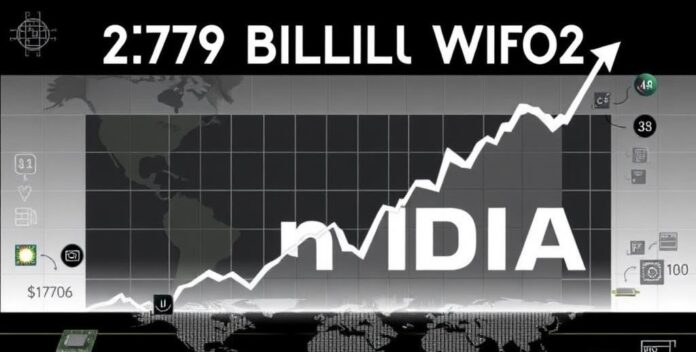

Nvidia’s $279 Billion Wipeout: An Overview

Background of Nvidia’s Market Position

Nvidia, a leader in graphics processing units, experienced a significant market shift. His market value dropped by (279 billion. This event highlighted vulnerabilities in his business model. It was a wake-up call. Despite his innovative products, market dynamics proved challenging. He faced intense competition. Investors reacted swiftly to the downturn. It was a shock. Consequently, Nvidia’s strategic adjustments became imperative. He needed to adapt. This period underscored the volatility of the tech industry. It was a lesson learned. Nvidia, a leader in graphics processing units, experienced a significant market shift. His market value dropped by )279 billion. Consequently, Nvidia’s strategic adjustments became imperative.

Key Events Leading to the Wipeout

Nvidia’s (279 billion wipeout was precipitated by several key events. Firstly, the unexpected decline in cryptocurrency mining demand significantly impacted revenue streams. It was a major blow. Additionally, supply chain disruptions exacerbated the situation, leading to inventory issues. This was a critical factor. Furthermore, increased competition from AMD and Intel intensified market pressures. It was a tough battle. Lastly, regulatory challenges in key markets added to the financial strain. It was a complex scenario. These events collectively led to a substantial market value decline. It was a significant loss. Nvidia’s )279 billion wipeout was precipitated by several key events.

Immediate Market Reactions

Following Nvidia’s (279 billion wipeout, immediate market reactions were swift and severe. His stock price plummeted, reflecting investor panic. It was a sharp decline. Analysts quickly revised their ratings, downgrading Nvidia’s outlook. It was a critical move. Additionally, institutional investors rebalanced their portfolios, reducing exposure to Nvidia. This was a strategic decision. The broader tech sector also felt the impact, with ripple effects seen across related stocks. It was a widespread reaction. These market responses underscored the volatility and interconnectedness of financial markets. It was a stark reminder. Following Nvidia’s )279 billion wipeout, immediate market reactions were swift and severe. Analysts quickly revised their ratings, downgrading Nvidia’s outlook.

Impact on Nvidia’s Financial Health

Revenue and Profit Losses

Nvidia’s financial health took a significant hit due to revenue and profit losses. His quarterly earnings report revealed a sharp decline in revenue, primarily driven by reduced demand in key markets. It was a substantial drop. Additionally, profit margins were squeezed by rising production costs and competitive pricing pressures. This was a critical issue. The company’s net income fell dramatically, impacting overall financial stability. It was a tough period. These financial setbacks necessitated strategic adjustments to mitigate further losses. It was a necessary move. The situation highlighted the importance of adaptive financial strategies in volatile markets. It was a crucial lesson. Nvidia’s financial health took a significant hit due to revenue and profit losses.

Stock Price Fluctuations

Nvidia’s stock price experienced significant fluctuations, impacting his financial health. Market volatility and investor sentiment played crucial roles in these changes. It was unpredictable. Additionally, quarterly earnings reports and external economic factors influenced stock performance. This was a key factor. The company’s stock saw sharp declines during periods of negative news. It was a tough time. Conversely, positive developments led to temporary recoveries. It was a brief respite. These fluctuations underscored the sensitivity of stock prices to market dynamics. It was a clear indication. Nvidia’s stock price experienced significant fluctuations, impacting his financial health.

