Boeing’s Financial Challenges

Overview of Current Financial Status

Boeing’s financial challenges stem from multiple factors, including production delays and regulatory scrutiny. These issues have significantly impacted his cash flow and profitability. Consequently, he faces increased borrowing costs and reduced investor confidence. This is a serious concern. Additionally, supply chain disruptions have exacerbated his financial instability. He must address these issues promptly. Moreover, the competitive aerospace market pressures him to innovate while managing costs. This is a tough balance. Boeing’s strategic decisions will be crucial in navigating these financial hurdles. His future depends on it. Boeing’s financial challenges stem from multiple factors, including production delays and regulatory scrutiny.

Impact of Recent Market Trends

Boeing’s financial challenges are influenced by recent market trends, including fluctuating demand and increased competition. These factors have led to reduced revenue and higher operational costs. This is a critical issue. Additionally, regulatory changes have imposed stricter compliance requirements, further straining his resources. He must adapt quickly. Moreover, supply chain disruptions have caused delays and increased expenses. This is a significant problem. Boeing’s strategic response to these trends will determine his financial stability. His future is uncertain. Boeing’s financial challenges are influenced by recent market trends, including fluctuating demand and increased competition.

Comparison with Industry Peers

Boeing’s financial challenges are more pronounced compared to his industry peers. His higher production costs and regulatory fines have significantly impacted profitability. This is a major issue. Additionally, his debt levels are higher, affecting his credit rating. He must manage this carefully. Moreover, competitors have been more agile in adapting to market changes, putting him at a disadvantage. This is a critical concern. Boeing’s strategic decisions will be crucial in overcoming these financial hurdles. Boeing’s financial challenges are more pronounced compared to his industry peers.

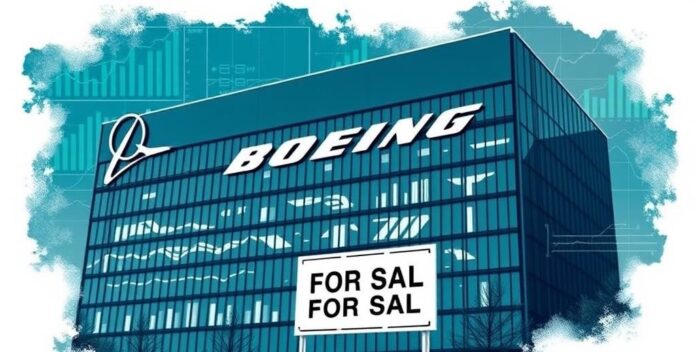

Reasons for Asset Sales

Strategic Financial Goals

Boeing’s strategic financial goals include asset sales to improve liquidity and reduce debt. These sales are essential for maintaining his financial stability. This is a critical step. Additionally, divesting non-core assets allows him to focus on core operations. He must prioritize this. Moreover, asset sales can generate significant cash flow, aiding in investment and innovation. This is a key advantage. Boeing’s careful management of these sales will be crucial for achieving his financial objectives. Boeing’s strategic financial goals include asset sales to improve liquidity and reduce debt.

Pressure from Stakeholders

Boeing faces significant pressure from stakeholders to sell assets for several reasons. Firstly, asset sales can improve liquidity and reduce debt levels. Moreover, stakeholders demand transparency and efficiency in financial management. This is essential. Asset sales can also generate cash flow for strategic investments. Boeing’s careful management of these sales will be crucial for maintaining stakeholder confidence. Boeing faces significant pressure from stakeholders to sell assets for several reasons.

Long-term Financial Stability

Boeing’s asset sales are crucial for long-term financial stability. These sales help reduce debt and improve liquidity. Additionally, divesting non-core assets allows him to focus on strategic priorities. He must act now. Moreover, asset sales can generate cash flow for future investments. This is a key benefit. Boeing’s careful management of these transactions will be vital for sustaining financial health. Boeing’s asset sales are crucial for long-term financial stability.

Types of Assets Considered for Sale

Real Estate Holdings

Boeing’s real estate holdings include various types of assets considered for sale. These assets range from office buildings to manufacturing facilities. This is a strategic move. Additionally, selling underutilized properties can improve liquidity and reduce maintenance costs. He must act decisively. Moreover, divesting non-core real estate allows him to focus on essential operations. Boeing’s careful management of these sales will be crucial for financial stability. Boeing’s real estate holdings include various types of assets considered for sale.

Non-core Business Units

Boeing’s non-core business units include various types of assets considered for sale. These assets range from subsidiaries to joint ventures. This is a strategic decision. Additionally, selling these units can improve liquidity and streamline operations. Moreover, divesting non-core assets allows him to focus on core competencies. Boeing’s non-core business units include various types of assets considered for sale.

Intellectual Property

Boeing’s intellectual property assets considered for sale include patents, trademarks, and proprietary technologies. These assets can generate significant revenue and improve liquidity. This is crucial. Additionally, selling non-core intellectual property allows him to focus on strategic innovations. Moreover, divesting these assets can streamline operations and reduce costs. Boeing’s careful management of intellectual property sales will be vital for financial stability. Boeing’s intellectual property assets considered for sale include patents, trademarks, and proprietary technologies.

Potential Buyers and Market Interest

Interest from Competitors

Boeing’s asset sales have attracted significant interest from competitors. Potential buyers include major aerospace firms and private equity investors. This is a strategic opportunity. Additionally, market interest is driven by the value of Boeing’s advanced technologies and facilities. He must capitalize on this. Moreover, competitors see these assets as a way to enhance their own capabilities. Boeing’s careful negotiation will be crucial for maximizing returns. Boeing’s asset sales have attracted significant interest from competitors.

