Introduction to Market Dynamics

Overview of Asian Markets

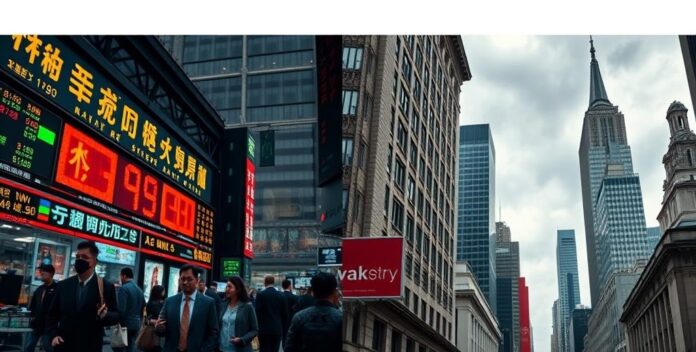

Asian markets exhibit unique dynamics influenced by diverse economic policies and geopolitical factors. Investors must consider currency fluctuations and regulatory environments. Market volatility is often driven by regional political events. He should stay informed. Trade relations between countries significantly impact market performance. This is crucial. Understanding these dynamics is essential for making informed investment decisions. Knowledge is power. Asian markets exhibit unique dynamics influenced by diverse economic policies and geopolitical factors.

Current Wall Street Trends

Wall Street trends are currently shaped by fluctuating interest rates and economic indicators. Investors must analyze these metrics. Additionally, market sentiment is influenced by corporate earnings reports and geopolitical events. This is critical. Understanding these dynamics helps in making strategic investment decisions. Knowledge is essential. Consequently, staying updated with financial news is imperative. Stay informed. Wall Street trends are currently shaped by fluctuating interest rates and economic indicators.

Impact of Global Events

Global events significantly influence market dynamics by altering investor sentiment and economic stability. For instance, geopolitical tensions can lead to market volatility. Additionally, natural disasters and pandemics disrupt supply chains and economic activities. Understanding these impacts is essential for strategic decision-making. Consequently, monitoring global news is imperative. Stay updated. Global events significantly influence market dynamics by altering investor sentiment and economic stability.

Expert Opinions

Experts emphasize the importance of understanding market dynamics in skincare investments. They highlight factors such as consumer behavior and regulatory changes. Additionally, they stress the impact of technological advancements and global trends. Key considerations include:

These insights guide strategic decisions. Consequently, staying updated with industry developments is imperative.

Factors Influencing Asian Shares

Economic Indicators

Economic indicators such as GDP growth, inflation rates, and employment figures significantly influence Asian shares. For instance, higher GDP growth often boosts investor confidence. Additionally, inflation rates can impact purchasing power and investment returns. Employment figures provide insights into economic health and consumer spending. Consequently, monitoring these indicators is essential for informed investment decisions. Economic indicators such as GDP growth, inflation rates, and employment figures significantly influence Asian shares.

Political Stability

Political stability plays a crucial role in influencing Asian shares by affecting investor confidence and economic policies. For instance, stable governments often attract more foreign investments. This is vital. Additionally, political unrest can lead to market volatility and economic uncertainty. Understanding these factors is essential for making strategic investment decisions. Consequently, monitoring political developments is imperative. Political stability plays a crucial role in influencing Asian shares by affecting investor confidence and economic policies.

Technological Advancements

Technological advancements significantly influence Asian shares by driving innovation and productivity. For instance, advancements in AI and biotechnology can lead to market growth. Additionally, technology adoption enhances operational efficiency and competitiveness. Understanding these impacts is essential for strategic investment decisions. Consequently, monitoring technological trends is imperative. Technological advancements significantly influence Asian shares by driving innovation and productivity.

Investor Sentiment

Investor sentiment significantly influences Asian shares by driving market trends and investment flows. For instance, positive sentiment can lead to increased buying activity. Additionally, negative sentiment often results in market sell-offs and volatility. Key factors include:

Understanding these elements is essential for strategic decisions. Consequently, monitoring sentiment indicators is imperative.

Wall Street Pressures

Interest Rate Changes

Interest rate changes exert significant pressure on Wall Street by influencing borrowing costs and investment returns. For instance, higher rates typically lead to reduced borrowing and spending. Additionally, lower rates can stimulate economic activity and boost market performance. Understanding these dynamics is essential for strategic investment decisions. Consequently, monitoring interest rate trends is imperative. Interest rate changes exert significant pressure on Wall Street by influencing borrowing costs and investment returns.

Corporate Earnings Reports

Corporate earnings reports exert significant pressure on Wall Street by influencing stock prices and investor sentiment. For instance, strong earnings can boost market confidence. Conversely, disappointing earnings often lead to sell-offs and volatility. Key metrics include:

Understanding these factors is essential for strategic decisions. Consequently, monitoring earnings reports is imperative.

