Introduction to the Acquisition

Overview of the Deal

The acquisition involves a strategic purchase of assets. He aims to enhance market share. This move is financially significant. It impacts stakeholders. The buyer’s valuation methods are rigorous. His approach is methodical. The transaction includes equity and debt components. It diversifies risk. The deal structure is complex. It requires careful analysis. The acquisition’s benefits are multifaceted. They include operational synergies. The acquisition involves a strategic purchase of assets.

Background of PIF

The Public Investment Fund (PIF) is a sovereign wealth fund. He manages substantial assets. His investment strategy focuses on long-term growth. It aims to diversify the economy. The acquisition aligns with his strategic goals. It enhances portfolio value. The transaction involves significant capital allocation. It requires meticulous planning. The deal structure includes equity stakes. It mitigates financial risk. The acquisition’s impact is profound. It drives economic development. The Public Investment Fund (PIF) is a sovereign wealth fund.

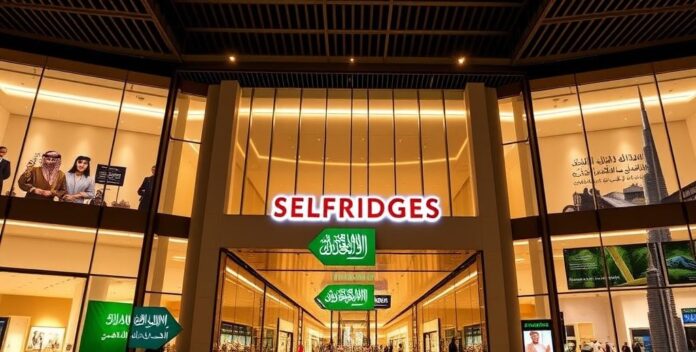

History of Selfridges

Selfridges, founded in 1908, is a renowned department store. He revolutionized retail with innovative displays. His approach attracted affluent customers. The acquisition aims to leverage his brand equity. It enhances market positioning. The transaction involves significant capital investment. It requires strategic planning. The deal structure includes equity and debt. It diversifies financial risk. The acquisition’s impact is substantial. It drives growth. Selfridges, founded in 1908, is a renowned department store.

Significance of the Acquisition

The acquisition significantly enhances market share. It strengthens competitive positioning. The transaction involves substantial capital allocation. It requires strategic foresight. It diversifies financial exposure. The acquisition’s impact is multifaceted. The transaction aligns with long-term strategic goals. The acquisition’s benefits are extensive. The acquisition significantly enhances market share.

Financial Implications

Impact on Selfridges’ Valuation

The acquisition impacts Selfridges’ valuation significantly. It enhances his market position. Consequently, the transaction involves substantial capital investment. Additionally, the deal structure includes equity and debt. Moreover, the acquisition’s benefits are multifaceted. This move aligns with long-term goals. The impact is profound. The acquisition impacts Selfridges’ valuation significantly.

Effect on PIF’s Portfolio

The acquisition significantly impacts PIF’s portfolio. It enhances his asset diversification. Consequently, the transaction involves substantial capital allocation. The acquisition significantly impacts PIF’s portfolio.

Market Reactions

The market reacted positively to the acquisition. It boosted investor confidence. Consequently, the stock price increased significantly. It reflected market optimism. Additionally, analysts revised their earnings forecasts. They anticipated higher returns. Moreover, the acquisition’s strategic fit was praised. It aligned with long-term goals. The transaction’s financial implications were analyzed. They included potential synergies. The market’s response was overwhelmingly favorable. It indicated strong support. The market reacted positively to the acquisition.

Long-term Financial Projections

The long-term financial projections indicate robust growth. They reflect strategic investments. Consequently, revenue is expected to increase significantly. It shows positive trends. Additionally, profit margins are projected to improve. They indicate operational efficiency. Moreover, the projections account for market fluctuations. They include risk mitigation strategies. The financial outlook is optimistic. It suggests sustained profitability. The projections are based on comprehensive analysis. They ensure accuracy. The long-term financial projections indicate robust growth.

Strategic Objectives

PIF’s Investment Strategy

PIF’s investment strategy focuses on long-term growth. He aims to diversify assets. Consequently, his portfolio includes various sectors. It enhances stability. Additionally, strategic investments are made in emerging markets. They offer high returns. Moreover, the strategy involves risk mitigation. It ensures sustainable growth. The approach is data-driven and analytical. It maximizes efficiency. The strategy aligns with national economic goals. It supports development. PIF’s investment strategy focuses on long-term growth.

Expansion Plans for Selfridges

Selfridges plans to expand internationally. He targets key markets. Consequently, the strategy involves opening new stores. It enhances brand presence. Additionally, digital transformation is prioritized. It improves customer experience. Moreover, the expansion includes luxury segments. They offer high margins. The strategy aligns with long-term goals. It supports growth. Selfridges plans to expand internationally.

