Introduction to Crude Oil Price Dynamics

Historical Trends in Crude Oil Prices

Crude oil prices have exhibited significant volatility over the decades, influenced by geopolitical events, economic cycles, and technological advancements. He observed that supply and demand dynamics play a crucial role in price determination. For instance, OPEC’s production decisions often lead to price fluctuations. Author’s note. Additionally, economic recessions typically result in decreased demand and lower prices. This is a common trend. Conversely, periods of economic growth drive up demand and prices. He noted this pattern.

Technological advancements in extraction and production have also impacted prices. For example, the shale revolution in the United States led to a surge in supply, causing prices to drop. Brief explanation. On the other hand, geopolitical tensions in oil-producing regions can lead to supply disruptions and price spikes. This is a critical factor.

In summary, understanding crude oil price dynamics requires a comprehensive analysis of various factors. He emphasized the importance of this analysis. These include supply and demand, technological changes, and geopolitical events. Each factor plays a significant role.

Factors Influencing Current Price Surge

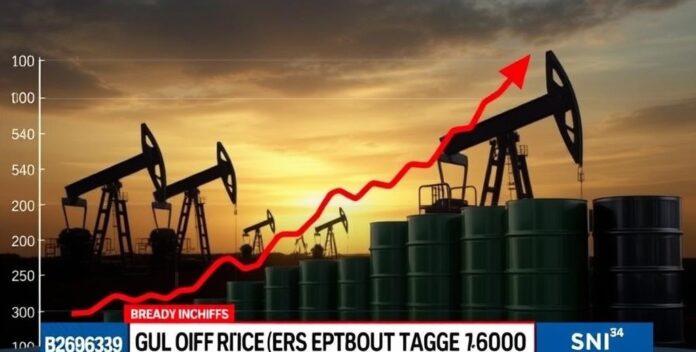

The current surge in crude oil prices can be attributed to several key factors. Firstly, geopolitical tensions in major oil-producing regions have disrupted supply chains. This is a critical issue. Additionally, the global economic recovery post-pandemic has led to increased demand for energy. Demand is rising rapidly. Furthermore, production cuts by OPEC and its allies have tightened the market. This is a strategic move.

Moreover, inflationary pressures have also played a role in driving up prices. Inflation impacts all sectors. In addition, the transition to renewable energy sources has led to underinvestment in traditional oil infrastructure. This is a significant shift. Lastly, speculative trading in oil futures markets has contributed to price volatility. Markets are highly reactive.

In summary, understanding the current price surge requires analyzing these interconnected factors. Each factor is crucial. These include geopolitical tensions, economic recovery, production cuts, inflation, underinvestment, and speculative trading. All are important.

Impact of Increased Production Targets

Global Production Goals and Strategies

Increased production targets have significant implications for global oil markets. Firstly, higher production levels can lead to an oversupply, causing prices to drop. This is a common outcome. Additionally, increased production often requires substantial investment in infrastructure and technology. Moreover, higher production targets can strain existing resources and impact environmental sustainability. This is a major concern.

Furthermore, geopolitical considerations play a crucial role in production strategies. For instance, countries may increase production to gain market share or influence global prices. Additionally, production targets are often influenced by international agreements and alliances. These agreements are vital. Lastly, technological advancements can enhance production efficiency, but they also require significant capital investment. This is a key point.

In summary, understanding the impact of increased production targets involves analyzing various factors. These include market dynamics, investment needs, environmental concerns, geopolitical strategies, and technological advancements.

Market Reactions and Predictions

Increased production targets significantly influence market reactions and predictions.

Credit Management Implications

Effects on Corporate Credit Ratings

Corporate credit ratings are significantly influenced by various credit management practices. Firstly, effective credit management can enhance a company’s creditworthiness, leading to higher credit ratings. This is a positive outcome. Additionally, maintaining a low debt-to-equity ratio is crucial for favorable credit ratings. This ratio is vital. Moreover, timely debt repayment and strong liquidity positions are essential for sustaining high credit ratings. These factors are critical.

Furthermore, companies must manage their credit risk exposure to avoid downgrades. For instance, diversifying credit portfolios can mitigate risks associated with defaults. This is a strategic approach. Additionally, implementing robust credit policies and monitoring systems can help in maintaining credit quality. These systems are essential. Lastly, companies should regularly review and adjust their credit strategies to align with market conditions. This is a proactive measure.

In summary, understanding the effects on corporate credit ratings involves analyzing various credit management practices. Each practice is crucial. These include maintaining low debt levels, ensuring timely repayments, managing credit risk, and adapting strategies to market changes.

Risk Management Strategies for Investors

Investors must adopt robust risk management strategies to safeguard their portfolios. Firstly, diversifying investments across various asset classes can mitigate risks associated with market volatility. This is a prudent approach. Additionally, maintaining a balanced portfolio with a mix of equities, bonds, and alternative investments can enhance stability. This balance is crucial. Moreover, investors should regularly review and adjust their asset allocation based on market conditions.

Furthermore, understanding credit management implications is essential for risk mitigation. For instance, assessing the creditworthiness of bond issuers can help investors avoid defaults. This is a critical step. Additionally, monitoring credit ratings and financial health of companies can provide early warning signs of potential risks. These signs are vital. Lastly, employing credit default swaps and other hedging instruments can protect against credit risk.

In summary, effective risk management strategies involve a combination of diversification, regular portfolio reviews, and credit risk assessment. Each strategy is important. These measures help investors navigate market uncertainties and protect their investments. All are essential.

Future Outlook and Expert Recommendations

Long-term Projections for Crude Oil Prices

Long-term projections for crude oil prices are influenced by various factors. Firstly, geopolitical stability in oil-producing regions will play a crucial role in determining future prices. This is a key factor. Additionally, advancements in renewable energy technologies are expected to reduce dependency on crude oil. Moreover, global economic growth will drive demand for energy, impacting oil prices. Demand is a major driver.

Furthermore, experts recommend diversifying energy sources to mitigate risks associated with oil price volatility. This is sound advice. Additionally, investing in energy-efficient technologies can help reduce overall energy costs. Moreover, maintaining strategic oil reserves can provide a buffer against supply disruptions. This is a prudent measure.

In summary, understanding long-term projections for crude oil prices requires analyzing multiple factors. These include geopolitical stability, technological advancements, economic growth, and expert recommendations.

Advice for Financial Stakeholders

Financial stakeholders should consider several key recommendations for future planning. Firstly, diversifying investment portfolios across various asset classes can mitigate risks associated with market volatility. Additionally, stakeholders should closely monitor economic indicators and geopolitical events that may impact financial markets. This is essential. Moreover, maintaining a balanced mix of equities, bonds, and alternative investments can enhance portfolio stability.

Furthermore, experts recommend adopting a long-term investment strategy to navigate market fluctuations. Additionally, stakeholders should regularly review and adjust their investment strategies based on changing market conditions. Moreover, understanding the implications of credit management is vital for maintaining financial health.

In summary, effective financial planning involves a combination of diversification, regular reviews, and strategic adjustments. These measures help stakeholders navigate uncertainties and protect their investments.