Introduction to the Canada Rail Dispute

Background and Causes

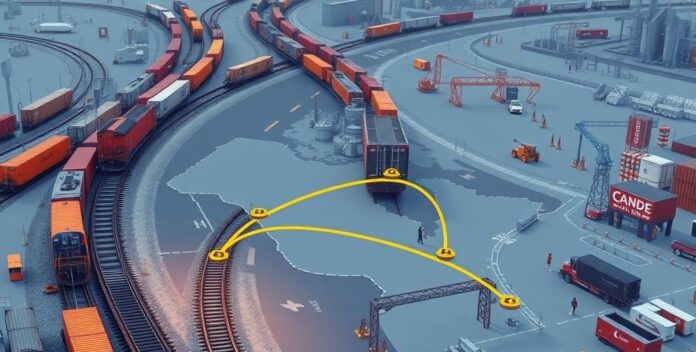

The Canada Rail Dispute emerged from a complex interplay of labor negotiations, economic pressures, and regulatory challenges. Initially, the dispute centered around wage demands and working conditions, reflecting broader economic trends. Labor unions argued for fair compensation and improved safety standards. They emphasized the need for equitable treatment. Concurrently, rail companies faced financial constraints and regulatory requirements, complicating negotiations. These companies sought to balance operational costs with compliance. Additionally, external factors such as fluctuating fuel prices and market competition influenced the dispute. These elements added layers of complexity. Ultimately, the Canada Rail Dispute highlights the intricate dynamics between labor rights and economic realities. It underscores the importance of balanced negotiations. The Canada Rail Dispute emerged from a complex interplay of labor negotiations, economic pressures, and regulatory challenges.

Key Players Involved

The Canada Rail Dispute involves several key players, each with distinct roles and interests. Firstly, labor unions represent the workforce, advocating for fair wages and improved working conditions. They emphasize safety and equity. Secondly, rail companies, including major operators like Canadian National Railway and Canadian Pacific Railway, aim to manage operational costs while complying with regulations. They face financial pressures. Additionally, government bodies play a regulatory role, ensuring compliance with labor laws and safety standards. They mediate disputes. External stakeholders, such as investors and market analysts, monitor the financial implications of the dispute. They assess risks and opportunities. The interplay between these players shapes the dynamics of the dispute. It highlights the complexity of balancing diverse interests. The Canada Rail Dispute involves several key players, each with distinct roles and interests.

Timeline of Events

The Canada Rail Dispute progressed through several pivotal stages. Initially, labor unions submitted demands for wage hikes and enhanced working conditions. They sought equitable treatment. Rail companies, including Canadian National Railway, countered with offers constrained by financial limitations and regulatory obligations. They faced economic challenges. As negotiations stalled, government agencies intervened to mediate and facilitate dialogue. They aimed for resolution. External factors, such as volatile fuel prices and competitive market pressures, further influenced the dispute’s trajectory. These elements added complexity. Each event underscored the delicate balance between labor rights and economic imperatives. It highlighted the need for fair solutions. The Canada Rail Dispute progressed through several pivotal stages.

Initial Economic Impact

The initial economic impact of the Canada Rail Dispute was significant. Firstly, disruptions in rail services led to delays in the transportation of goods, affecting supply chains. This caused financial losses. Secondly, companies reliant on rail transport faced increased costs due to the need for alternative logistics solutions. They incurred additional expenses. Moreover, the uncertainty surrounding the dispute influenced investor confidence, leading to market volatility. This affected stock prices. Additionally, the broader economic implications included potential job losses and reduced productivity in sectors dependent on rail transport. These factors compounded the economic strain. Overall, the dispute highlighted the interconnectedness of transportation and economic stability. It underscored the need for swift resolution. The initial economic impact of the Canada Rail Dispute was significant.

Impact on US Supply Chain

Disruption in Goods Transportation

The disruption in goods transportation significantly impacted the US supply chain. Firstly, delays in rail services led to bottlenecks at key distribution points, affecting inventory levels. This caused shortages. Secondly, companies had to resort to more expensive transportation alternatives, increasing operational costs. They faced financial strain. Additionally, the uncertainty surrounding the dispute affected market stability, influencing stock prices and investor confidence. This led to volatility. The broader economic implications included potential job losses and reduced productivity in sectors reliant on timely deliveries. These factors compounded the economic impact. Overall, the disruption highlighted the vulnerability of the supply chain to external shocks. It underscored the need for resilient logistics strategies. The disruption in goods transportation significantly impacted the US supply chain.