Investor Sentiment

Investor sentiment significantly influenced Nvidia’s financial health. His stock price was highly sensitive to market perceptions. It was volatile. Negative news, such as declining revenues, led to bearish sentiment. Conversely, positive developments, like new product launches, temporarily boosted confidence. It was a brief uplift. Analysts’ ratings and forecasts also played a crucial role in shaping investor behavior. It was influential. The overall sentiment was reflected in trading volumes and stock price movements. It was a clear indicator. These dynamics underscored the importance of managing investor expectations. It was a vital strategy. Investor sentiment significantly influenced Nvidia’s financial health.

Global Chip Market Dynamics

Current State of the Chip Market

The current state of the chip market is characterized by supply chain disruptions and increased demand. This has led to significant price volatility. It was a major shift. Additionally, geopolitical tensions have impacted production capabilities. Companies are investing heavily in expanding manufacturing capacity to meet demand. It was a strategic move. Furthermore, technological advancements are driving innovation in chip design. It was a key development. These dynamics highlight the complexity and rapid evolution of the global chip market. It was a significant change. The current state of the chip market is characterized by supply chain disruptions and increased demand.

Major Players and Competitors

In the global chip market, major players include Intel, AMD, and Nvidia. These companies dominate due to their advanced technologies and extensive R&D investments. It was a strategic advantage. Additionally, competitors like Qualcomm and Samsung are significant due to their diverse product portfolios. Emerging companies in China are also gaining traction, challenging established leaders. It was a notable trend. The competitive landscape is shaped by innovation, market demand, and geopolitical factors. It was a complex environment. These dynamics drive continuous advancements in chip technology. It was a rapid evolution. In the global chip market, major players include Intel, AMD, and Nvidia.

Supply Chain Challenges

Supply chain challenges in the global chip market are multifaceted. His production delays are caused by raw material shortages. It was a critical issue. Additionally, logistical disruptions have led to increased lead times and costs. This was a significant factor. Companies are facing difficulties in maintaining inventory levels, impacting their ability to meet demand. It was a tough situation. Furthermore, geopolitical tensions have exacerbated these challenges, affecting cross-border trade. These factors collectively strain the supply chain, necessitating strategic adjustments. Supply chain challenges in the global chip market are multifaceted.

Repercussions for Tech Industry

Impact on Tech Giants

The impact on tech giants due to market fluctuations has been profound. His revenue streams have been disrupted by supply chain issues. It was a significant challenge. Additionally, increased competition has pressured profit margins. Companies like Apple and Microsoft have had to adjust their strategies to maintain market share. Furthermore, regulatory changes have added complexity to their operations. These factors collectively underscore the volatility and interconnectedness of the tech industry. The impact on tech giants due to market fluctuations has been profound.

Effect on Startups and Smaller Firms

Startups and smaller firms face significant challenges in the tech industry. They often struggle with limited resources and intense competition. Larger companies can outspend them on research and development. This creates a tough environment. Many startups innovate to survive. They focus on niche markets. This strategy helps them stand out. However, scaling up remains difficult. They need more funding. Investors are cautious. They prefer established firms. This limits growth opportunities. Startups must be agile. They adapt quickly. This is their strength. Startups and smaller firms face significant challenges in the tech industry.

Long-term Industry Trends

Long-term industry trends indicate significant shifts in the tech sector. He observes increased automation and AI integration. This impacts job markets. Many roles become obsolete. However, new opportunities arise. He notes the rise of remote work. This changes workplace dynamics. Companies adapt to flexible models. Additionally, cybersecurity becomes crucial. Threats evolve rapidly. Firms invest heavily in protection. He sees a focus on sustainability. Green tech gains traction. This influences product development. The industry must innovate. They face constant change. Adaptation is key. Long-term industry trends indicate significant shifts in the tech sector.

Regulatory and Legal Implications

Antitrust Investigations

Antitrust investigations significantly impact the tech industry. They scrutinize monopolistic practices. This ensures fair competition. Regulatory bodies impose fines. Companies face legal challenges. Consequently, compliance costs rise. Firms must adapt. They restructure operations. This affects market dynamics. Additionally, mergers are closely examined. Authorities prevent anti-competitive behavior. This protects consumers. Legal frameworks evolve. They address new market realities. Firms need robust legal strategies. They must navigate complex regulations. This is crucial for survival. Antitrust investigations significantly impact the tech industry.

Government Policies and Regulations

Government policies and regulations significantly impact skincare practices. He must adhere to safety standards. This ensures product efficacy. Regulatory bodies enforce guidelines. Companies comply with labeling laws. Additionally, new policies address emerging concerns. They focus on ingredient safety. Firms must stay updated. They adapt formulations accordingly. This maintains market trust. Moreover, regulations influence marketing claims. Authorities prevent misleading information. This fosters transparency. He needs to understand these implications. They affect product choices. Compliance is crucial. It ensures consumer safety. Government policies and regulations significantly impact skincare practices.