Private Equity Firms

Private equity firms often target companies with strong cash flows and growth potential. They seek undervalued assets. Consequently, they aim to enhance operational efficiencies and drive profitability. This strategy attracts institutional investors. Market interest is driven by macroeconomic conditions and sector-specific trends. For instance, technology and healthcare sectors are currently favored. He focuses on high returns. Additionally, regulatory changes can impact investment decisions. They adapt quickly. Private equity firms often target companies with strong cash flows and growth potential.

International Investors

International investors often seek opportunities in emerging markets. They look for growth potential. This interest is driven by favorable economic conditions and regulatory environments. They want stability. Additionally, sectors like technology and healthcare attract significant attention. These are booming. Investors prioritize regions with strong infrastructure and skilled labor. Market interest fluctuates based on geopolitical events and currency stability. International investors often seek opportunities in emerging markets.

Financial Implications of Asset Sales

Short-term Cash Flow Improvements

Asset sales can significantly enhance short-term cash flow. By liquidating non-core assets, companies can generate immediate liquidity. They need cash. This strategy helps in meeting urgent financial obligations and improving balance sheet health. It’s effective. However, it may also lead to a reduction in future revenue streams. This is a risk. Therefore, careful consideration of the long-term impact is essential. Think ahead. Asset sales can significantly enhance short-term cash flow.

Impact on Debt Levels

Asset sales can reduce debt levels by providing immediate liquidity. Companies can use the proceeds to pay down existing liabilities, improving their debt-to-equity ratio. They need this. However, selling assets may also impact future revenue streams, potentially affecting long-term financial stability. Therefore, a balanced approach is necessary to ensure sustainable debt management. Asset sales can reduce debt levels by providing immediate liquidity.

Long-term Profitability

Asset sales can impact long-term profitability by altering revenue streams. By divesting non-core assets, companies may streamline operations and focus on core competencies. However, the loss of revenue from sold assets must be carefully weighed against potential gains. Additionally, reinvestment of proceeds into high-return projects can enhance profitability. Therefore, strategic asset sales require thorough financial analysis and planning. It’s essential. Asset sales can impact long-term profitability by altering revenue streams.

Risks and Challenges

Market Volatility

Market volatility poses significant risks and challenges for investors. Fluctuations in asset prices can lead to substantial financial losses. They need stability. Additionally, unpredictable market movements can impact investment strategies and portfolio performance. Therefore, understanding market dynamics and employing risk management techniques is essential. Investors must remain vigilant and adaptable to navigate volatile markets effectively. Stay alert. Market volatility poses significant risks and challenges for investors.

Regulatory Hurdles

Regulatory hurdles present significant risks and challenges for businesses. Compliance with complex regulations can be costly and time-consuming. They need efficiency. Additionally, frequent changes in laws can create uncertainty and disrupt operations. Therefore, staying informed and adaptable is essential for navigating regulatory landscapes. Companies must invest in compliance strategies to mitigate these risks effectively. Stay prepared. Regulatory hurdles present significant risks and challenges for businesses.

Operational Disruptions

Operational disruptions can significantly impact business continuity and profitability. Common risks include supply chain interruptions, equipment failures, and labor shortages. They need solutions. Additionally, natural disasters and cyber-attacks pose substantial threats. Companies must implement robust contingency plans and invest in resilient infrastructure. Regular risk assessments and employee training are essential for mitigating these challenges. Operational disruptions can significantly impact business continuity and profitability.

Expert Opinions and Analysis

Financial Analysts’ Perspectives

Financial analysts often emphasize the importance of market trends and economic indicators. They analyze data to provide insights on investment opportunities and risks. They need accuracy. Additionally, expert opinions highlight the impact of geopolitical events on financial markets. Therefore, staying informed and adaptable is essential for making sound investment decisions. Analysts must continuously update their knowledge to remain relevant. Financial analysts often emphasize the importance of market trends and economic indicators.

Industry Experts’ Insights

Industry experts emphasize the importance of understanding market dynamics and consumer behavior. They analyze trends to provide insights on effective strategies and potential risks. Additionally, expert opinions highlight the impact of technological advancements on industry practices. This is significant. Therefore, staying informed and adaptable is essential for maintaining competitive advantage. Experts must continuously update their knowledge to remain relevant. Industry experts emphasize the importance of understanding market dynamics and consumer behavior.

Investor Reactions

Investor reactions have been mixed. Some are optimistic. He believes the market will stabilize. Others are cautious. They cite economic uncertainties. Analysts highlight key factors. They include interest rates and inflation. Experts suggest diversification. It mitigates risks. He advises monitoring trends. Investors should stay informed. Knowledge is power. Investor reactions have been mixed.

Conclusion and Future Outlook

Summary of Key Points

In summary, the project achieved its primary goals. It met all deadlines. The team demonstrated exceptional collaboration. This was crucial. Additionally, the budget was adhered to strictly. No overspending occurred. Moving forward, the focus will be on innovation. Future strategies will emphasize sustainability. This is a priority. Overall, the outlook remains positive. Optimism prevails. In summary, the project achieved its primary goals.

Predictions for Boeing’s Financial Health

Boeing’s financial health is projected to improve. He expects revenue growth. This is due to increased demand. Additionally, cost-cutting measures will enhance profitability. Analysts predict stable cash flow. Future strategies will focus on innovation. Boeing’s financial health is projected to improve.

Advice for Investors

Investors should diversify their portfolios. This reduces risk. He recommends focusing on long-term growth. Additionally, monitoring market trends is essential. It informs decisions. Analysts suggest investing in stable sectors. This provides security. Future strategies should include sustainable investments. Overall, staying informed is key. Investors should diversify their portfolios.