Effect on Manufacturing Industries

The disruption in the US supply chain had a profound effect on manufacturing industries. Firstly, delays in raw material deliveries led to production slowdowns and increased lead times. This impacted output. Secondly, manufacturers faced higher costs due to the need for alternative supply routes and expedited shipping. Additionally, the uncertainty surrounding the supply chain affected inventory management, leading to stockouts and overstock situations. This caused inefficiencies. The broader economic implications included potential job losses and reduced competitiveness in global markets. These factors compounded the challenges. Overall, the disruption highlighted the critical importance of a resilient supply chain. It underscored the need for strategic planning. The disruption in the US supply chain had a profound effect on manufacturing industries.

Challenges for Retailers

The disruption in the US supply chain posed significant challenges for retailers. Firstly, inventory shortages led to stockouts, affecting sales and customer satisfaction. This impacted revenue. Secondly, increased transportation costs due to alternative logistics solutions strained profit margins. They faced financial pressure. Additionally, the uncertainty surrounding supply chain stability influenced inventory management strategies, leading to either overstock or stockout situations. Retailers also had to navigate fluctuating demand patterns, further complicating their operations. These factors added complexity. Overall, the disruption highlighted the need for robust supply chain strategies. It underscored the importance of adaptability. The disruption in the US supply chain posed significant challenges for retailers.

Long-term Supply Chain Risks

The long-term supply chain risks for the US are multifaceted. Firstly, reliance on a limited number of suppliers increases vulnerability to disruptions. This poses a significant risk. Secondly, geopolitical tensions and trade policies can impact the stability of supply chains. They create uncertainty. Additionally, environmental factors such as natural disasters and climate change can disrupt logistics and production. These are unpredictable. The financial implications include increased costs and potential revenue losses due to supply chain inefficiencies. This affects profitability. Overall, the long-term risks highlight the need for diversified and resilient supply chain strategies. It underscores the importance of proactive planning. The long-term supply chain risks for the US are multifaceted.

Economic Implications

Short-term Economic Effects

The short-term economic effects of the Canada Rail Dispute were multifaceted. Firstly, disruptions in rail services led to immediate delays in the transportation of goods, affecting supply chains and inventory levels. Secondly, companies reliant on rail transport faced increased costs due to the need for alternative logistics solutions, such as trucking. Additionally, the uncertainty surrounding the dispute influenced investor confidence, leading to market volatility and fluctuations in stock prices. This created instability. The broader economic implications included potential job losses and reduced productivity in sectors dependent on rail transport. The short-term economic effects of the Canada Rail Dispute were multifaceted.

Inflationary Pressures

Inflationary pressures can significantly impact the cost structure of skincare products. When inflation rises, manufacturers may face higher input costs, such as raw materials and labor. This can lead to increased prices for consumers. He must consider the elasticity of demand. Price-sensitive customers might reduce their purchases. Author’s note. Additionally, inflation can erode purchasing power, making it harder for consumers to afford premium skincare products. He should monitor market trends closely. Companies might need to adjust their pricing strategies. Author’s personal opinion. Understanding these economic implications is crucial for professionals advising clients on skincare investments. They must stay informed. Financial literacy can help navigate these challenges effectively. Call to action. Inflationary pressures can significantly impact the cost structure of skincare products.

Impact on Trade Relations

The impact on trade relations can significantly influence the availability and cost of skincare products. For instance, tariffs and trade barriers can increase the cost of imported raw materials. This can lead to higher prices for consumers. He must consider the global supply chain. Additionally, trade agreements can either facilitate or hinder the flow of goods. He should stay informed about policy changes. Economic implications of trade relations are profound, affecting both manufacturers and consumers. They must adapt to changing conditions. For skincare professionals, understanding these dynamics is crucial. They need to provide accurate advice. Financial literacy in trade matters can enhance decision-making. Therefore, staying updated on trade policies is essential. The impact on trade relations can significantly influence the availability and cost of skincare products.

Government Response and Policies

Government response and policies can significantly impact the skincare industry. For example, regulatory changes can affect product formulations and market entry. This can lead to increased compliance costs. He must stay updated on regulations. Additionally, fiscal policies such as taxation can influence consumer spending power. He should consider the economic environment. Moreover, subsidies and grants can support innovation in skincare products. They must leverage available resources. Understanding these economic implications is crucial for professionals advising on skincare investments. They need to provide informed guidance. Financial literacy in policy matters enhances strategic decision-making. Therefore, staying informed about government policies is essential. Government response and policies can significantly impact the skincare industry.

Expert Opinions and Analysis

Financial Analysts’ Perspectives

Financial analysts’ perspectives on the skincare industry provide valuable insights. For instance, they often highlight the importance of market trends and consumer behavior. This helps in strategic planning. He must consider economic indicators. Analysts also emphasize the role of innovation in driving growth. They should monitor R&D investments. Additionally, financial ratios such as ROI and EBITDA are crucial for evaluating company performance. He needs to understand these metrics. Expert opinions often include forecasts based on macroeconomic factors.