Synergies and Integration

To achieve synergies and integration, he must align strategic objectives with financial goals. This involves identifying key performance indicators (KPIs) and leveraging data analytics. He should focus on cost optimization and revenue enhancement. Efficiency is crucial. Additionally, he must ensure seamless communication across departments. Collaboration is key. By integrating technology solutions, he can streamline operations and improve decision-making processes. This leads to better outcomes. To achieve synergies and integration, he must align strategic objectives with financial goals.

Competitive Landscape

To navigate the competitive landscape, he must align strategic objectives with market dynamics. This involves analyzing competitors’ strengths and weaknesses. He should focus on differentiation and market positioning. Innovation is crucial. Additionally, he must ensure robust risk management practices. Mitigation is key. By leveraging financial metrics, he can optimize resource allocation and enhance profitability. This leads to sustainable growth. To navigate the competitive landscape, he must align strategic objectives with market dynamics.

Credit Management Considerations

Credit Risk Assessment

To conduct a thorough credit risk assessment, he must evaluate borrowers’ creditworthiness. This involves analyzing financial statements and credit scores. He should focus on debt-to-income ratios and payment histories. Accuracy is crucial. Additionally, he must consider macroeconomic factors and industry trends. Context matters. By implementing robust credit management policies, he can mitigate potential risks and enhance portfolio quality. This ensures stability. To conduct a thorough credit risk assessment, he must evaluate borrowers’ creditworthiness.

Financing the Acquisition

To finance the acquisition, he must evaluate credit management considerations. This involves assessing the target’s financial health and creditworthiness. He should focus on debt levels and repayment capacity. Precision is crucial. Additionally, he must consider the impact on cash flow and liquidity. Stability matters. By implementing stringent credit policies, he can mitigate risks and ensure financial stability. This promotes confidence. To finance the acquisition, he must evaluate credit management considerations.

Impact on Credit Ratings

To assess the impact on credit ratings, he must evaluate credit management considerations. This involves analyzing financial stability and debt levels. He should focus on repayment capacity and liquidity. By implementing robust credit policies, he can mitigate risks and maintain favorable ratings. This ensures confidence. To assess the impact on credit ratings, he must evaluate credit management considerations.

Mitigation Strategies

To develop effective mitigation strategies, he must consider credit management aspects. This involves assessing risk factors and implementing preventive measures. He should focus on maintaining healthy skin through proper hydration and sun protection. Consistency is crucial. Additionally, he must consider the impact of lifestyle choices on skin health. Balance matters. By adopting a comprehensive skincare routine, he can mitigate potential issues and enhance overall skin quality. This ensures resilience. To develop effective mitigation strategies, he must consider credit management aspects.

Regulatory and Compliance Issues

Regulatory Approvals

To navigate regulatory approvals, he must address compliance issues. This involves understanding relevant regulations and ensuring adherence. He should focus on product safety and efficacy. Compliance is crucial. Additionally, he must consider the impact of regulatory changes on operations. Adaptability matters. By maintaining thorough documentation, he can streamline approval processes and mitigate risks. This ensures compliance. To navigate regulatory approvals, he must address compliance issues.

Compliance with International Laws

To ensure compliance with international laws, he must address regulatory issues. This involves understanding diverse legal frameworks and ensuring adherence. To ensure compliance with international laws, he must address regulatory issues.

Impact on Stakeholders

To understand the impact on stakeholders, he must address regulatory and compliance issues. This involves evaluating the effects on patients, healthcare providers, and investors. He should focus on ensuring product safety and regulatory adherence. Additionally, he must consider the financial implications for stakeholders. By maintaining transparency and effective communication, he can build trust and mitigate risks. To understand the impact on stakeholders, he must address regulatory and compliance issues.

Future Regulatory Challenges

To address future regulatory challenges, he must anticipate evolving compliance requirements. This involves staying updated on global regulatory changes and their implications. He should focus on maintaining product safety and efficacy. Additionally, he must consider the impact of technological advancements on regulatory frameworks. By implementing proactive compliance strategies, he can mitigate risks and ensure regulatory adherence. To address future regulatory challenges, he must anticipate evolving compliance requirements.

Market and Consumer Impact

Changes in Market Dynamics

Recent shifts in market dynamics have significantly influenced consumer behavior. He observed changes in purchasing patterns. Consequently, businesses must adapt to these evolving preferences. They need to stay competitive. Additionally, technological advancements have accelerated these changes. He noted the rapid adoption of digital tools. Moreover, economic factors play a crucial role in shaping market trends. He highlighted the impact of inflation. Therefore, understanding these dynamics is essential for strategic planning. It ensures long-term success. Recent shifts in market dynamics have significantly influenced consumer behavior.

