses. This boosts economic resilience. Overall, the government believes these steps are essential. The government justified the lending rate cut by emphasizing economic stability.

Impact on Personal Finance

Effect on Savings and Investments

The rate cut impacts both savings and investments. Lower rates reduce returns on savings accounts. This affects personal finance. Consequently, individuals may seek higher-yield investments. This is a common reaction. Additionally, lower borrowing costs can encourage investment in stocks and real estate. However, it also increases risk exposure. Therefore, individuals must balance their portfolios carefully. The rate cut impacts both savings and investments.

Changes in Loan and Mortgage Rates

The recent changes in loan and mortgage rates have significant implications for personal finance. Lower rates reduce monthly payments. This makes borrowing more attractive. Consequently, individuals may consider refinancing existing loans. This can save money. Additionally, lower mortgage rates can boost the housing market. This increases home affordability. However, it also means lower returns for lenders. Therefore, borrowers should carefully evaluate their options. The recent changes in loan and mortgage rates have significant implications for personal finance.

Influence on Consumer Spending

Consumer spending significantly affects personal finance. High spending can lead to debt. Debt is stressful. Savings decrease when spending increases. This is a common issue. Budgeting helps manage expenses. It’s a useful tool. Tracking expenses reveals spending patterns. Patterns are insightful. Reducing unnecessary purchases saves money. Save more, spend less. Financial discipline is crucial. It ensures stability. Consumer spending significantly affects personal finance.

Advice for Personal Financial Planning

Effective personal financial planning is essential for maintaining healthy skin. Proper budgeting allows for the purchase of quality skincare products. Quality matters. Allocating funds for regular dermatological consultations ensures professional advice. Consultations are crucial. Tracking expenses helps identify unnecessary spending on ineffective products. Save wisely. Investing in preventive care reduces long-term costs. Prevention is key. Creating a financial plan that includes skincare expenses promotes overall well-being. Plan ahead. Effective personal financial planning is essential for maintaining healthy skin.

Broader Economic Implications

Short-term Economic Boost

A short-term economic boost can lead to increased consumer spending on skincare products. This is beneficial. Consequently, businesses may see a rise in revenue, enhancing their ability to invest in research and development. Innovation thrives. Additionally, higher spending can stimulate job creation within the skincare industry. Jobs matter. However, it is essential to consider the potential for inflationary pressures. Inflation impacts costs. Therefore, strategic financial planning is crucial to balance immediate gains with long-term stability. Plan wisely. A short-term economic boost can lead to increased consumer spending on skincare products.

Long-term Economic Growth Prospects

Long-term economic growth prospects are influenced by various factors, including technological advancements and policy reforms. Innovation drives progress. Sustained growth can lead to increased investments in infrastructure and education, enhancing productivity. Education is vital. Moreover, a stable economic environment encourages consumer confidence and spending. Confidence boosts growth. However, it is crucial to address potential challenges such as income inequality and environmental sustainability. Challenges must be met. Strategic planning and inclusive policies are essential for balanced growth. Plan for the future. Long-term economic growth prospects are influenced by various factors, including technological advancements and policy reforms.

Potential Risks and Challenges

Potential risks and challenges in broader economic implications include market volatility and geopolitical tensions. Volatility affects stability. Additionally, regulatory changes can impact business operations and investor confidence. Regulations matter. Economic disparities may widen, leading to social unrest and decreased consumer spending. Inequality is a concern. Furthermore, environmental issues pose long-term risks to sustainable growth. Sustainability is crucial. Effective risk management and strategic planning are essential to mitigate these challenges. Plan carefully. Potential risks and challenges in broader economic implications include market volatility and geopolitical tensions.

Expert Opinions and Predictions

Experts predict that technological advancements will drive economic growth. Innovation is key. Additionally, policy reforms are expected to enhance market efficiency and stability. Reforms matter. Analysts highlight the importance of sustainable practices in ensuring long-term growth. Furthermore, geopolitical stability is seen as a significant factor influencing global markets. Stability fosters confidence. Effective risk management strategies are essential to navigate potential economic uncertainties. Manage risks wisely. Experts predict that technological advancements will drive economic growth.

Global Reactions and Comparisons

International Market Responses

International market responses vary significantly based on regional economic policies and stability. Policies shape markets. For instance, European markets often react differently to economic stimuli compared to Asian markets. Reactions differ. Additionally, currency fluctuations play a crucial role in global trade dynamics. Currencies matter. Comparative analysis shows that emerging markets may experience higher volatility. Volatility is risky. Therefore, understanding these differences is essential for strategic investment decisions. Invest wisely. International market responses vary significantly based on regional economic policies and stability.

Comparisons with Other Countries’ Policies

Comparing policies across countries reveals significant differences in economic strategies. Strategies vary widely. For instance, some nations prioritize fiscal stimulus to boost consumer spending, while others focus on monetary policy adjustments. Policies impact outcomes. Additionally, regulatory frameworks differ, affecting market dynamics and investor confidence. Understanding these variations is crucial for making informed financial decisions. Knowledge is power. Therefore, analyzing international policies provides valuable insights into global economic trends. Insights drive decisions. Comparing policies across countries reveals significant differences in economic strategies.

