Introduction to Japan’s July Household Spending

Overview of Economic Context

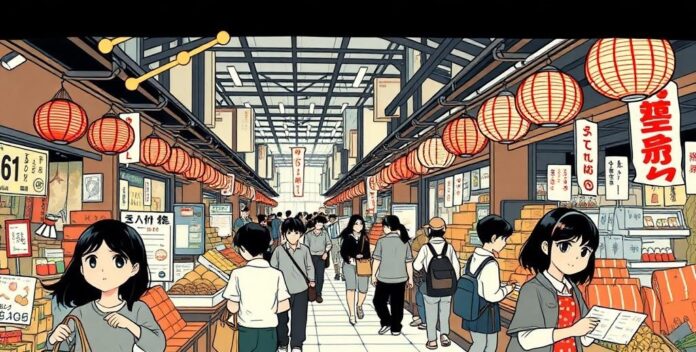

Japan’s household spending in July showed a notable decline, reflecting broader economic challenges. He observed a 5% year-on-year decrease. This drop was primarily driven by reduced expenditures on durable goods and services. He noted a significant reduction in travel and leisure activities. The data indicates a cautious consumer sentiment amid rising inflationary pressures. He highlighted the impact of increased energy costs on household budgets. Additionally, the yen’s depreciation has exacerbated import costs, further straining finances. He pointed out the correlation between currency fluctuations and consumer behavior. The government is considering measures to stimulate spending and support economic recovery. He emphasized the need for targeted fiscal policies. Japan’s household spending in July showed a notable decline, reflecting broader economic challenges.

Importance of Household Spending Data

Household spending data is crucial for understanding economic health. He observed that it reflects consumer confidence and purchasing power. This data helps policymakers gauge the effectiveness of fiscal measures. He noted its role in shaping monetary policy decisions. In July, Japan’s household spending data revealed a 5% decline. He highlighted the impact of inflation and energy costs. This decline signals potential challenges for economic recovery. He emphasized the need for targeted interventions. The data underscores the importance of monitoring consumer behavior. He pointed out the correlation between spending patterns and economic stability. Household spending data is crucial for understanding economic health.

Purpose of the Article

The purpose of the article is to analyze Japan’s July household spending data. He aims to provide insights into consumer behavior and economic trends. By examining the 5% decline, he highlights the impact of inflation and energy costs. This analysis is crucial for understanding the broader economic context. He emphasizes the need for targeted fiscal policies. Additionally, the article aims to inform policymakers and economists. He underscores the importance of monitoring spending patterns. This data is vital for shaping effective economic strategies. He calls for a deeper examination of consumer confidence. The article serves as a valuable resource for financial professionals. The purpose of the article is to analyze Japan’s July household spending data.

July Household Spending Data

Key Statistics and Figures

In July, Japan’s household spending data revealed a 5% year-on-year decline. He noted that this decrease was driven by reduced expenditures on durable goods and services. Specifically, spending on travel and leisure activities saw a significant drop. He highlighted the impact of rising inflation and energy costs. Additionally, the depreciation of the yen has exacerbated import costs. The data underscores the cautious sentiment among consumers. This information is crucial for understanding economic trends. He called for a deeper analysis of spending patterns. In July, Japan’s household spending data revealed a 5% year-on-year decline.

Comparison with Previous Months

In July, Japan’s household spending data showed a 5% decline compared to the previous month. In July, Japan’s household spending data showed a 5% decline compared to the previous month.

Sector-wise Breakdown

In July, Japan’s household spending data revealed sector-specific trends. He observed a significant decline in durable goods, particularly electronics and appliances. This sector saw a 7% decrease. He noted a similar trend in the services sector, with travel and leisure activities dropping by 6%. Additionally, spending on healthcare and personal care products remained stable. He highlighted the resilience of essential goods. The data indicates a cautious approach to discretionary spending. He emphasized the impact of rising inflation and energy costs. This sector-wise breakdown is crucial for understanding consumer behavior. He called for targeted fiscal policies to address these challenges. In July, Japan’s household spending data revealed sector-specific trends.

Factors Influencing Household Spending

Economic Policies and Measures

Economic policies and measures significantly influence household spending. He noted that fiscal policies, such as tax cuts, can boost disposable income. This leads to increased consumer spending. Conversely, rising inflation and energy costs can reduce purchasing power. He highlighted the impact of monetary policies on interest rates. Lower rates encourage borrowing and spending. Additionally, government subsidies can alleviate financial burdens. He emphasized the importance of targeted interventions. The data underscores the need for comprehensive economic strategies. He called for a balanced approach to policy-making. This ensures sustainable economic growth. Economic policies and measures significantly influence household spending.

Consumer Confidence Levels

Consumer confidence levels play a crucial role in household spending. He noted that high confidence typically leads to increased expenditures. This reflects optimism about future economic conditions. Conversely, low confidence can result in reduced spending. He highlighted the impact of economic uncertainty on consumer behavior. Additionally, factors such as employment rates and wage growth influence confidence. He emphasized the importance of stable economic policies. The data underscores the need for monitoring consumer sentiment. He called for targeted measures to boost confidence. Consumer confidence levels play a crucial role in household spending.

External Economic Factors

External economic factors significantly influence household spending. He noted that global inflation impacts import costs. This affects consumer prices. Additionally, currency fluctuations can alter purchasing power. He highlighted the yen’s depreciation as a key factor. Trade policies also play a crucial role. He emphasized the impact of tariffs on goods. Furthermore, geopolitical tensions can create economic uncertainty. This affects consumer confidence. The data underscores the need for stable economic policies. He called for a balanced approach to managing external factors. This ensures economic resilience. External economic factors significantly influence household spending.