Future Legal Challenges

Future legal challenges in skincare will likely focus on compliance with evolving regulations. He must navigate complex legal landscapes. This ensures product safety. Regulatory bodies may introduce stricter guidelines. Companies must adapt quickly. This affects market strategies. Additionally, intellectual property issues may arise. Firms need robust legal protections. This safeguards innovations. Moreover, data privacy concerns will grow. Authorities will enforce stringent measures. He must ensure compliance. This builds consumer trust. Legal expertise is crucial. It mitigates risks. Adaptation is essential. It ensures market viability. Future legal challenges in skincare will likely focus on compliance with evolving regulations.

Investor Strategies and Recommendations

Short-term Investment Strategies

Short-term investment strategies often focus on market timing and liquidity. He must analyze market trends. This identifies entry and exit points. Additionally, diversification reduces risk. Investors spread capital across assets. This mitigates potential losses. Moreover, leveraging can amplify returns. It involves borrowing funds. However, it increases risk. He must monitor investments closely. This ensures timely decisions. Professional advice is beneficial. It provides expert insights. Adaptation is crucial. Markets are volatile. Flexibility is key. It maximizes gains. Short-term investment strategies often focus on market timing and liquidity.

Long-term Investment Outlook

Long-term investment outlooks emphasize stability and growth. He should consider diversified portfolios. This reduces risk exposure. Additionally, compounding interest benefits long-term investments. It amplifies returns over time. Moreover, understanding market cycles is crucial. He must recognize economic indicators. This informs strategic decisions. Furthermore, asset allocation plays a key role. Balancing equities and bonds is essential. He should monitor performance regularly. This ensures alignment with goals. Professional advice is valuable. It provides tailored strategies. Adaptation is necessary. Markets evolve constantly. Flexibility enhances success. Long-term investment outlooks emphasize stability and growth.

Expert Opinions and Analysis

Expert opinions and analysis highlight the importance of tailored skincare routines. He should consider individual skin types. This ensures effective treatment. Additionally, dermatologists recommend evidence-based products. They provide proven results. Moreover, understanding ingredient interactions is crucial. He must avoid harmful combinations. This prevents adverse reactions. Furthermore, regular consultations with professionals are advised. They offer personalized guidance. He should monitor skin changes. This ensures timely adjustments. Professional advice is invaluable. It enhances skincare outcomes. Skin needs evolve. Flexibility ensures optimal care. Expert opinions and analysis highlight the importance of tailored skincare routines.

Future Outlook for Nvidia

Recovery Plans and Strategies

Recovery plans and strategies for Nvidia focus on innovation and market expansion. He must prioritize research and development. This drives technological advancements. Additionally, strategic partnerships enhance market presence. Collaborations open new opportunities. Moreover, diversifying product lines mitigates risks. It ensures revenue stability. Furthermore, understanding market trends is crucial. He must adapt to consumer demands. This maintains competitive edge. Markets evolve rapidly. Flexibility ensures success. Recovery plans and strategies for Nvidia focus on innovation and market expansion.

Predicted Market Performance

Predicted market performance for Nvidia suggests robust growth. He should consider technological advancements. This drives demand for GPUs. Additionally, expanding AI applications boost revenue. They open new markets. Moreover, strategic acquisitions enhance capabilities. This strengthens competitive position. Furthermore, global semiconductor demand remains high. He must monitor supply chain dynamics. This impacts production. Professional insights are valuable. They guide investment decisions. Markets shift rapidly. Flexibility ensures resilience. Predicted market performance for Nvidia suggests robust growth.

Expert Predictions and Insights

Nvidia’s future outlook remains robust, driven by advancements in AI and gaming technology. His strategic investments in AI research are expected to yield significant returns. This is promising. Furthermore, Nvidia’s dominance in the GPU market positions him favorably against competitors. He leads the market. Analysts predict continued revenue growth, supported by strong demand for high-performance computing. Growth is anticipated. Additionally, Nvidia’s expansion into new sectors, such as autonomous vehicles, enhances his long-term prospects. This is exciting. Nvidia’s future outlook remains robust, driven by advancements in AI and gaming technology.