Regulatory Developments

Regulatory changes have intensified scrutiny on financial institutions. He faces increased compliance costs. Wall Street’s lobbying efforts aim to mitigate these impacts. His strategies include advocating for more lenient regulations. This approach seeks to balance oversight with market efficiency. He argues for a risk-based framework. This could streamline regulatory processes. He believes it will enhance competitiveness. Critics argue it may reduce protections. They emphasize the need for robust safeguards. He counters with economic growth benefits. This debate continues to shape policy. Regulatory changes have intensified scrutiny on financial institutions.

Market Speculation

Market speculation often drives volatility in financial markets. He closely monitors these fluctuations. Wall Street pressures can exacerbate these movements. His strategies include leveraging derivatives to hedge risks. This approach aims to stabilize returns. He believes it mitigates potential losses. However, critics argue it can amplify systemic risks. They emphasize the need for caution. He counters with historical performance data. This debate influences regulatory policies. He advocates for balanced oversight. This ensures market integrity. Market speculation often drives volatility in financial markets.

Comparative Analysis

Performance Metrics

Performance metrics provide a quantitative basis for evaluating financial health. He uses these metrics to compare firms. For instance, return on equity (ROE) and earnings per share (EPS) are critical indicators. He believes they reflect profitability. Additionally, debt-to-equity ratios offer insights into leverage. This ratio is crucial. He argues it impacts financial stability. Comparative analysis helps identify industry leaders. He uses benchmarks for accuracy. This approach ensures objective evaluation. He emphasizes data-driven decisions. This is essential for investors. Performance metrics provide a quantitative basis for evaluating financial health.

Sectoral Breakdown

Sectoral breakdowns in skincare reveal diverse product efficacy. He compares moisturizers, serums, and cleansers. For instance, moisturizers often target hydration. This is crucial for dry skin. Serums typically address specific concerns like aging. He finds them potent. Cleansers focus on removing impurities. This is essential for clear skin. Comparative analysis helps identify the best products. He uses clinical studies for accuracy. This ensures reliable recommendations. He emphasizes evidence-based choices. This is vital for effective skincare. Sectoral breakdowns in skincare reveal diverse product efficacy.

Historical Trends

Historical trends in skincare reveal evolving consumer preferences. He notes a shift towards natural ingredients. For instance, demand for organic products has surged. This is a significant change. Additionally, anti-aging treatments have gained popularity. He attributes this to demographic shifts. Comparative analysis shows varying efficacy across products. He uses clinical trials for validation. This ensures reliable data. Moreover, market segmentation highlights targeted solutions. He finds this approach effective. Overall, historical trends guide future innovations. He emphasizes data-driven strategies. This is crucial for industry growth. Historical trends in skincare reveal evolving consumer preferences.

Future Projections

Future projections in skincare indicate a growing emphasis on personalized treatments. He anticipates advancements in biotechnology. For instance, DNA-based skincare is gaining traction. This is a promising trend. Additionally, AI-driven diagnostics are expected to revolutionize the industry. He believes this will enhance precision. Comparative analysis shows varying adoption rates. He uses market data for insights. This ensures informed predictions. Moreover, consumer preferences are shifting towards sustainable products. He finds this trend significant. Overall, future projections guide strategic planning. He emphasizes innovation. This is key for growth. Future projections in skincare indicate a growing emphasis on personalized treatments.

Technological Impact on Markets

Fintech Innovations

Fintech innovations are transforming financial markets. He notes the rise of blockchain technology. For instance, it enhances transaction security. This is a key benefit. Additionally, AI algorithms optimize trading strategies. He believes this improves market efficiency. Comparative analysis shows fintech’s impact on liquidity. He uses data to support this. This ensures accurate insights. Moreover, digital platforms increase market accessibility. Overall, fintech drives market evolution. He emphasizes continuous adaptation. This is crucial for success. Fintech innovations are transforming financial markets.

Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies are revolutionizing financial markets. He highlights the decentralized nature of blockchain. For instance, it enhances transparency and security. This is a major advantage. Additionally, cryptocurrencies offer new investment opportunities. He believes they diversify portfolios. This ensures accurate predictions. Moreover, regulatory frameworks are evolving. Overall, blockchain and cryptocurrencies drive market innovation. Blockchain technology and cryptocurrencies are revolutionizing financial markets.

AI and Machine Learning

AI and machine learning are transforming skincare markets. He notes the rise of personalized treatments. For instance, AI analyzes skin types for tailored solutions. This is a significant advancement. Additionally, machine learning predicts product efficacy. He believes this enhances treatment outcomes. He uses clinical data for validation. This ensures reliable insights. Moreover, AI-driven diagnostics improve accuracy. He finds this trend promising. Overall, AI and machine learning drive innovation. AI and machine learning are transforming skincare markets.