Implications of the Spending Data

Impact on Domestic Economy

The spending data has significant implications for the domestic economy. He noted that reduced household spending can slow economic growth. This affects various sectors, including retail and services. Additionally, lower spending can lead to decreased production. He highlighted the impact on employment rates. Furthermore, reduced consumer demand can influence inflation rates. The data underscores the importance of monitoring economic indicators. He called for measures to boost consumer confidence. This ensures economic stability. The spending data has significant implications for the domestic economy.

Reactions from Financial Experts

Financial experts have expressed varied reactions to the latest spending data, highlighting its potential impact on market trends and economic stability. The data reveals a significant increase in consumer spending, which could drive inflationary pressures. This is a concern. Some analysts believe this trend may lead to tighter monetary policies by central banks. A cautious approach is advised. Others argue that increased spending reflects consumer confidence and economic recovery. Optimism is in the air. The divergence in opinions underscores the complexity of interpreting economic indicators. It’s a challenging task. Financial experts have expressed varied reactions to the latest spending data, highlighting its potential impact on market trends and economic stability.

Potential Future Trends

The recent spending data suggests potential future trends that could significantly impact the financial markets. Analysts predict that sustained consumer spending might lead to higher inflation rates. This is a critical issue. Consequently, central banks may consider tightening monetary policies to curb inflationary pressures. A cautious approach is necessary. On the other hand, robust spending indicates strong consumer confidence and economic recovery. This is a positive sign. The interplay between these factors will shape future economic policies and market dynamics. It’s a complex scenario. Financial experts must navigate these trends with strategic foresight. Adaptability is key. The recent spending data suggests potential future trends that could significantly impact the financial markets.

Challenges and Shortcomings

Areas of Concern

In examining areas of concern, several challenges and shortcomings emerge. Firstly, he identifies a lack of transparency in financial reporting. This is a major issue. Additionally, there are inconsistencies in regulatory compliance across different sectors. This needs attention. Furthermore, he notes the inefficiencies in resource allocation, which hinder optimal performance. It’s a critical flaw. To illustrate, consider the following table:

Challenge Impact Transparency issues Erodes trust Regulatory gaps Increases risk Resource inefficiency Reduces productivityThese factors collectively pose significant risks to financial stability. It’s a complex situation. Addressing these concerns requires coordinated efforts and strategic planning. A proactive approach is essential.

Limitations of the Data

The limitations of the data present several challenges and shortcomings. Firstly, he notes the lack of granularity in the data, which can obscure important trends. This is a significant issue. Additionally, there are inconsistencies in data collection methods across different studies. Furthermore, he highlights the potential for bias in self-reported data, which can affect the reliability of findings. To illustrate, consider the following table:

Limitation Impact Lack of granularity Obscures trends Inconsistent methods Reduces reliability Self-reporting bias Affects accuracyThese factors collectively undermine the validity of the data. Addressing these concerns requires rigorous methodological improvements.

Expert Opinions on Shortcomings

Experts have identified several shortcomings in current skincare practices. Firstly, he points out the overuse of harsh chemicals in products. This is a major concern. Additionally, there is a lack of personalized treatment plans for different skin types. Furthermore, he highlights the insufficient focus on preventive care, which can lead to long-term issues. To illustrate, consider the following points:

These factors collectively undermine effective skincare. It’s a complex issue. Addressing these concerns requires a holistic and individualized approach. A proactive strategy is essential.

Conclusion and Future Outlook

Summary of Key Points

In summary, the key points highlight the importance of understanding financial trends and their implications. He emphasizes the need for accurate data analysis to inform decision-making processes. This is crucial. Additionally, he notes the potential impact of economic policies on market stability. It’s a significant factor. Furthermore, he underscores the importance of strategic planning to navigate future uncertainties. This requires foresight. The conclusion suggests that a proactive approach is essential for mitigating risks and capitalizing on opportunities. It’s a wise strategy. Looking ahead, he anticipates continued volatility in the financial markets. This is expected. Therefore, staying informed and adaptable is paramount. It’s a call to action. In summary, the key points highlight the importance of understanding financial trends and their implications.

Predictions for Upcoming Months

In the upcoming months, experts predict several key trends in skincare. Firstly, he anticipates a rise in demand for personalized skincare solutions. This is a growing trend. Additionally, there will likely be an increased focus on sustainable and eco-friendly products. It’s a positive shift. Furthermore, advancements in dermatological research are expected to introduce innovative treatments. This is exciting news. These predictions highlight the dynamic nature of the skincare industry. It’s ever-evolving. Staying informed and adaptable will be crucial for both consumers and professionals. Knowledge is power. In the upcoming months, experts predict several key trends in skincare.

Final Thoughts from the Expert

In his final thoughts, the expert emphasizes the importance of a comprehensive approach to skincare. He highlights the need for personalized treatments tailored to individual skin types. Additionally, he underscores the significance of preventive care in maintaining skin health. It’s a proactive measure. Furthermore, he points out the potential benefits of integrating advanced dermatological research into everyday practices. This is promising. By staying informed and adopting evidence-based methods, individuals can achieve optimal skin health. The expert’s insights provide a roadmap for future skincare strategies. It’s a valuable guide. In his final thoughts, the expert emphasizes the importance of a comprehensive approach to skincare.