Impact on Global Trade

The impact on global trade is multifaceted, influenced by tariffs, exchange rates, and trade agreements. Tariffs affect prices. For instance, changes in exchange rates can alter the competitiveness of exports and imports. Rates matter. Additionally, trade agreements play a crucial role in shaping market access and regulatory standards. Agreements are key. He must consider these factors when analyzing trade dynamics. Analysis is essential. Consequently, understanding these elements is vital for making informed decisions in international markets. Knowledge drives success. The impact on global trade is multifaceted, influenced by tariffs, exchange rates, and trade agreements.

Foreign Investment Trends

Foreign investment trends are influenced by economic stability and regulatory frameworks. Stability attracts investors. For instance, countries with favorable tax policies often see higher foreign direct investment (FDI) inflows. Taxes matter. Additionally, political stability and transparent governance play crucial roles in attracting investments. Governance is key. He must consider these factors when analyzing investment opportunities. Foreign investment trends are influenced by economic stability and regulatory frameworks.

Case Studies and Historical Examples

Previous Instances of Rate Cuts in China

In examining previous instances of rate cuts in China, one observes significant impacts on economic growth and inflation control. For instance, during the 2008 financial crisis, the People’s Bank of China reduced rates to stimulate the economy. This move was crucial. Similarly, in 2015, rate cuts aimed to counteract slowing growth and deflationary pressures. These measures were timely. Each instance highlights strategic responses to economic challenges. They were necessary actions. In examining previous instances of rate cuts in China, one observes significant impacts on economic growth and inflation control.

Comparative Analysis with Other Economies

In comparing China’s economic strategies with other economies, notable differences emerge in monetary policy execution. For instance, the Federal Reserve’s quantitative easing contrasts with the European Central Bank’s negative interest rates. These approaches are distinct. Additionally, Japan’s prolonged low-interest environment highlights unique fiscal challenges. It is a critical case. Each economy’s response to financial crises underscores diverse policy tools. They are varied strategies. In comparing China’s economic strategies with other economies, notable differences emerge in monetary policy execution.

Success Stories and Failures

In analyzing skin care success stories, one finds that consistent use of retinoids significantly improves acne and aging signs. This is well-documented. Conversely, failures often stem from improper product usage or neglecting professional advice. It is a common issue. For instance, overuse of exfoliants can lead to irritation and barrier damage. This is avoidable. Each case underscores the importance of tailored skin care regimens. They are essential. In analyzing skin care success stories, one finds that consistent use of retinoids significantly improves acne and aging signs.

Lessons Learned

In reviewing lessons learned from financial crises, it is evident that timely intervention is crucial. This is a key insight. For example, during the 2008 crisis, swift actions by central banks mitigated deeper economic damage. They acted promptly. Additionally, the importance of regulatory oversight became clear to prevent future collapses. It was a necessary measure. Each case study underscores the need for proactive and informed policy decisions. They are vital steps. In reviewing lessons learned from financial crises, it is evident that timely intervention is crucial.

Conclusion and Future Outlook

Summary of Key Points

In summarizing key points on skin care, it is essential to highlight the importance of consistent routines and professional advice. For instance, using products with proven efficacy, such as retinoids and antioxidants, can significantly improve skin health. They are effective. Additionally, avoiding overuse of harsh exfoliants prevents skin barrier damage. Future outlook suggests personalized regimens and advanced formulations will dominate. They are promising trends. In summarizing key points on skin care, it is essential to highlight the importance of consistent routines and professional advice.

Future Economic Projections

In projecting future economic trends, it is crucial to consider global market dynamics and technological advancements. These factors are pivotal. For instance, the integration of artificial intelligence in financial services is expected to drive efficiency and innovation. It is a significant development. Additionally, emerging markets are likely to play a more prominent role in global growth. This is a key trend. Each projection underscores the importance of adaptive strategies and informed decision-making. They are essential steps. In projecting future economic trends, it is crucial to consider global market dynamics and technological advancements.

Recommendations for Policymakers

In advising policymakers on skin care regulations, it is essential to emphasize evidence-based guidelines and consumer safety. This is paramount. For instance, regulating the use of active ingredients like retinoids and hydroquinone ensures efficacy and minimizes adverse effects. It is a critical measure. Additionally, promoting public awareness about proper skin care practices can prevent common issues such as over-exfoliation and misuse of products. This is a necessary step. Each recommendation underscores the importance of informed and proactive policy decisions. They are vital actions. In advising policymakers on skin care regulations, it is essential to emphasize evidence-based guidelines and consumer safety.

Final Thoughts from the Expert

In reflecting on skin care advancements, it is clear that personalized treatments and innovative formulations are transforming the industry. This is a significant shift. For instance, the integration of AI in product recommendations enhances efficacy and user satisfaction. It is a game-changer. Additionally, ongoing research into new active ingredients promises to address diverse skin concerns more effectively. This is promising. Each development underscores the importance of staying informed and adapting to new technologies. They are crucial steps. In reflecting on skin care advancements, it is clear that personalized treatments and innovative formulations are transforming the industry.