Introduction to Inflation and Its Impact on Savings

Understanding Inflation: Definition and Causes

Inflation refers to the general increase in prices over tjme

The Historical Context of Inflation Rates

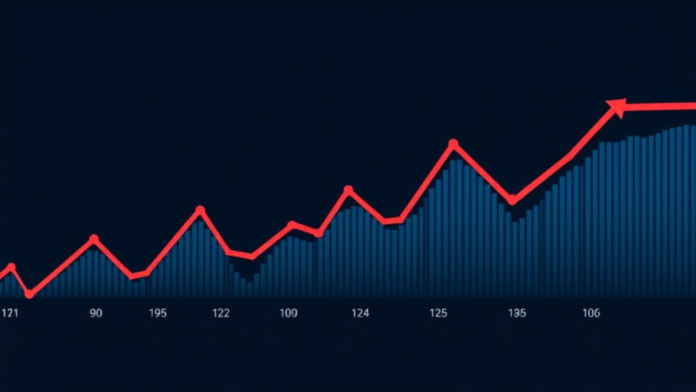

Historically, inflation rates have fluctuated significantly due to various economic factors. For instance, during the 1970s, stagflation led to unprecedented inflation levels. This period illustrated how supply shocks can drastically affect purchasing power. Many individuals faced financial strain. It was a challenging time for savers. Conversely, the late 20th century saw more stable inflation rates. Stability can foster economic growth. Understanding these historical trends is crucial for effective financial planning. Knowledge is power in finance.

Current Trends in Inflation and Economic Outlook

Current inflation trends indicate rising prices across various sectors. This increase is driven by supply chain disruptions and heightened demand. Many consumers are feeling the pinch. Central banks are responding with monetary policy adjustments. Interest rates may rise soon. Such changes can impact savings and investments. Savers should remain vigilant. Awareness is essential for financial health.

The Importance of Safeguarding Your Savings

Why Traditional Savings Accounts May Fall Short

Traditional savings accounts often provide minimal interest rates. This can lead to insufficient growth of savings over time. Many individuals may not realize this. Inflation can further erode purchasing power. As a result, the real value of savings diminishes. He should consider alternative options. Diversification is key to financial health. Exploring other investment vehicles is advisable.

The Erosion of Purchasing Power

The erosion of purchasing power significantly impacts savings. As inflation rises, the cost of goods increases. This means he can buy less with the same amount. Many individuals underestimate this effect. Consequently, savings may not keep pace with expenses. He should evaluate his financial strategies. Awareness is crucial for effective planning. Understanding inflation is essential for financial health.

Long-Term vs. Short-Term Savings Strategies

Long-term savings strategies typically involve investments with higher growth potential. These can include stocks or real estate. He may benefit from compounding interest over time. Short-term savings, however, focus on liquidity and accessibility. This often includes high-yield savings accounts. He should assess his financial goals. Balancing both strategies is essential. Diversification can mitigate risks effectively.

Investment Options to Combat Inflation

Stocks: A Hedge Against Inflation

Stocks can serve as an effective hedge against inflation. Historically, equities tend to outpace inflation over the long term. This growth is often driven by corporate earnings increases. He should take diversifying his portfolio. Investing in sectors like consumer goods can be beneficial. These companies often pass costs to consumers. Understanding market trends is crucial for success. Knowledge empowers better investment decisions.

Real Estate Investments and Their Benefits

Real estate investments can provide a solid hedge against inflation. Property values typically appreciate over time, often outpacing inflation rates. He should consider rental income as a consistent cash flow. This income can help offset rising cksts. Additionally, real estate offers tax advantages. Understanding local market dynamics is essential. Knowledge leads to informed investment choices.

Commodities and Precious Metals as Safe Havens

Commodities and precious metals often serve as safe havens during inflationary periods. These assets typically retain value when currencies weaken. He should consider investing in gold and silver. They have historically acted as a hedge against economic uncertainty. Additionally, agricultural commodities can provide diversification. Key options include:

Understanding market trends is vital. Knowledge enhances investiture strategies.