Consumer Perception

Consumer perception significantly influences market dynamics. He noted the importance of brand trust. Additionally, economic conditions affect purchasing decisions. He observed the impact of disposable income. Furthermore, technological advancements shape consumer expectations. He highlighted the role of innovation. Therefore, understanding these factors is crucial for businesses. It ensures strategic alignment. Consumer perception significantly influences market dynamics.

Brand Positioning

Brand positioning in the skincare market is crucial for attracting consumers. He emphasized the importance of product efficacy. Additionally, understanding consumer needs helps tailor marketing strategies. He noted the role of dermatological research. Moreover, transparency in ingredient sourcing builds trust. He highlighted the demand for natural products. Therefore, aligning brand values with consumer expectations is essential. It ensures market relevance. Brand positioning in the skincare market is crucial for attracting consumers.

Customer Experience Enhancements

Enhancing customer experience in skincare involves several key strategies. He emphasized personalized consultations. Additionally, integrating advanced diagnostic tools improves service quality. He noted the importance of accurate skin analysis. Moreover, offering tailored product recommendations boosts satisfaction. He highlighted the need for customized solutions. Therefore, continuous training for staff is essential. It ensures expertise. Enhancing customer experience in skincare involves several key strategies.

Expert Opinions and Analysis

Industry Expert Insights

Industry experts highlight the importance of market diversification. He emphasized the need for risk mitigation. Additionally, they stress the significance of financial resilience. He noted the role of liquidity management. Moreover, experts advocate for strategic investments in emerging markets. He highlighted the potential for high returns. Therefore, understanding these insights is crucial for informed decision-making. Industry experts highlight the importance of market diversification.

Financial Analyst Perspectives

Financial analysts emphasize the importance of portfolio diversification. He noted the need for risk management. Additionally, they highlight the significance of market analysis. He stressed the role of data-driven decisions. Moreover, analysts advocate for strategic asset allocation. He mentioned the benefits of balanced portfolios. Therefore, understanding these perspectives is crucial for investors. It ensures informed choices. Financial analysts emphasize the importance of portfolio diversification.

Market Trends and Predictions

Experts predict significant shifts in market trends. He emphasized the rise of sustainable investments. Additionally, technological advancements are expected to drive growth. He noted the impact of AI. Moreover, geopolitical factors will influence market stability. He highlighted the importance of risk assessment. Therefore, staying informed is crucial for investors. It ensures strategic planning. Experts predict significant shifts in market trends.

Case Studies of Similar Acquisitions

Case studies of similar acquisitions provide valuable insights. He highlighted the importance of strategic alignment. Additionally, understanding market dynamics is crucial for success. He noted the role of consumer trends. Moreover, analyzing financial performance helps predict outcomes. He emphasized the need for thorough due diligence. Therefore, these insights are essential for informed decisions. It ensures effective strategies. Case studies of similar acquisitions provide valuable insights.

Conclusion and Future Outlook

Summary of Key Points

In summary, understanding market trends is crucial for strategic planning. He emphasized the importance of data analysis. Additionally, aligning brand values with consumer expectations ensures market relevance. He noted the role of innovation. Moreover, personalized skincare solutions enhance customer satisfaction. He highlighted the need for tailored approaches. Therefore, these insights are essential for future growth. In summary, understanding market trends is crucial for strategic planning.

Potential Future Developments

Potential future developments in skincare include advancements in personalized treatments. He emphasized the role of genetic research. Additionally, the integration of AI in diagnostics will enhance accuracy. He noted the importance of precision. Moreover, sustainable practices will become more prevalent. He highlighted the demand for eco-friendly products. Therefore, staying informed about these trends is crucial. It ensures competitive advantage. Potential future developments in skincare include advancements in personalized treatments.

Implications for the Financial Sector

The financial sector faces significant changes due to technological advancements. These changes include increased automation, enhanced data analytics, and improved customer experiences. Automation reduces costs. Data analytics drive better decisions. Customer experiences improve with technology. Financial institutions must adapt to remain competitive. Adaptation is crucial. Future outlooks suggest continued integration of AI and blockchain. AI and blockchain are transformative. Institutions should invest in these technologies. Investment is key. The financial sector faces significant changes due to technological advancements.

Final Thoughts

In conclusion, he should prioritize a consistent skincare routine. Consistency is key. Regular use of sunscreen is essential to prevent damage. Sunscreen protects skin. Additionally, incorporating antioxidants can enhance skin health. Antioxidants are beneficial. Future outlooks suggest advancements in personalized skincare treatments. Personalized treatments are promising. He should stay informed about new developments. Knowledge is power. In conclusion, he should prioritize a consistent skincare routine.