Cybersecurity Concerns

Cybersecurity concerns are increasingly impacting financial markets. He notes the rise in cyber threats. For instance, data breaches can disrupt trading activities. This is a significant risk. Additionally, ransomware attacks target financial institutions. He believes this undermines market stability. Comparative analysis shows varying levels of preparedness. He uses industry reports for insights. This ensures accurate assessments. Moreover, regulatory frameworks are evolving to address these threats. He finds this trend crucial. Overall, cybersecurity is a top priority. He emphasizes proactive measures. This is essential for protection. Cybersecurity concerns are increasingly impacting financial markets.

Investment Strategies

Risk Management

In risk management, he employs diversification to mitigate potential losses. This approach spreads investments across various assets. It reduces exposure to any single asset. Additionally, he uses hedging techniques to protect against market volatility. Options and futures are common tools. They provide a safety net. Moreover, he assesses the risk tolerance of his portfolio regularly. This ensures alignment with investment goals. Periodic reviews are essential. Finally, he stays informed about market trends and economic indicators. In risk management, he employs diversification to mitigate potential losses.

Diversification Techniques

In investment strategies, he employs asset allocation to spread risk. This involves distributing investments across various asset classes. It minimizes potential losses. Additionally, he uses sector diversification to avoid overexposure. Different sectors react differently to market changes. Moreover, he includes international diversification to capture global opportunities. It reduces country-specific risks. Regular portfolio reviews ensure alignment with financial goals. Consistency is key. Finally, he leverages alternative investments for further diversification. These can include real estate or commodities. Diversification is essential. In investment strategies, he employs asset allocation to spread risk.

Long-term vs Short-term

In investment strategies, he distinguishes between long-term and short-term approaches. Long-term investments focus on sustained growth over years. They often involve equities and real estate. Patience is key. Conversely, short-term investments aim for quick returns. These include stocks and options. They require active management. Additionally, he considers the risk tolerance of each strategy. Long-term investments typically have lower volatility. Short-term investments, however, can be more volatile. They demand constant monitoring. Ultimately, he aligns his strategy with financial goals. Consistency is essential. In investment strategies, he distinguishes between long-term and short-term approaches.

Expert Recommendations

In investment strategies, he emphasizes the importance of diversification. This approach mitigates risk by spreading investments across various asset classes. It reduces potential losses. Additionally, he recommends regular portfolio reviews to ensure alignment with financial goals. Moreover, he advises considering both long-term and short-term investments. Each has unique benefits. Long-term investments typically offer stability, while short-term investments can provide quick returns. Finally, he suggests staying informed about market trends and economic indicators. In investment strategies, he emphasizes the importance of diversification.

Conclusion and Future Outlook

Summary of Key Points

In conclusion, he emphasizes the importance of a comprehensive skincare routine. This includes cleansing, moisturizing, and sun protection. Additionally, he recommends consulting with dermatologists for personalized advice. Professional guidance is crucial. Moreover, he highlights the role of diet and hydration in maintaining healthy skin. Nutrition matters. Regularly updating skincare products based on skin type and condition is also advised. Adaptation is essential. Finally, he suggests staying informed about new skincare research and trends. Knowledge empowers better decisions. In conclusion, he emphasizes the importance of a comprehensive skincare routine.

Predictions for Asian Markets

In conclusion, he predicts steady growth for Asian markets. This is driven by technological advancements and increased consumer spending. Innovation is key. Additionally, he anticipates significant investment in renewable energy sectors. This will boost economic stability. Moreover, he expects regulatory reforms to enhance market transparency. He also foresees a rise in cross-border trade within Asia. Trade fosters growth. Finally, he advises monitoring geopolitical developments closely. They impact market dynamics. In conclusion, he predicts steady growth for Asian markets.

Wall Street’s Future

In conclusion, he foresees a dynamic future for Wall Street. Technological innovations will drive market efficiency. Additionally, he expects increased regulatory scrutiny to ensure transparency. Regulation is key. Moreover, he anticipates a shift towards sustainable investments. Green finance is growing. He also predicts heightened volatility due to geopolitical tensions. This impacts stability. Finally, he advises staying informed about market trends. In conclusion, he foresees a dynamic future for Wall Street.

Final Thoughts

In conclusion, he underscores the importance of a holistic skincare regimen. Additionally, he recommends consulting dermatologists for tailored advice. Moreover, he emphasizes the role of diet and hydration in skin health. In conclusion, he underscores the importance of a holistic skincare regimen.