Utilizing Bonds and Fixed Income Investments

Understanding Inflation-Protected Securities

Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), adjust principal based on inflation rates. This feature helps preserve purchasing power over time. He should consider these investments for stability. The interest payments also increase with inflation. This can provide a reliable income stream. Understanding the mechanics of TIPS is essential. Knowledge leads to informed investment decisions.

The Role of Corporate and Municipal Bonds

Corporate and municipal bonds provide fixed income opportunities for investors. These bonds typically offer lower risk compared to stocks. He should evaluate the credit ratings before investing. Higher-rated bonds generally provide more security. Additionally, municipal bonds often come with tax advantages. Understanding the yield and duration is crucial. Knowledge enhances investment effectiveness.

Strategies for Bond Laddering

Bond laddering involves purchasing bonds with varying maturities. This strategy helps manage interest rate risk effectively. He can reinvest proceeds from maturing bonds. This creates a steady income stream. Additionally, it provides flexibility in changing market conditions. Understanding yield curves is essential. Knowledge leads to better investment outcomes.

Retirement Accounts: Adapting to Inflation

Maximizing Contributions to 401(k) and IRAs

Maximizing contributions to 401(k) and IRAs is essential for retirement planning. These accounts offer tax advantages that can enhance savings growth. He should aim to contribute the maximum allowed each year. This strategy can significantly increase his retirement nest egg. Additionally, taking advantage of employer matching is crucial. Free money is always beneficial. Understanding contribution limits is vital for effective planning. Knowledge empowers better financial decisions.

Roth vs. Traditional Accounts in an Inflationary Environment

In an inflationary environment, choosing between Roth and traditional accounts is crucial. Roth accounts allow tax-free withdrawals in retirement. This can be advantageous when inflation erodes purchasing power. Conversely, traditional accounts offer tax deductions now. He should consider his current and future tax brackets. Key factors include:

Understanding these differences is essential. Knowledge aids in making informed decisions.

Withdrawal Strategies During Inflation

Withdrawal strategies during inflation require careful planning. He should prioritize essential expenses first. This ensures liquidity in uncertain times. Additionally, utilizing a mix of accounts can be beneficial. Tax implications must be considered for each withdrawal. Understanding required minimum distributions is crucial. Knowledge leads to better financial outcomes.

Alternative Strategies for Inflation Protection

Investing in Inflation-Linked Annuities

Investing in inflation-linked annuities can provide a reliable income stream. These products adjust payouts based on inflation rates. He should consider them for long-term financial security. Additionally, they offer protection against purchasing power erosion. Understanding the terms and conditions is essential. Knowledge helps in making informed choices. This strategy can enhance retirement planning.

Utilizlng High-Yield Savings Accounts

Utilizing high-yield savings accounts can enhance savings growth . These accounts typically offer better interest rates than traditional ones. He should compare different options available. This can help combat inflation’s impact. Additionally, they provide liquidity for emergencies. Understanding the terms is crucial. Knowledge leads to smarter financial choices.

Exploring Peer-to-Peer Lending Opportunities

Exploring peer-to-peer lending opportunities can diversify investment portfolios. This alternative financing method connects borrowers directly with investors. He should assess the associated risks carefully. Returns can be higher than traditional investments. Additionally, platforms often provide detailed borrower information. Understanding credit ratings is essential for informed decisions. Knowledge enhances investment success.

Conclusion: Taking Action to Protect Your Financial Future

Creating a Diversified Investment Portfolio

Creating a diversified investment portfolio is essential for risk management. He should include various asset classes, such as stocks, bonds, and real estate. This strategy helps mitigate potential losses. Additionally, he should consider geographic diversification. Key components may include:

Understanding market correlations is crucial.

Regularly Reviewing and Adjusting Your Strategy

Regularly reviewing and adjusting investment strategies is vital for success. He should assess performance against financial goals periodically. This ensures alignment with changing market conditions. Additionally, he must consider life changes that may impact his strategy. Key factors to evaluate include:

Understanding these elements is essential. Knowledge fosters informed decision-making.

Seeking Professional Financial Advice

Seeking professional financial advice can heighten investment strategies. He ehould consult with certified financial planners for tailored guidance. This expertise can help navigate complex financial landscapes. Additionally, professionals provide insights into tax implications and retirement planning. Key considerations include:

Understanding these factors is crucial.