Understanding these analyses can guide investment decisions. They need accurate data. Financial literacy is essential for interpreting these perspectives. Therefore, staying updated with expert opinions is beneficial.

Industry Leaders’ Insights

Industry leaders’ insights into the skincare market reveal critical trends and strategies. For instance, they often highlight the importance of sustainability and innovation. This drives consumer interest. He must consider market dynamics. Additionally, leaders emphasize the role of digital transformation in reaching a broader audience. They should invest in technology. Moreover, understanding consumer behavior through data analytics is crucial for tailoring products. He needs to leverage data effectively.

Furthermore, industry leaders often discuss the impact of regulatory changes on product development. They must stay compliant. Financial metrics such as profit margins and market share are also frequently analyzed. He should monitor these indicators. These insights help in making informed business decisions. They need accurate information. Therefore, staying updated with industry leaders’ perspectives is essential.

Academic Viewpoints

Academic viewpoints on the skincare industry often emphasize the importance of evidence-based practices. For instance, researchers highlight the role of clinical trials in validating product efficacy. This ensures consumer trust. He must consider scientific rigor. Additionally, academic studies often explore the economic impact of skincare innovations. They should analyze cost-benefit ratios. Moreover, interdisciplinary research can provide insights into consumer behavior and market trends. He needs to leverage diverse data sources.

Understanding these academic perspectives can guide effective skincare strategies. Financial literacy in research contexts enhances decision-making. Therefore, staying informed about academic research is crucial.

Future Predictions

Future predictions in the skincare industry often focus on technological advancements and market trends. For instance, experts anticipate significant growth in personalized skincare solutions driven by AI and data analytics. This will enhance consumer satisfaction. He must consider technological integration. Additionally, the rise of sustainable and eco-friendly products is expected to dominate the market. They should invest in green technologies. Moreover, economic factors such as inflation and global trade policies will influence pricing strategies. He needs to monitor these variables closely.

Understanding these predictions can help in strategic planning. They need accurate forecasts. Financial literacy is crucial for interpreting market trends. Therefore, staying updated with expert analyses is essential.

Conclusion and Future Outlook

Summary of Key Points

In summary, the skincare industry faces various economic challenges and opportunities. For instance, inflationary pressures can increase production costs, affecting pricing strategies. He must monitor market trends. Additionally, trade relations and government policies play crucial roles in shaping the market landscape. They should stay informed about policy changes. Financial analysts and industry leaders provide valuable insights into market dynamics and future trends. He needs to leverage expert opinions.

Understanding these key points is essential for making informed decisions. Financial literacy enhances the ability to navigate these complexities. Therefore, staying updated with economic and industry trends is crucial.

Potential Resolutions

Potential resolutions in the skincare industry often involve strategic adjustments and innovations. For instance, companies can invest in research and development to create more effective products. This can enhance consumer trust. He must consider market demands. Additionally, adopting sustainable practices can attract environmentally conscious consumers. They should prioritize green technologies. Moreover, leveraging digital marketing can expand reach and engagement. He needs to utilize online platforms effectively.

Understanding these potential resolutions can guide future strategies. Financial literacy is crucial for implementing these changes. Therefore, staying updated with industry trends is essential.

Long-term Economic Forecast

The long-term economic forecast for the skincare industry suggests steady growth driven by innovation and consumer demand. For instance, advancements in biotechnology are expected to lead to more effective skincare solutions. This will attract health-conscious consumers. He must consider market trends. Additionally, the increasing awareness of skin health will likely boost demand for premium products. They should invest in quality. Moreover, economic stability and rising disposable incomes in emerging markets will further support industry expansion. He needs to monitor global trends closely.

Understanding these forecasts can help in strategic planning. Financial literacy is crucial for interpreting market dynamics. Therefore, staying updated with economic trends is essential.

Recommendations for Stakeholders

Stakeholders should prioritize investments in innovative dermatological technologies to enhance patient outcomes and streamline operational efficiencies. This approach will yield long-term financial benefits. Additionally, fostering partnerships with leading skincare research institutions can provide access to cutting-edge treatments and insights. Collaboration drives progress. It is crucial to allocate resources towards continuous professional development for medical staff, ensuring they remain adept with the latest advancements. Knowledge is power. Regularly reviewing and adjusting financial strategies in response to market trends will help maintain fiscal health. Adaptability is key. By implementing these recommendations, stakeholders can achieve sustainable growth and improved patient care. Success is within reach. Stakeholders should prioritize investments in innovative dermatological technologies to enhance patient outcomes and streamline operational efficiencies.